Cryptocurrencies Price Prediction: Bitcoin, Chainlink & Litecoin – American Wrap 22 December

Bitcoin is quantum computing resistant regardless of rising fears among investors

All cryptocurrencies are based on cryptography and require miners to solve extremely complex mathematical problems in order to secure the network. The idea behind quantum computing is that it will be able to crack Bitcoin’s algorithm much faster than the network.

The basic principle is that Bitcoin’s network has to be sufficiently fast in order for a quantum attacker to not have enough time to derive the private key of a specific public key before the network.

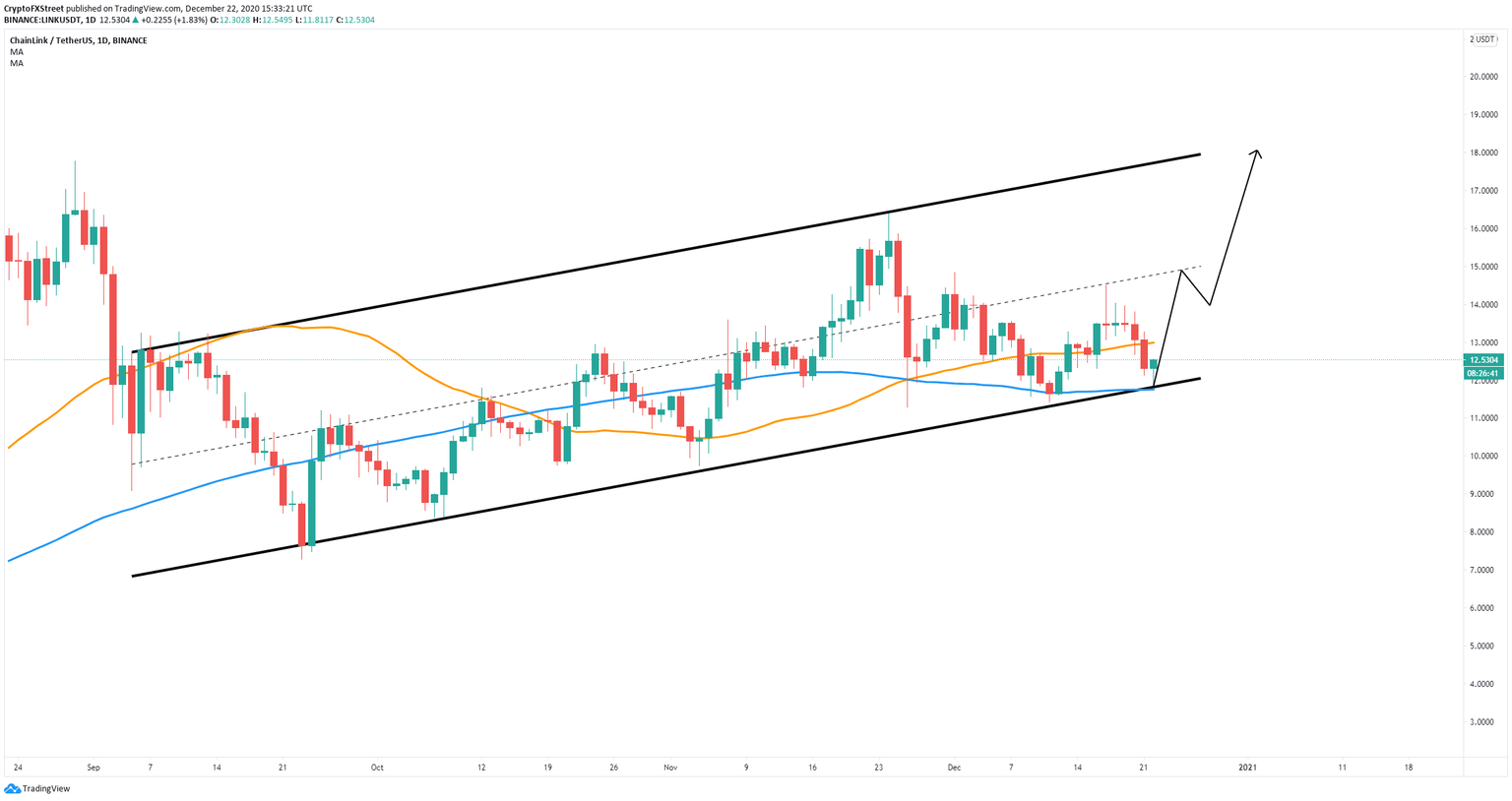

Chainlink price once again defends critical support level eying up a rebound to $18

Chainlink has been trading inside a long-term ascending parallel channel on the daily chart. Bulls have defended the lower trendline support several times in a row and now aim for a massive rebound.

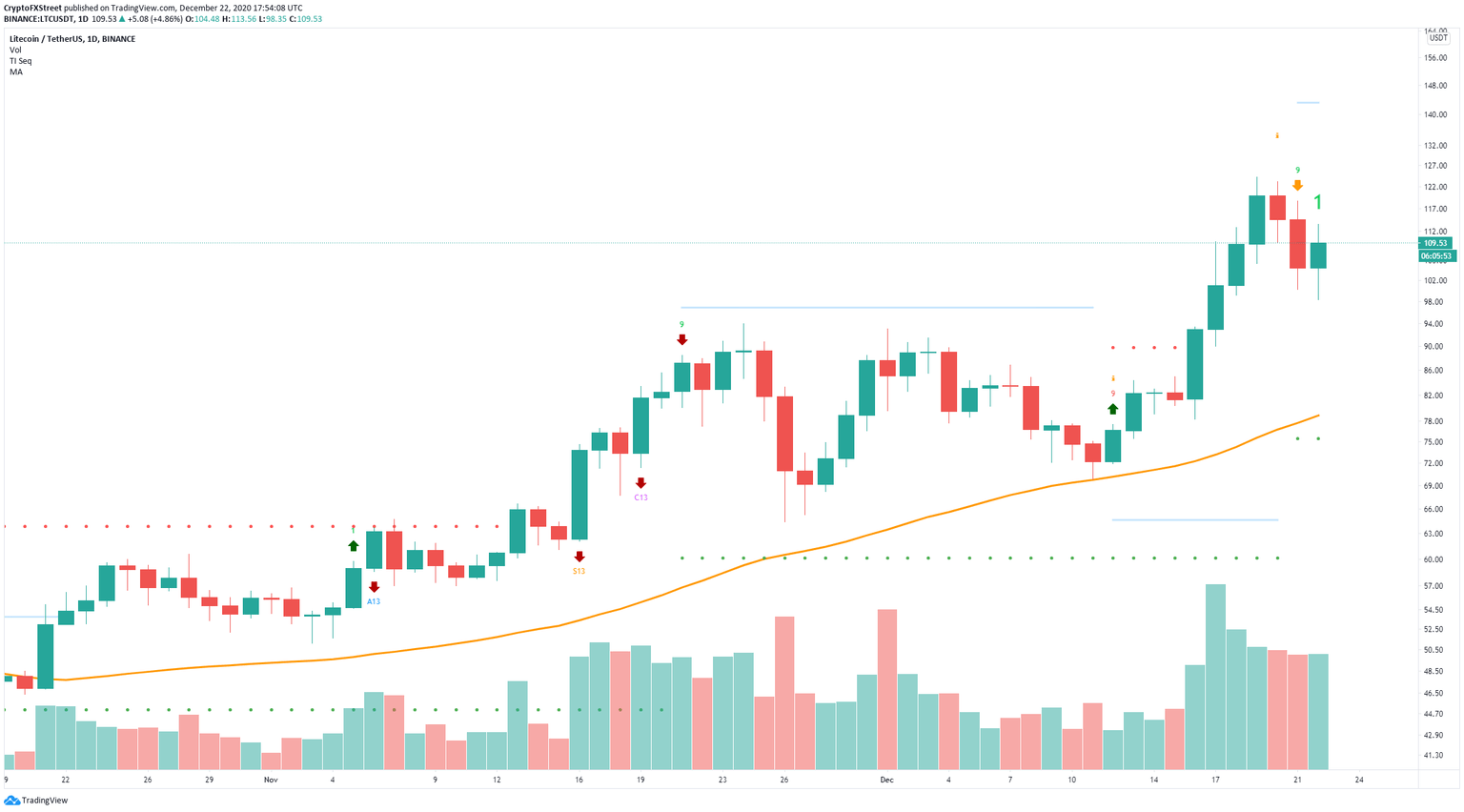

Litecoin price poised for a correction after massive uptrend to $120

Litecoin price is up by almost 60% in the past week hitting a new 2020-high at $124. The digital asset has experienced a healthy correction down to $98 but might need to drop even further as several indicators have turned bearish.

Author

FXStreet Team

FXStreet