Crypto Today: Bitcoin, Ethereum, XRP retreat as traders brace for Fed rate decision

- Bitcoin and Ethereum hover close to psychologically important price levels ahead of the Federal Reserve interest-rate decision.

- XRP loses nearly 3% as trader sentiment towards risk assets reverts to fear.

- BNB chain partners with Binance and other cryptocurrency exchanges to offer free stablecoin transfers and boost adoption.

Bitcoin, Ethereum and XRP updates

- Bitcoin (BTC) and Ethereum (ETH) trade close to key support levels hours ahead of the Federal Open Market Committee (FOMC) decision on interest rates on Wednesday.

- Bitcoin rallied past $61,000 on Tuesday amidst increasing expectations of a large interest-rate cut. The top crypto has settled around $59,400 at the time of writing.

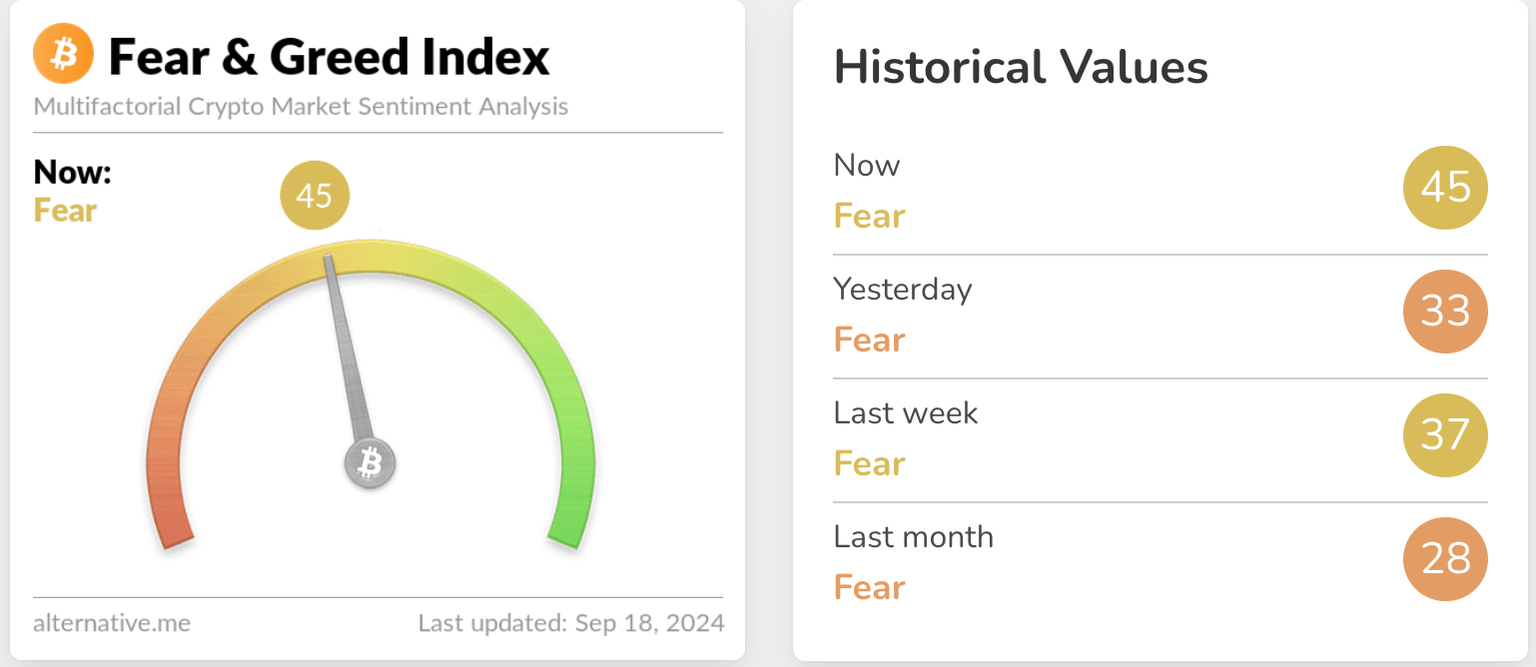

- The Crypto Fear & Greed Index, a tracker that measures the sentiment of market participants on a scale of 0 to 100, under five labels extreme fear, fear, neutral, greed and extreme greed, flashes “fear (45).” On Tuesday, the index read fear at 33. This signals that crypto traders get increasingly nervous ahead of the key Fed decision later today.

Fear & Greed Index

- XRP slips lower on Wednesday, down to $0.5671.

Chart of the day: ImmutableX (IMX)

IMX/USDT daily chart

ImmutableX (IMX) loses 5% on Wednesday, ranking among the worst-performing coins.

Despite the decline, technical analysis suggests that the native token of the Layer 2 blockchain that powers web3 games is likely gearing up for a recovery.

The Moving Average Convergence Divergence (MACD), a momentum indicator flashes green histogram bars above the neutral line, signaling underlying positive momentum in IMX price trend.

If bullish momentum emerges, IMX could extend gains by 13.42% from the current price of $1.329 and hit resistance at $1.50. This level has been tested as resistance throughout September. If IMX successfully breaks past resistance, it could target $1.690, the June 16 low.

Looking down, the first support zone extends between $1.281 and $1.323.

Market updates

- Toncoin (TON) drives growth on Bitget crypto exchange, acting as a catalyst that pushed user base to 45 million, growth in African, South Asian and Southeast Asian users in 2024.

- The LayerZero Foundation has announced up to $300 million investment in integrated projects, alongside launch partners a16z crypto, Animoca Brands, Atrum and Delphi Ventures.

Introducing lzCatalyst

— LayerZero (@LayerZero_Core) September 17, 2024

LayerZero Foundation is launching lzCatalyst, a program dedicated to connecting the best builders with the best venture capital firms in crypto.

As lzCatalyst launch partners, a16z Crypto, Animoca Brands, Atrum, Delphi Ventures, Faction, Franklin… pic.twitter.com/zmDevqnvau

- The US Securities & Exchange Commission (SEC) has reached a settlement with audit firm Prager Metis, according to an official statement. The firm agreed to pay a $1.95 million fine to resolve two charges involving misconduct in its audit of FTX, falsely misrepresenting FTX's financial condition, and failing to disclose the relationship between Alameda and FTX.

Industry updates

- Binance, one of the largest crypto exchanges, said in a press release that it is not responsible for WazirX creditors. “We urge the WazirX team under Zanmai/Zettai to be accountable to WazirX users (...) Their responsibility to WazirX users is unrelated to their dispute with Binance,” the exchange said.

- Asset management giant BlackRock said on Tuesday that it has teamed up with Microsoft to launch a $30 billion fund to invest in Artificial Intelligence (AI) infrastructure, data centres and energy projects.

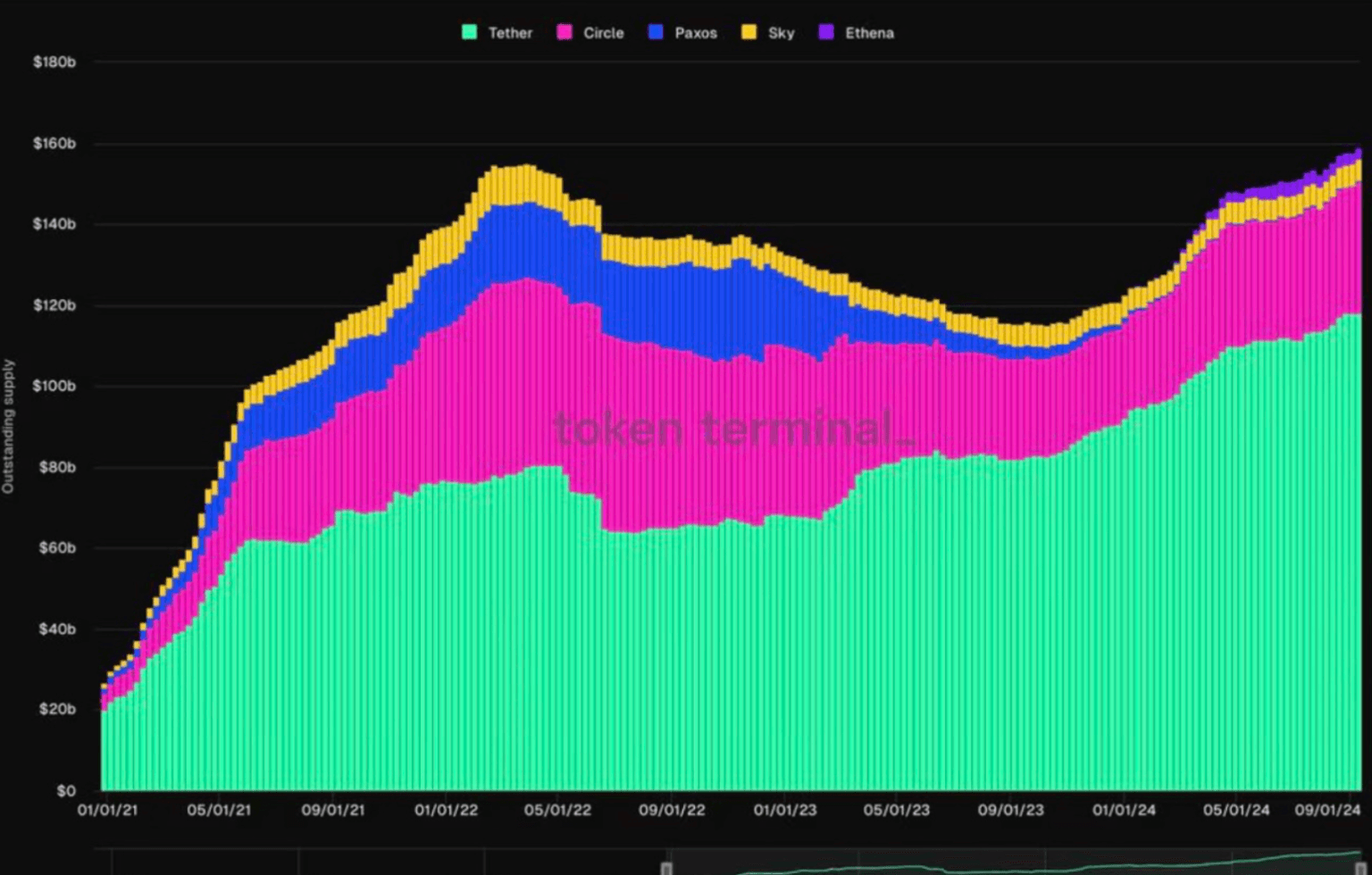

- Tether’s USDT accounts for 75% stablecoin market share, almost doubling in almost two years, per TokenTerminal data. The project has faced criticism from several industry leaders for audits and collateral.

Stablecoin market share

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.