Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Ripple – Asian Wrap 05 February

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP still show signs of weakness

Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) hover around key levels on Wednesday after failing to maintain their recoveries from the recent falls this week. The technical outlook for all these top cryptocurrencies shows signs of weakness and suggests a further correction ahead.

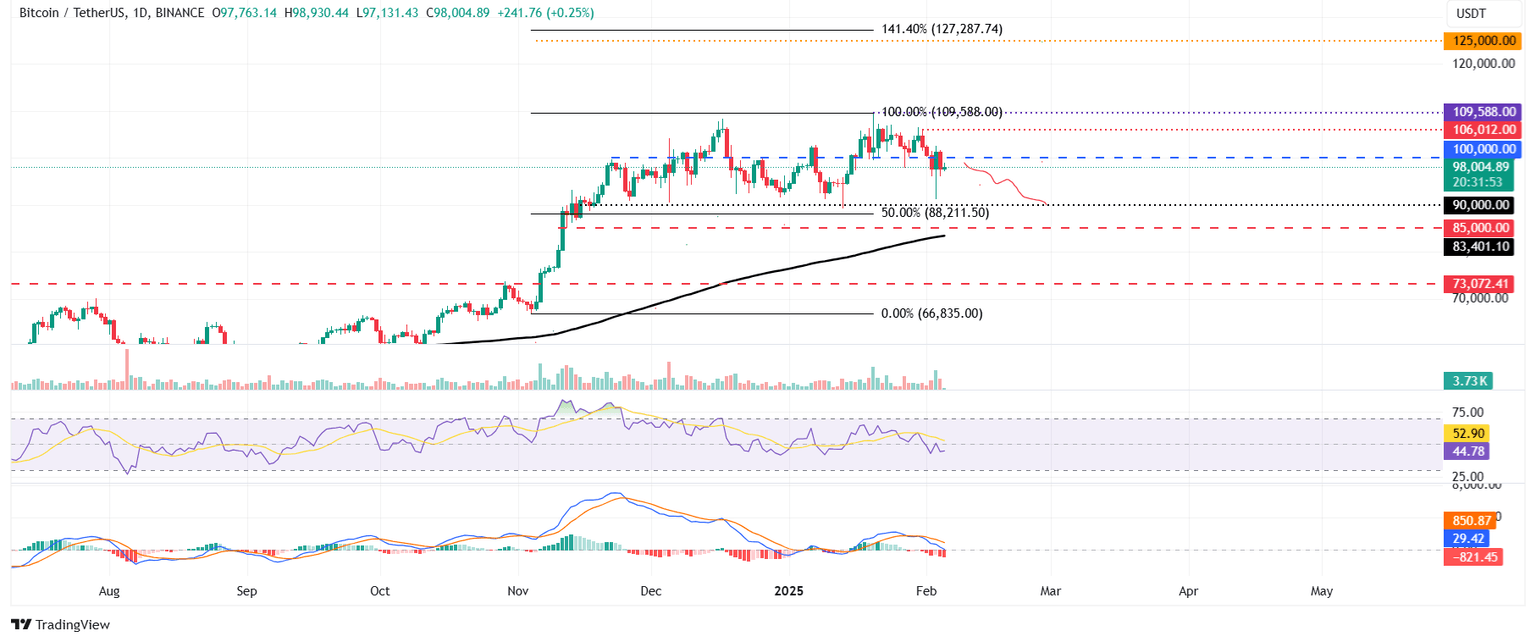

Bitcoin price faced a pullback in the early Asian trading session, reaching a low of $91,231, but quickly recovered from its fall to close above $101,300 on Monday. However, it failed to maintain its recovery and declined 3.52% on Tuesday.

Ripple (XRP), Ethereum, Cardano lead $200B crypto market rebound as Canada and Mexico end Trump trade war

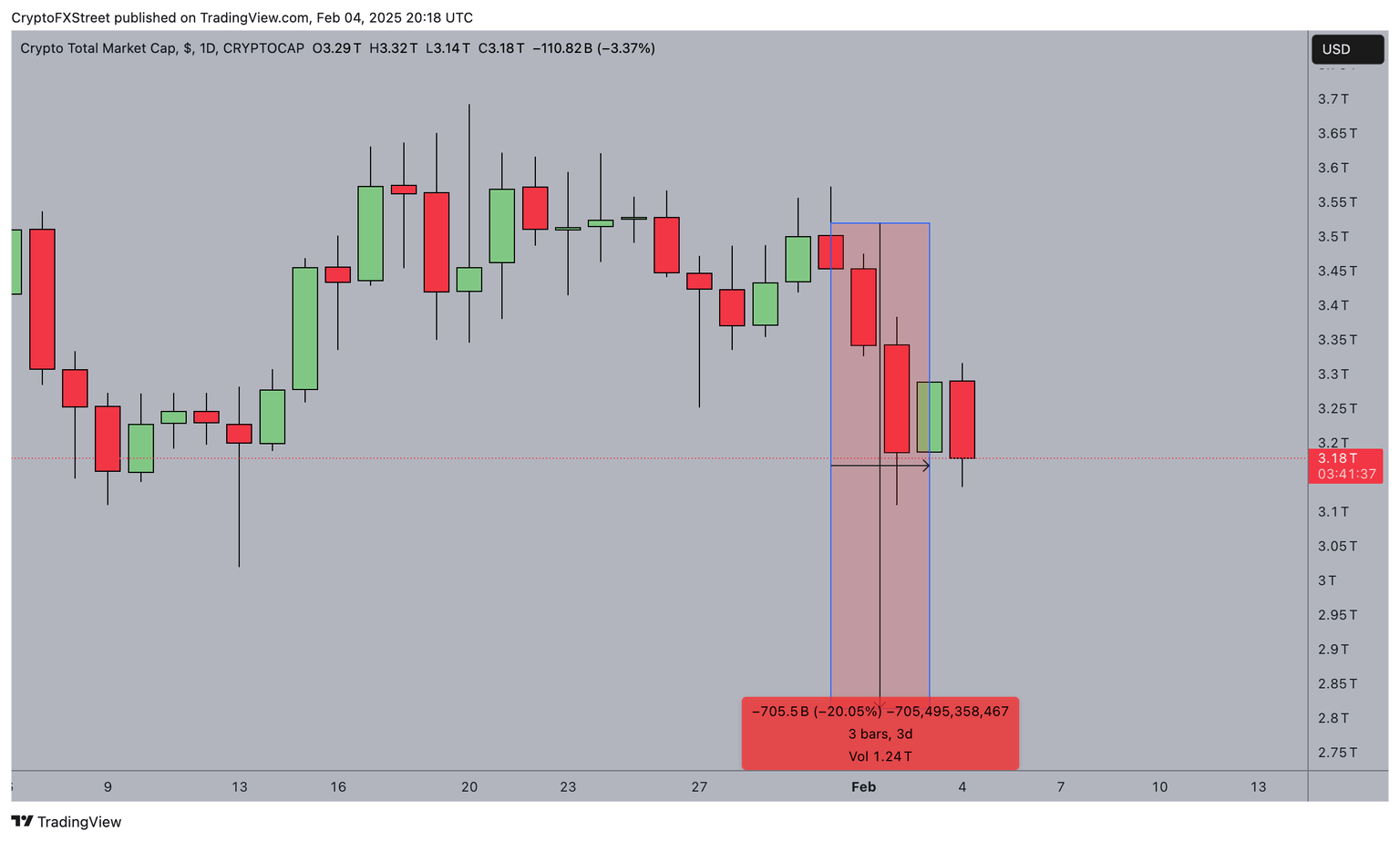

The crypto market rebounded sharply, adding over $190 billion to its aggregate valuation on Tuesday per Coingecko data as US President Donald Trump postponed tariffs imposed on Mexico and Canada. This decision triggered a rally in top Layer-1 cryptocurrencies such as XRP, ETH, and ADA, which led to the recovery phase.

The global crypto market experienced a rough start to February, facing multiple bearish catalysts that suppressed investor confidence. One key trigger was the DeepSeek vs. OpenAI dispute in late January, which sent shockwaves through AI-related stocks, wiping out over $600 billion from NVIDIA’s market cap.

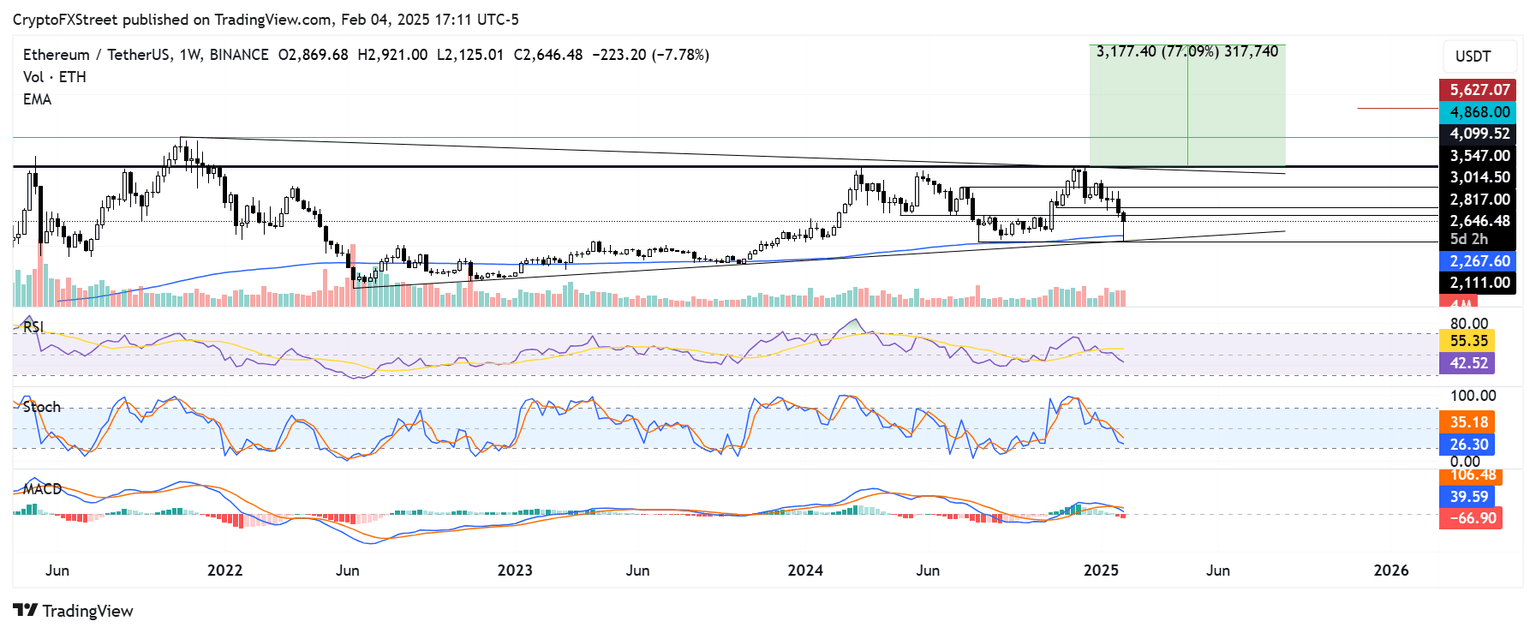

Ethereum Price Forecast: ETH drops below $2,800 amid gas limit increase above 30 million units

Ethereum (ETH) is down 7% on Tuesday after validators reached a consensus to increase the network's gas limit above 30 million. Meanwhile, investors have been scooping up ETH since the market crash with rising buying activity across ETH exchange-traded funds (ETFs) and crypto exchanges.

Ethereum's gas limit increased to 32 million in several blocks in the past 24 hours, with over 50% of validators reaching a consensus to remove the limit of 30 million units and improve scalability. The upgrade didn't require a hardfork as it automatically became standard after over half of the network's validators signaled support for the change by updating their nodes, according to data from gaslimit.pics.

Author

FXStreet Team

FXStreet