Crypto Today: XRP, ADA, XLMsurge as Ripple donates $25M to pro-crypto Fairshake

- The cryptocurrency sector valuation grew 1.4% on Wednesday, adding $80 billion to its opening valuation of $3.11 trillion.

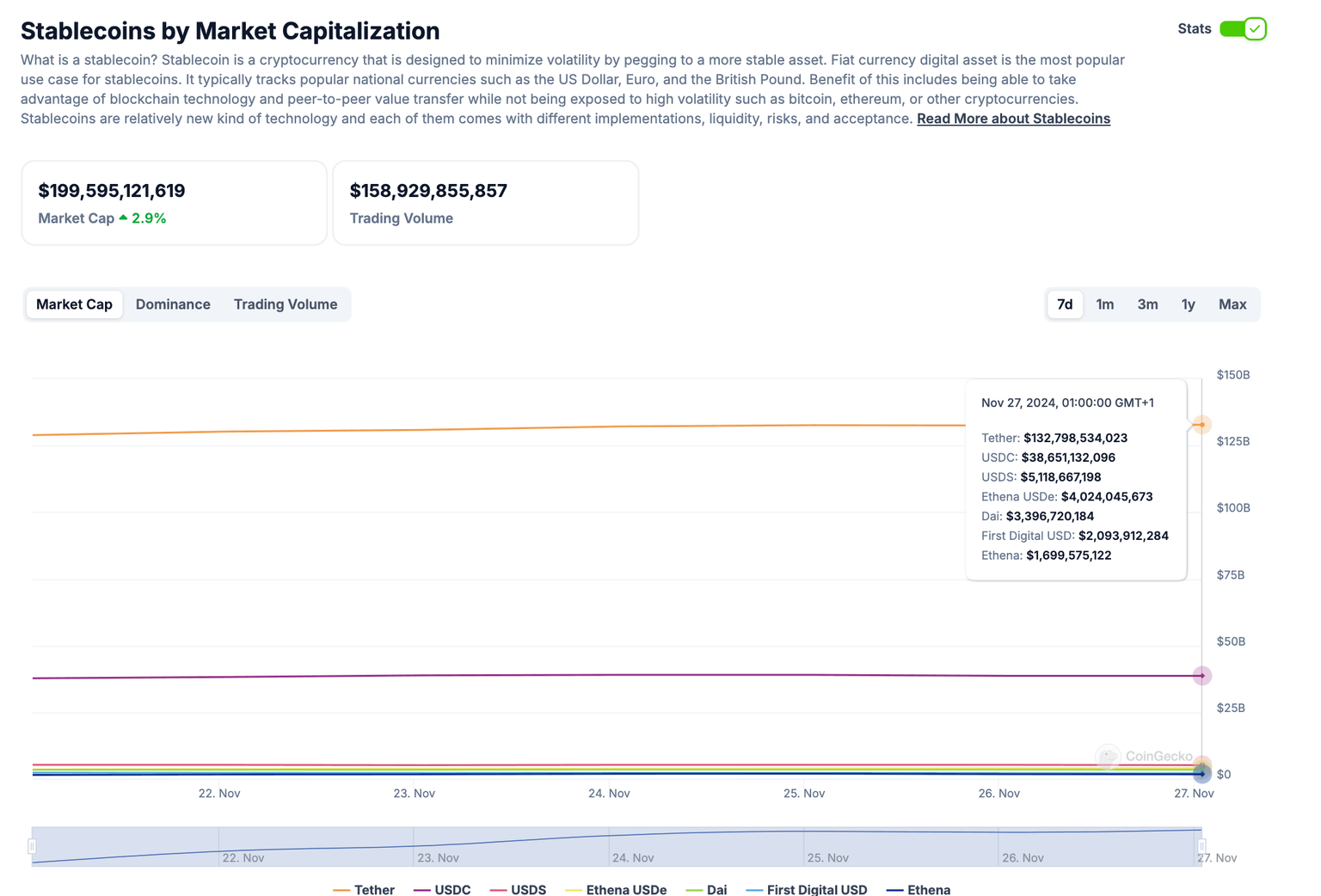

- Stablecoins grew 2.9% to reach $199.6 billion, reflecting $5.6 billion inflows.

- In the futures markets, 99,394 trades worth $286.72 million were liquidated with bulls booking 57% of the daily timeframe losses.

Altcoin market updates: XRP, XLM, ADA emerge top gains as BTC stagnates

While Bitcoin price continued to consolidate within the $92,000 to $93,000 range on Wednesday, the altcoin market grew by $40 billion.

The altcoin market rally was propelled by news of Ripple Labs donating another $25 million to Fairshake, a Political Action Committee (PAC) that promotes political candidates committed to securing crypto-friendly policy in the United States in the 2026 midterm elections.

- Ripple (XRP) gained 6% to reclaim the $1.40 resistance territory on Wednesday.

- Stellar (XLM) mirrored XRP’s uptrend, scoring 11% gains as it breached the $0.50 mark.

- After briefly losing the $0.90 support, Cardano (ADA) price also entered a 12% bullish reversal to flip the $1 sell-wall on Wednesday.

Chart of the day: Stablecoins approach $200B market cap, signaling December rally ahead

Despite volatile movements observed in the crypto markets this week, the sector continues to attract significant capital inflows.

The Aggregate Stablecoin market capitalization is a key market metric that helps to track the directional flow of capital within the cryptocurrency sector.

The Coingecko chart above shows the total Stablecoin market cap grew by 2.9% in the last 24 hours to hit the $199.6 billion mark.

This implies that stablecoin deposits grew by $5.8 billion despite major assets like BTC and ETH experiencing significant losses.

Aggregate Stablecoin market capitalization | Source: Coingecko

When stablecoin reserves grow during a market downturn, it poses a bullish outlook for two key reasons.

Firstly, it implies that crypto traders selling their assetsare seeking refuge in stablecoins rather than exiting the market.

Additionally, since stablecoins are the main on-ramp method, inflows suggest that more investors are bringing in fresh capital towards the crypto markets.

As market volatility subsides, BTC, altcoins and memecoins could experience a major boost in the coming weeks as investors begin to deploy their stablecoins holdings into risk assets.

Crypto news updates:

- Kraken shuts NFT marketplace to focus on fresh projects

Kraken, one of the largest centralized cryptocurrency exchanges, has announced plans to shut down its NFT marketplace as it shifts focus toward new initiatives.

The marketplace will officially cease operations on February 27, 2025. The exchange has advised users to transfer their NFTs to their Kraken wallet or an alternative self-custodial wallet to ensure the security of their assets.

This strategic move underscores Kraken’s intent to reallocate resources toward exploring innovative projects, signaling a shift in priorities amid a rapidly evolving crypto ecosystem.

- Brazil proposes a national Bitcoin reserve to diversify treasury assets

Brazil’s Congress has introduced a groundbreaking bill to establish a Sovereign Strategic Reserve of Bitcoin, which could hold up to 5% of the nation’s international reserves.

The legislation, proposed by a federal deputy, aims to diversify Brazil's treasury holdings while strengthening the foundation for its central bank digital currency (CBDC).

The reserve would leverage blockchain technology and artificial intelligence to ensure transaction integrity, reflecting Brazil’s commitment to adopting innovative financial solutions.

If enacted, this initiative could position Brazil as a global leader in cryptocurrency adoption and deepen digital asset integration within sovereign finance systems.

- Federal court declares treasury's sanctions on Tornado Cash unlawful

A United States (US) federal appeals court has ruled that the Treasury Department’s sanctions on Tornado Cash smart contracts were unlawful, stating they exceeded the department's legal authority.

The court determined that the sanctions, imposed by the Office of Foreign Assets Control (OFAC), unjustly targeted open-source software, which cannot be classified as property under existing laws.

The ruling emphasized that Tornado Cash's immutable smart contracts do not qualify as “property” under the International Emergency Economic Powers Act (IEEPA), as they are not capable of being owned or controlled by any entity.

This decision marks a significant precedent in the ongoing debate over the regulation of decentralized technologies and their intersection with U.S. sanctions law.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.