Crypto Today:Justin Sun offers $1 million to free Telegram's Pavel Durov, Bitcoin eyes $70000, AI tokens rally

- Justin Sun promises $1 million in funds to DAO for freeing Telegram CEO Pavel Durov, who was arrested in France.

- Bitcoin hovers around $64,000 on Monday, holding up Friday’s gains after Fed Chairman Powell’s speech paved the way for an interest-rate cut in the US.

- Artificial Intelligence tokens FET, TAO, RNDR, AGIX and OCEAN see price gains in the last 24 hours.

- Ethereum sustains above key support at $2,700 even as Spot Ether ETFs had net outflows of $44.54 million last week.

Bitcoin, Ethereum, XRP updates

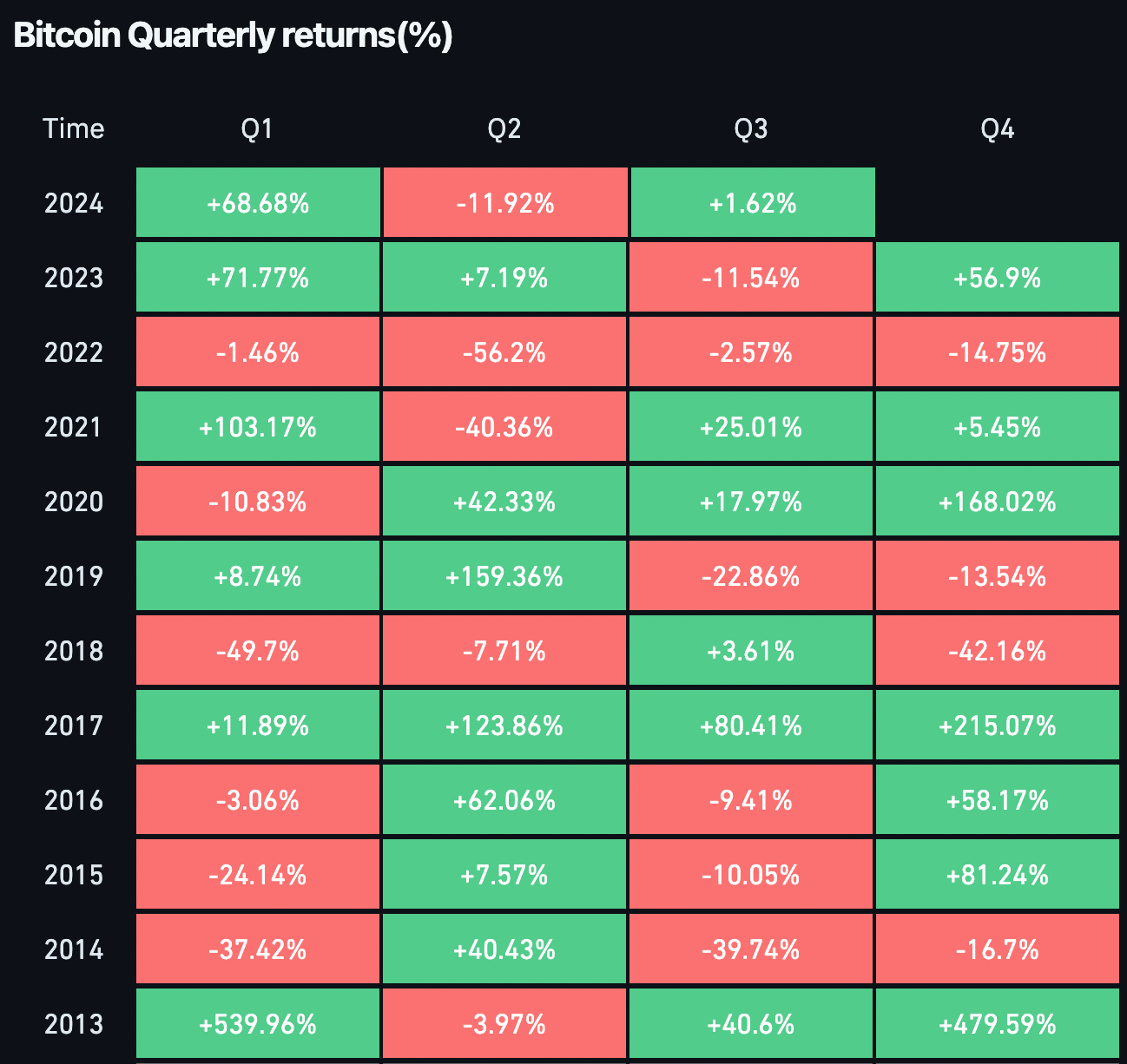

- Bitcoin trades at $63,737 at the time of writing on Monday, holding up the 6% gains it saw on Friday after Federal Reserve (Fed) Chairman Jerome Powell said the time has come for US interest-rate cuts, supporting a rally in risk assets. More broadly, the largest crypto asset by market capitalization has historically registered a positive performance in Q4 most times, according to data from Coinglass.

Bitcoin quarterly returns

- Ethereum Spot ETFs registered a net outflow of $44.54 million in the week of August 19 to 23, per data from Sosovalue. Even as institutional capital left Ether Spot ETFs, the altcoin sustained above key support at $2,700, trading around $2,735 at the time of writing.

- XRP hovers around key psychological support at $0.60. The native token of XRPLedger trades at $0.5948 at the time of writing.

Chart of the day

Dog-themed meme coin FLOKI (FLOKI) rose by a sharp 31% last week and is rallying further on Monday. The coin, which trades at $0.0001532, could extend gains by 7.86% on its way to a key resistance level at $0.0001642. Before that, FLOKI also faces resistance in the Fair Value Gap (FVG) extending between $0.0001592 and $0.0001610, as seen in the FLOKI/USDT daily chart below.

The Moving Average Convergence Divergence (MACD) indicator shows green histogram bars above the neutral line, implying FLOKI price trend has an underlying positive momentum. The Relative Strength Index (RSI) is slightly above the 60.00 level, providing further credence to the bullish thesis.

FLOKI/USDT daily chart

In case of a downward correction, FLOKI could find support in the Fair Value Gap between $0.0001444 and $0.0001465.

Market updates

- Justin Sun, the founder of the TRON network, announced $1 million proposing a DAO for Telegram CEO Pavel Durov, who is currently under arrest in France. Sun called the crypto community to form the DAO in an official tweet on X.

We should show the cryptocurrency industry's unity by organizing a #FreePavel DAO to help Telegram founder Pavel Durov legally gain freedom. I'll donate $1 million if it's created in a decentralized way with enough community support. @elonmusk @MarioNawfal

— H.E. Justin Sun 孙宇晨(hiring) (@justinsuntron) August 25, 2024

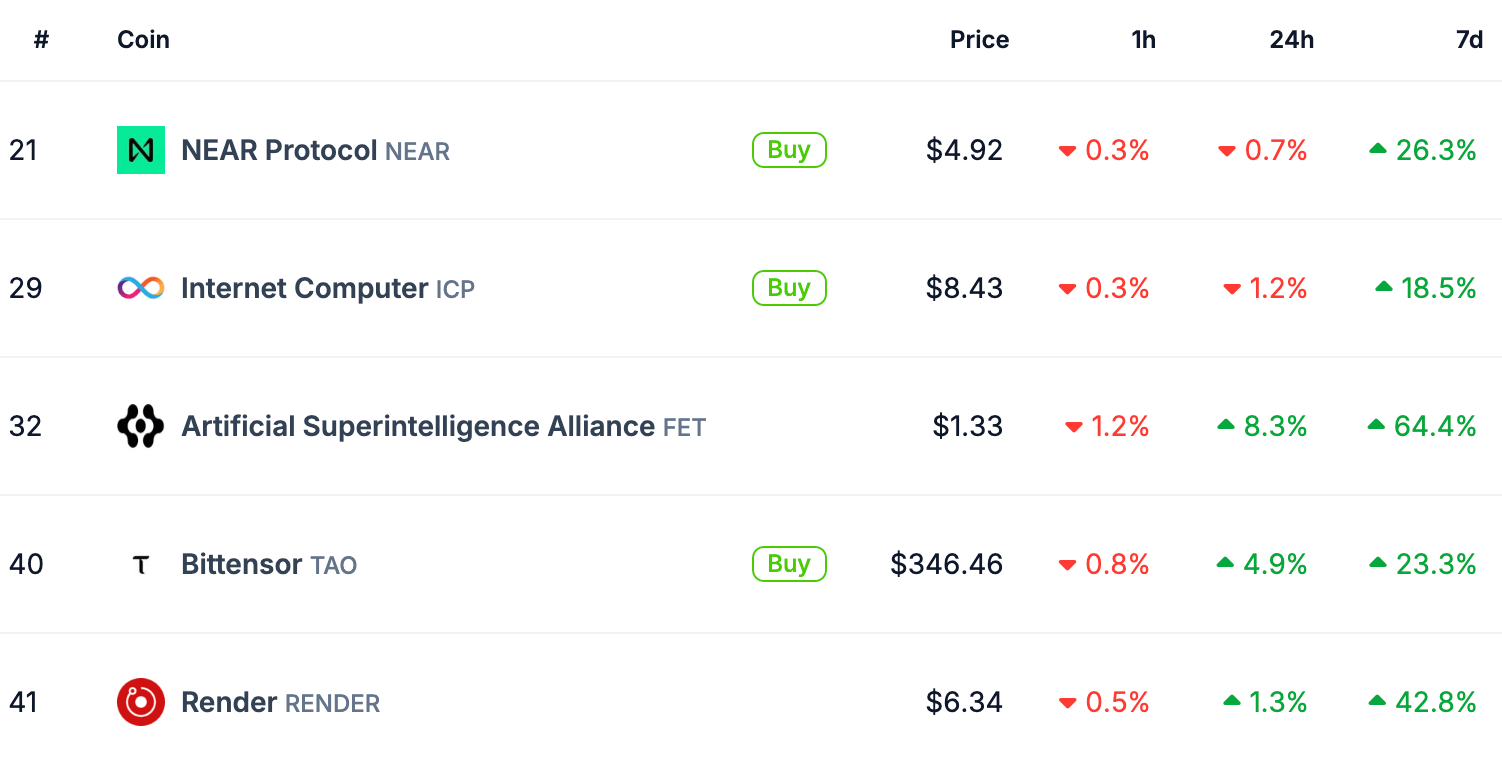

- NVIDIA (NVDA) Q2 earnings report is scheduled to be released on Wednesday. In the run-up to the release, Artificial Intelligence (AI) crypto tokens extended gains in the last 24 hours. Artificial Superintelligence Alliance (FET), Bittensor (TAO) and Render (RENDER) registered gains from 1.3% to 8.3%, according to CoinGecko data.

AI tokens

- SingularityNET (AGIX) and Ocean Protocol (OCEAN) added 8.4% and 7.8% to their value in the same 24 hour timeframe.

Industry updates

- Ethereum and blockchain technology are incorporated in high school courses in Argentina through a partnership with the ETH Kipu Foundation, according to press release released by the foundation. Starting August 27, students in Buenos Aires can participate in blockchain projects and internships, it said.

️Dijimos que Ethereum Argentina para Jóvenes era sólo el comienzo...

— ETH Kipu (@ETHKipu) August 23, 2024

Lo que viene ➡️ Incorporar Ethereum a la currícula de los estudiantes secundarios de la Ciudad de Buenos Aires

Gracias ministra @mechimiguel por confiar en ETH Kipu para este hermoso desafío ✨ https://t.co/mlh4JzwfU3

- A CoinShares report shows that digital asset investment products saw inflows totaling $533 million last week, the largest level in five weeks.

- Floki announced on its official X account that its trading bot crossed $11.6 million trading volume and hit an all-time high with 10,600 users.

FLOKI TRADING BOT HITS VOLUME AND USER ATH

— FLOKI (@RealFlokiInu) August 26, 2024

Floki Trading Bot just crossed $11.6 million trading volume and 10,600+ users -- an ATH. This is an impressive user and adoption growth as the bot now trades an average daily volume of $2.5 million.

This is coming just as we announced… pic.twitter.com/CARSOaNPGu

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.