Cryptocurrencies Price Prediction: Bitcoin, Ripple & Ethereum – European Wrap 18 April

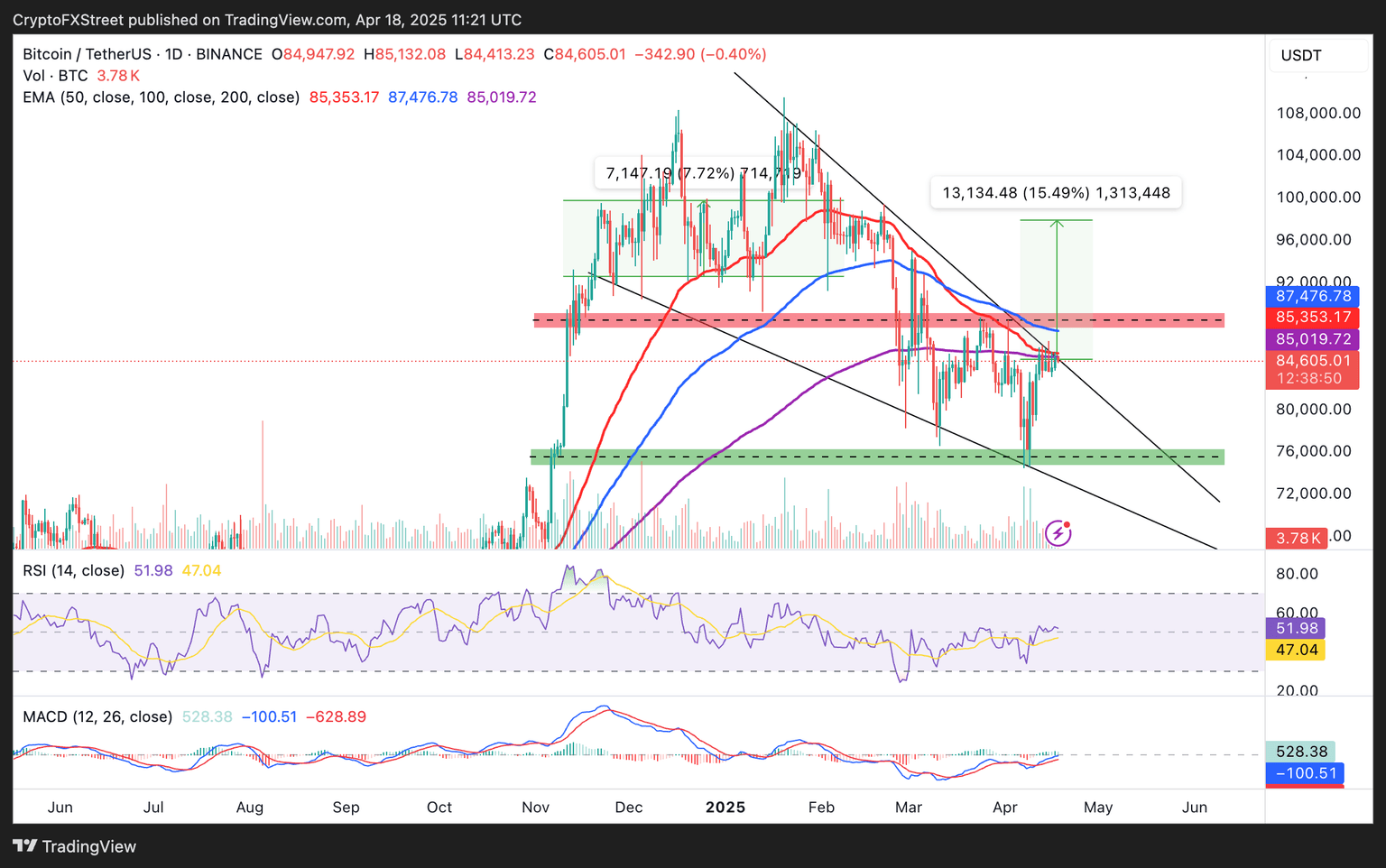

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin (BTC) price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by United States (US) President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries. Bitcoin exchanges hands at $84,605 at the time of writing on Friday, with its technical structure suggesting that a breakout may soon be imminent.

Federal Reserve (Fed) Chair Jerome Powell expressed concerns about the current economic conditions, suggesting that the central bank could find itself in a dilemma between keeping inflation in check and supporting economic growth. "We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension," Powell said in his remarks at the Economic Club of Chicago on Wednesday.

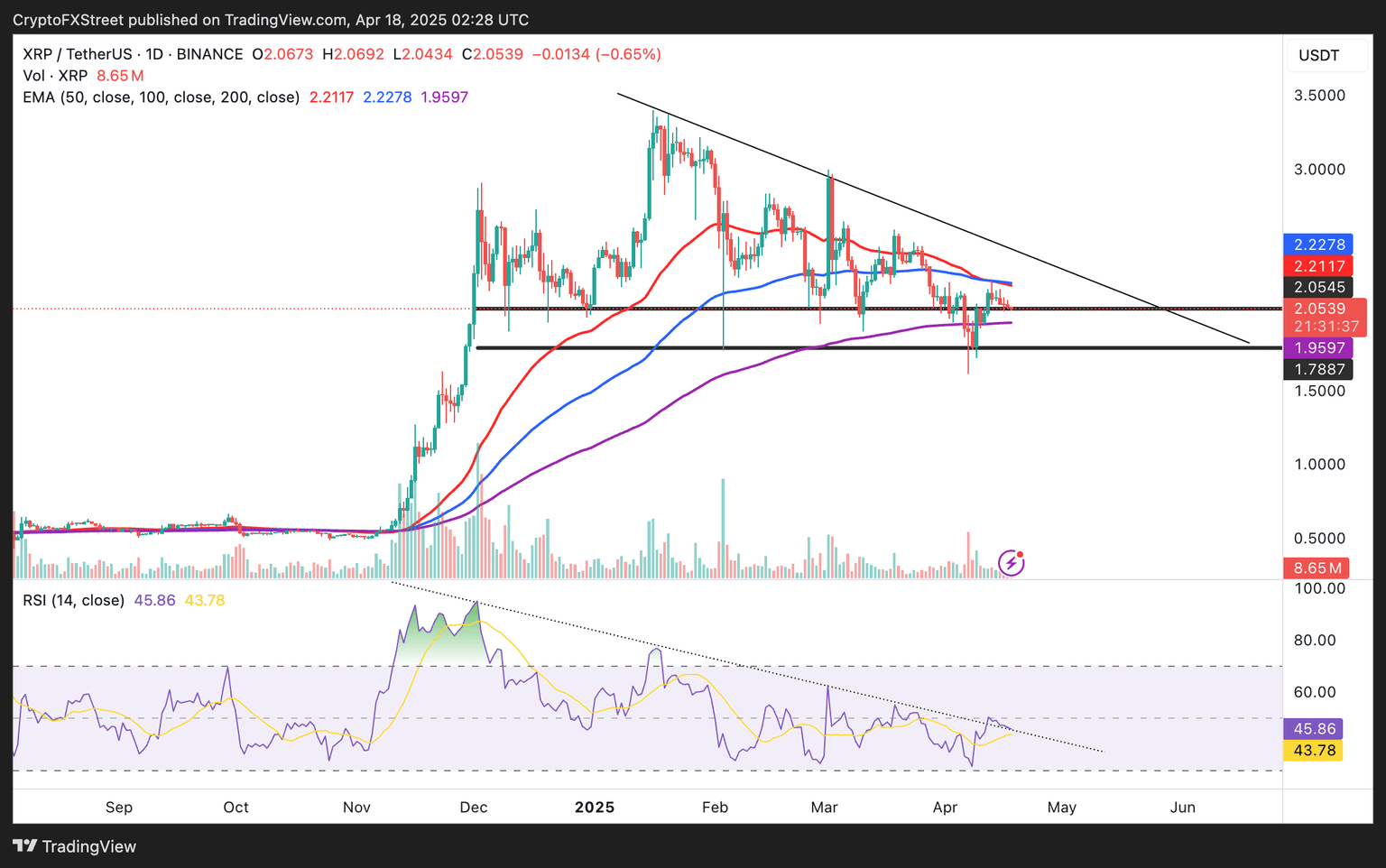

How SEC-Ripple case and ETF prospects could shape XRP’s future

Ripple (XRP) consolidated above the pivotal $2.00 level while trading at $2.05 at the time of writing on Friday, reflecting neutral sentiment across the crypto market. Investors have tempered expectations amid the tariff war waged by United States (US) President Donald Trump, which has significantly morphed into a larger trade war between the US and China. XRP bulls have shown resilience despite shifting macroeconomic factors, suggesting that a bullish turnaround is around the corner.

The approval of a joint motion filed by Ripple and the Securities and Exchange Commission (SEC) to pause appeals in the longstanding legal battle on Wednesday hardly moved XRP price, underscoring the negative impact of the changing macroeconomic environment on cryptocurrencies.

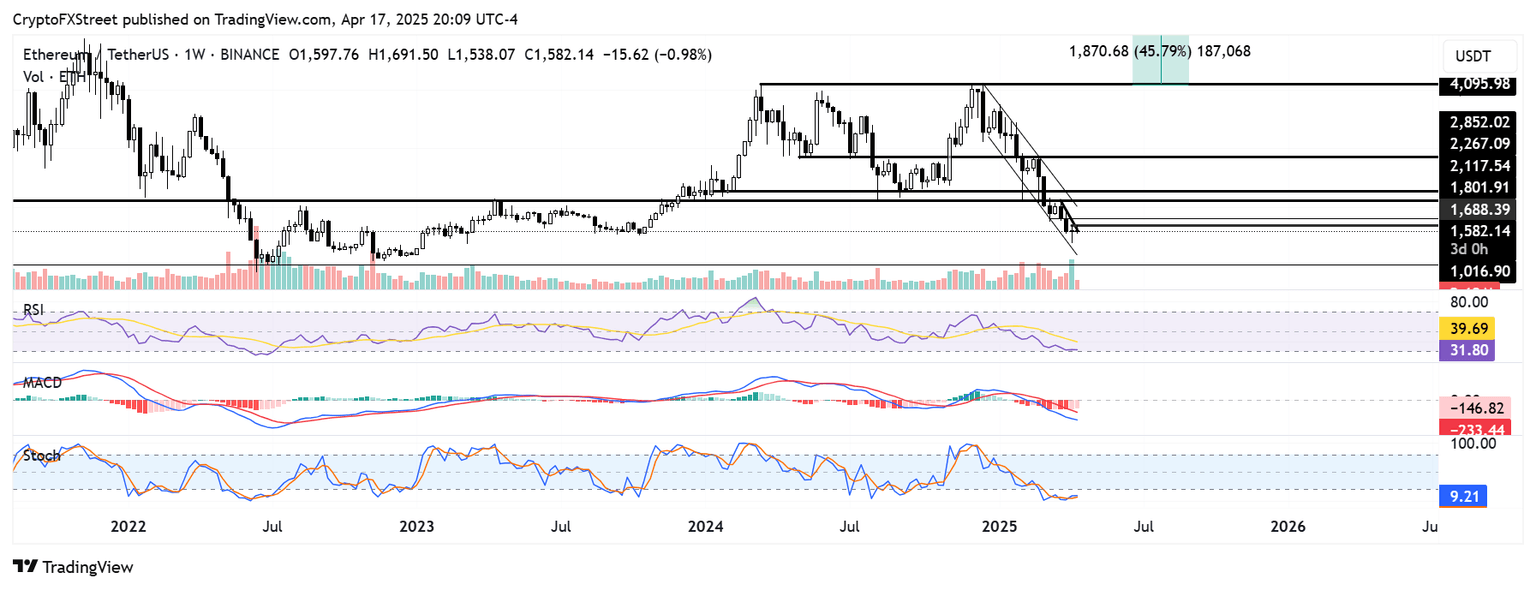

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum (ETH) traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs. Meanwhile, Tron founder Justin Sun said that he won't sell his ETH holdings despite the sustained downtrend in the top altcoin’s price.

US spot Ether exchange-traded funds (ETFs) continued their negative flows on Wednesday after shedding $12.01 million, per SoSoValue data. Since Trump’s tariffs went live, ETH ETFs have seen a net outflow of $909 million.

Author

FXStreet Team

FXStreet