Cryptocurrencies Price Prediction: Bitcoin, Ripple and Shiba Inu – European Wrap 19 October

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets continue to chop

Bitcoin price has shown no signs of slowing down since it began its sell-off on October 18. There is a high chance this trend will continue until BTC finds a stable support level. Until this happens, investors should be open to seeing Ethereum, Ripple and other altcoins also shed weight.

Ripple price action sours as UK inflation reminds traders of bigger picture

Ripple (XRP) price action has already printed 5% losses over the past two days as price action slips back below $0.48 in what turned out to be a bull trap. The week started on a high note, with strong earnings and stock markets rallying firmly higher. Unfortunately, reality kicked in again this morning as UK inflation numbers printed a new record high, putting pressure on the BoE to address the inflation with more aggressive rate hikes, which in turn could spark a severe recession as a massive wave of defaults hits the already battered UK economy.

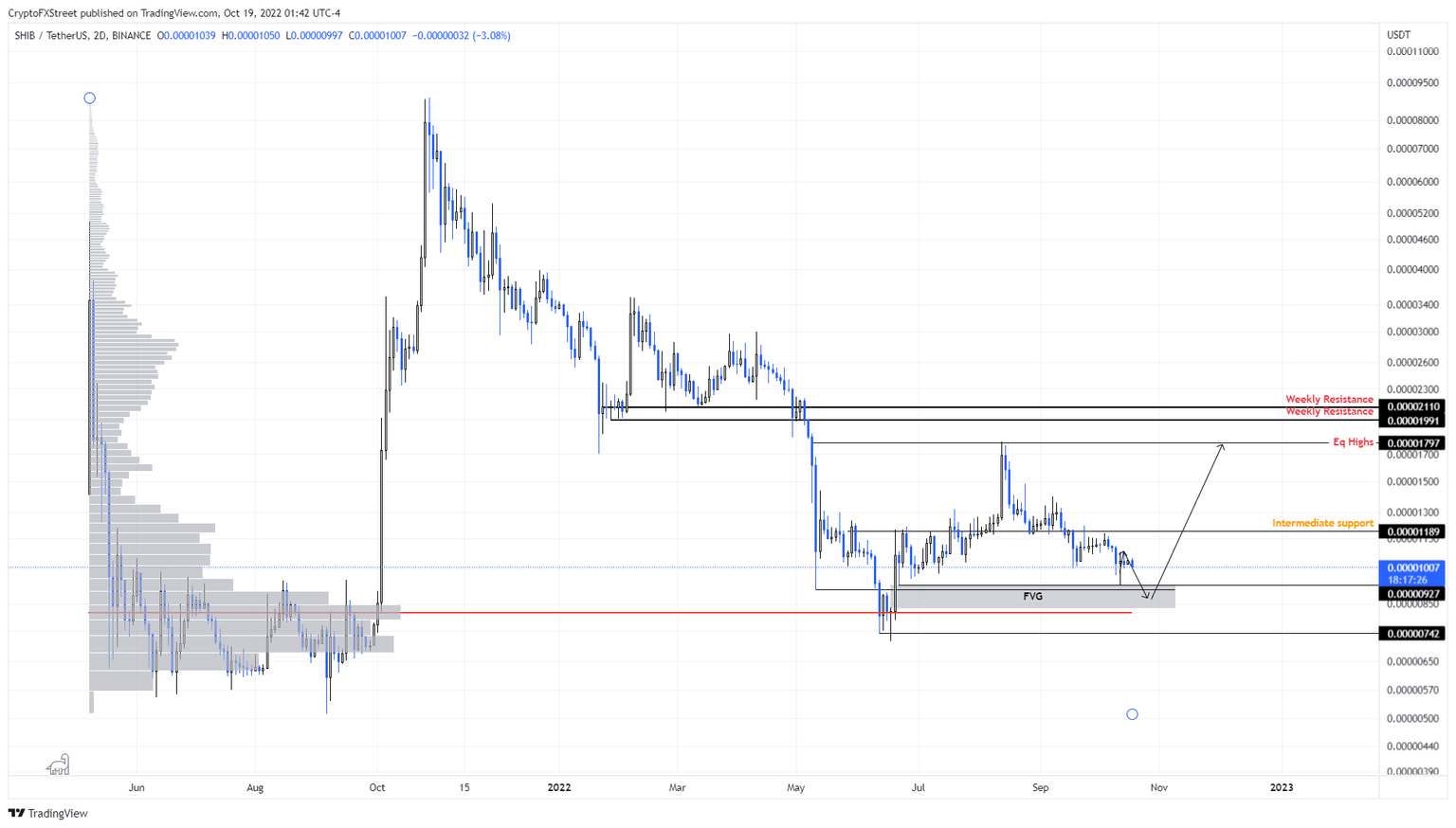

Shiba Inu Price Prediction: Key levels to watch as SHIB bulls plan to revisit $0.0000179

Shiba Inu price shows a lack of bullish momentum that has caused its recent run-up to reverse. As a result, SHIB is likely to undo the recent gains and slide lower before retesting a critical support level.

Author

FXStreet Team

FXStreet