Crypto Today: SHIB, Pi Network and DOGE emerge as top gainers as Bitcoin crosses $2T market cap

- The global cryptocurrency market capitalization consolidates near $3.5 trillion on Monday as investors brace for a positive start to the US trading week.

- Bitcoin price hits $105,800, claiming the $2 trillion valuation milestone, after US and China confirmed a temporary trade agreement to lower tariffs.

- Shiba Inu, Pi Network and Dogecoin emerge as top gainers among the 20 main crypto assets.

Cryptocurrency markets consolidated near the $3.5 trillion market cap, down by a mild 0.7%, at press time on Monday.

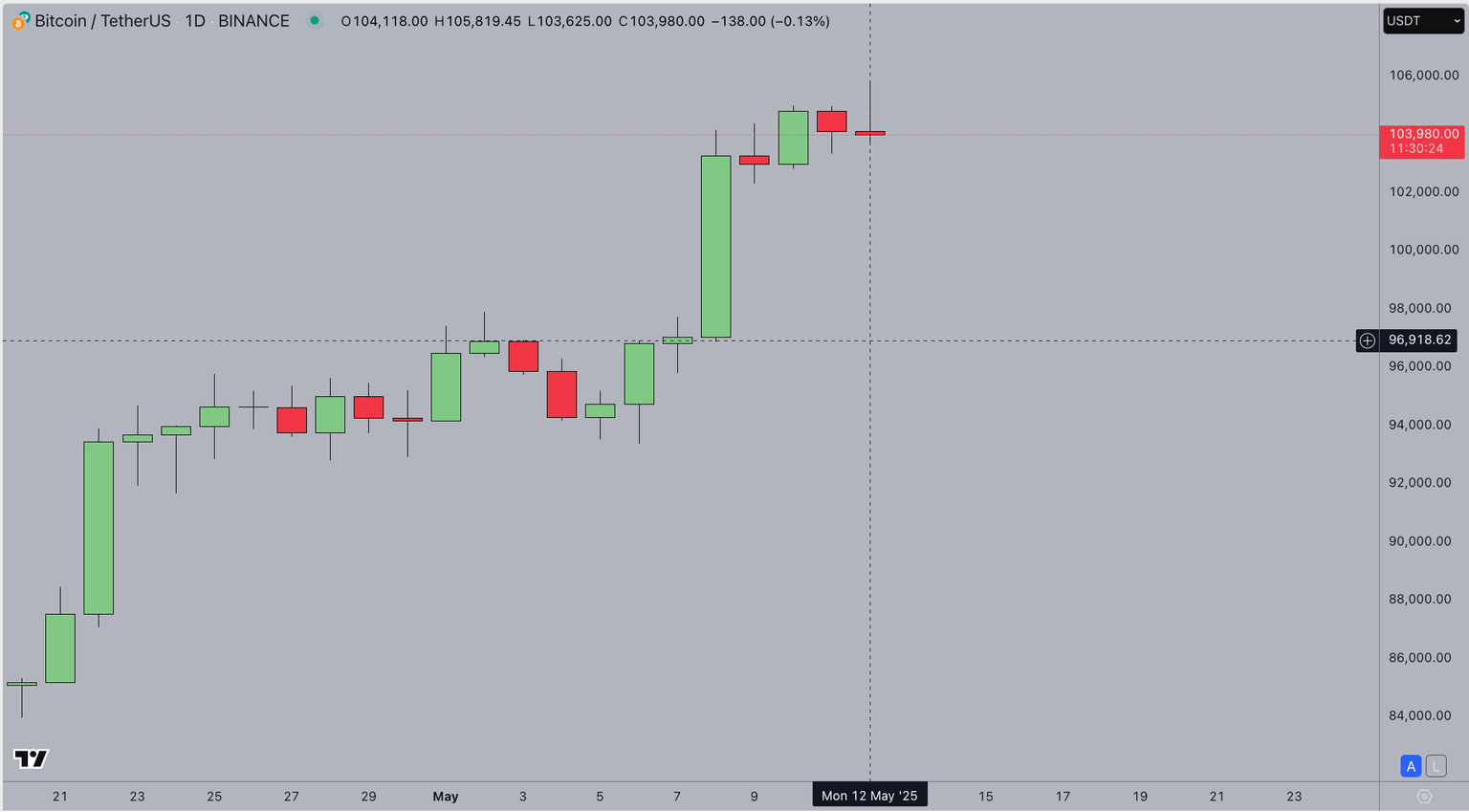

Bitcoin price failed to breach all-time highs as investors remain cautious of making additional inflows into crypto, awaiting the next directional move from US corporate investors after the US and China confirmed a temporary trade agreement amid a series of meetings held in Switzerland over the weekend.

Bitcoin market updates:

- On Monday, Bitcoin price extended its rally above another critical psychological support, trading as high as $105,800 on Binance.

Bitcoin price action, May 12, 2025 | BTCUSDT (Binance)

- At press time, Coingecko data shows Bitcoin’s 24-hour trading volumes crossing the $33 billion for the first time since US markets closed on Friday.

This signals that despite BTC’s failure to breach its previous all-time high, Bitcoin demand is on the rise again as tradfi markets open.

Chart of the day: Speculative bets near $100B as Bitcoin traders anticipate all-time high

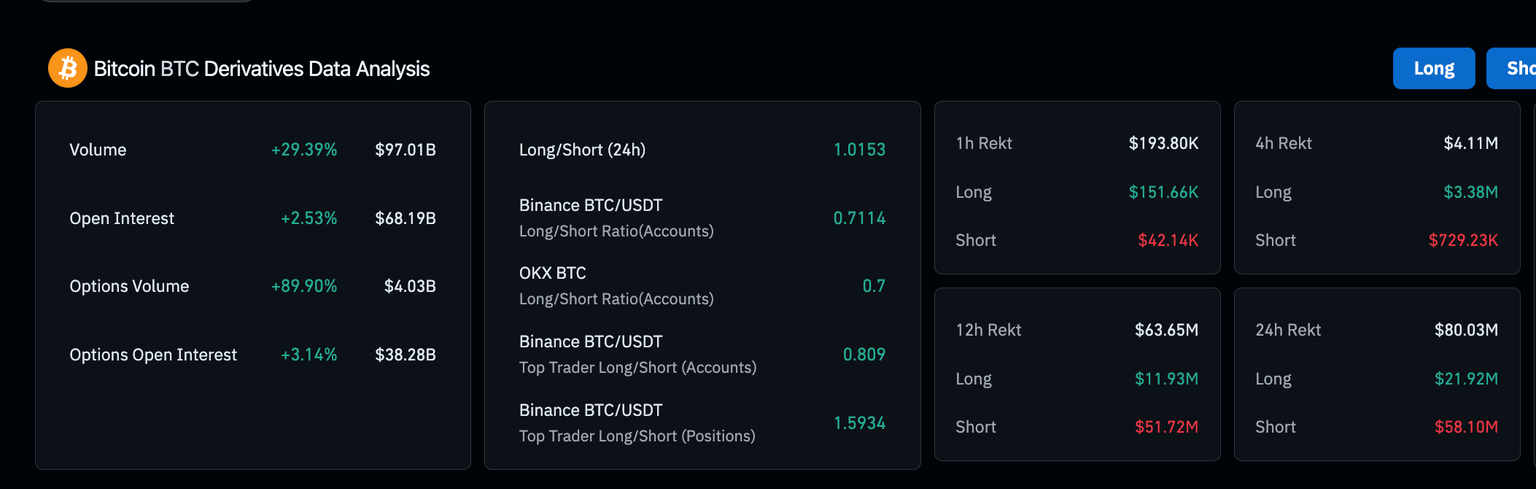

With positive sentiment surrounding the US - China trade agreement dominating market discourse over the weekend, BTC derivatives markets have seen a flurry of long bets on Monday as the majority of investors are anticipating more gains as the coming session unfolds.

Bitcoin derivatives market analysis, May 12, 2025 | Source: Coinglass

While Bitcoin spot price action shows marginal gains, stalling below previous all-time highs around $107,000, derivatives data reflects a persistent build up of bullish bets.

As seen in the Coinglass chart above, Bitcoin Open interest has increased by 2.53% to reach $68.19 billion, signaling aggressive capital inflows across major exchanges.

More notably, trade volume spiked 29.39% to $97.01 billion, more than 300% higher than the spot market trading volume of $33 billion.

This signals that despite BTC price consolidation investors continue placing aggressive long bets behind the scenes, anticipating amplified profits if Bitcoin price enters price discovery in the coming sessions.

Another key bullish Bitcoin price indicator is evident in the options market. Options volume soared 89.90% to $4.03 billion, while options open interest climbed 3.14% to $38.28 billion.

This divergence typically indicates heavy institutional involvement and large positions bets being placed on the continuation of the current price trend.

Altcoin market updates: Dogecoin, Pi Network and Shiba Inu emerge standout performers as retail frenzy begins

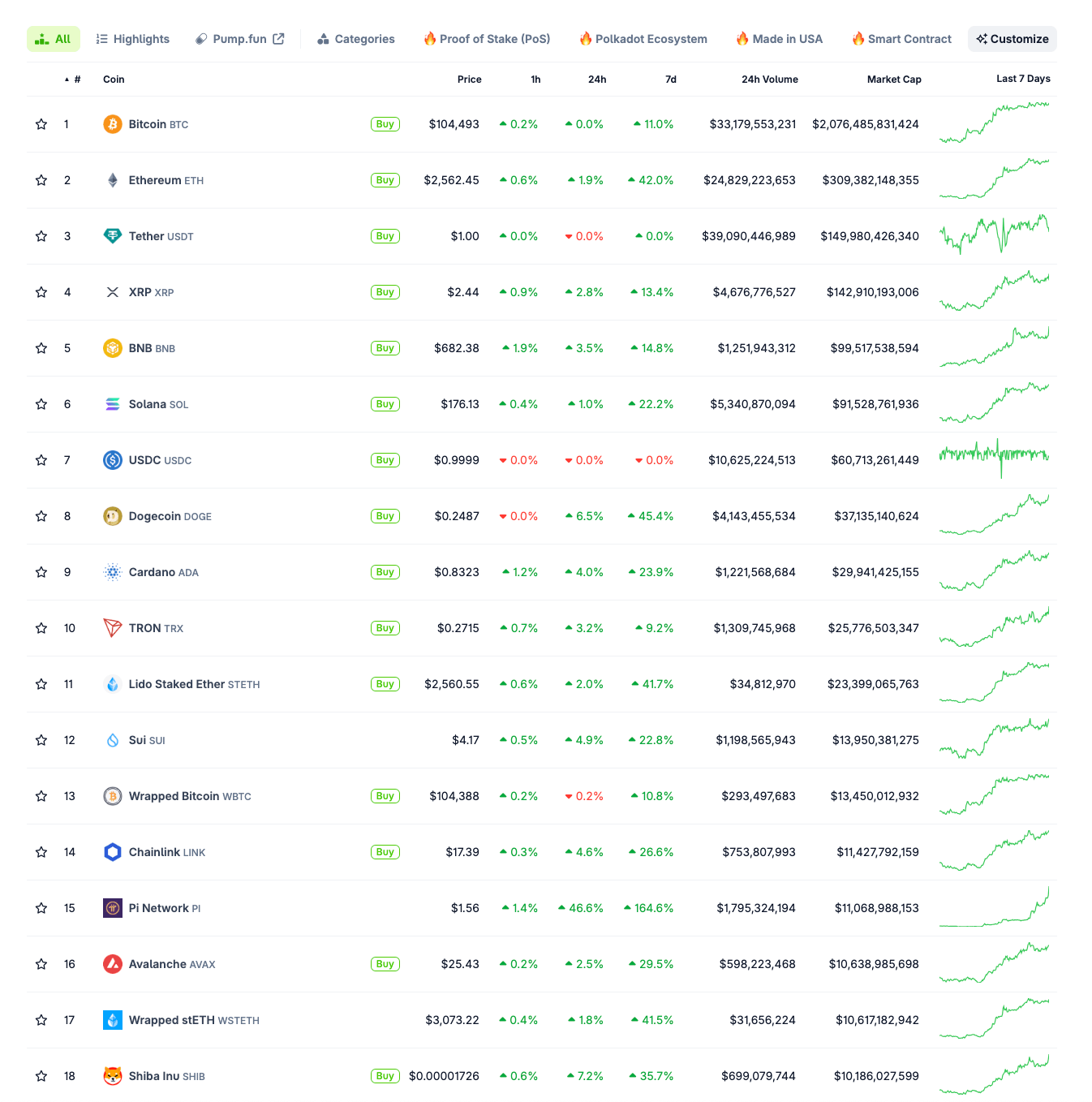

In the altcoin markets, mid-cap assets with large retail communities dominated investor mindshare on Monday. Memecoins led the rally on Monday, with Dogecoin and Shiba Inu climbing 6.5% and 7.2% over the last 24 hours. Pi Network, a community-driven project that allows retail participants to mine coins through mobile devices, posted a blistering 46.6% uptick.

Top 20 Cryptocurrencies performance, May 12, 2025 | Source: Coingecko

DOGE, SHIB and PI, top-20 ranked crypto assets, signal the following shifts in market dynamics:

- Retail participation is on the rise as positive market sentiment persists.

- Institutions are quietly placing high-leverage bets on memecoins and low-liquidity tokens, capitalizing on the increased market-depth from the retail euphoria.

With Bitcoin consolidating just under its all-time high at $105,000, altcoins and memecoins have become the proxy trade for risk-on positioning. The aggregate $3.49 trillion total market capitalization reflects a 0.7% dip on the day, further emphasizing the trickle-down, capital-rotation narrative.

Crypto market updates:

Ledger regains Discord server control after moderator account is compromised

Crypto storage firm Ledger has restored control of its official Discord server after a hacker gained access by compromising a moderator’s account. The attacker used the access to deploy a bot that directed users to a fraudulent website, urging them to input their wallet seed phrases.

The company responded by swiftly removing the compromised moderator account and deleting the malicious bot. Ledger also reported the phishing website to relevant authorities and implemented stricter server permissions to prevent similar breaches in the future.

US and China progress in trade talks

The United States and China have made “substantial progress” in bilateral trade negotiations held in Switzerland, according to a joint statement from Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer. A detailed announcement outlining the terms is expected tomorrow.

Talks, which spanned two days, included senior officials from both governments and featured direct communication with President Trump. Greer noted that the meetings “laid critical groundwork for swift agreement,” while Bessent emphasized the “constructive tone and shared urgency” that defined the sessions.

Though the final details remain under wraps, expectations are high that this round of negotiations will lead to renewed commitments on tariffs, market access and supply chain stability, which are key concerns for both Wall Street and global markets.

FTX EU users can now withdraw funds via Backpack after KYC verification

Former users of FTX EU can now begin reclaiming their funds through the crypto exchange Backpack, which acquired the bankrupt platform's European arm in January 2025.

Former FTX EU customers may now complete the two-step process to claim their Euro funds via Backpack EU.

— Backpack 🎒 (@Backpack) May 12, 2025

1. Get Verified

2. Withdraw Funds

Start here: https://t.co/qvUDpbs6oi pic.twitter.com/26Bkk2Zum3

Backpack announced on May 12 via X.com that eligible FTX EU users who selected it as their distribution channel may now withdraw Euro balances, provided they complete the Know Your Customer (KYC) verification process.

“If they do not, you will need to contact Backpack EU support at [email protected] to update your Backpack EU account to reflect the same information used for your FTX EU claim,” the platform stated.

The claims process began on April 1, with no deadline currently set for submissions.

Backpack clarified that only users who registered with FTX EU on or after March 7, 2022, qualify for the process.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.