Crypto Today: A bit of calm before the storm

Here's what you need to know on Friday

Markets:

The BTC/USD is currently trading at $7,100 (-0.6%). The coin has entered range-bound trading after wild gyrations in the first half of the week. During early Asian hours, the first digital coin is oscillation in a narrow 100-dollar range.

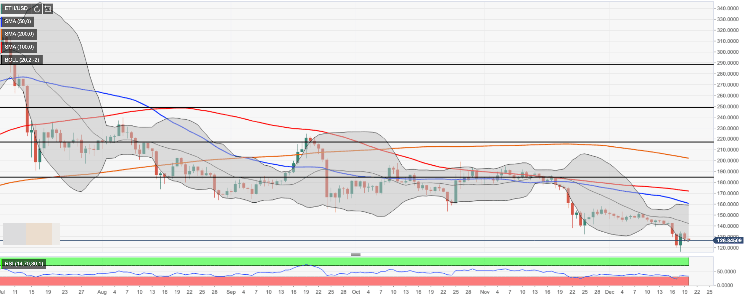

The ETH/USD pair is currently trading at $126.56 (-1.38%). The Ethereum has resumed the decline during early Asian hours after an unsuccessful attempt to break above $130.00.

XRP/USD settled below $0.1900 to trade at $0.1854 by press time. The coin is down 1.4% since the beginning of the day amid increasing bearish pressure.

Among the 100 most important cryptocurrencies, the best of the day are LUNA (LUNA) $0.2501 (+19.3%), FTX Token (FTT) $2.18 (+14.4%) and Crypterium (CRPT) $0.3807 (+13.2%). The day's losers are Lisk (LSK) $0.5175 (-5.8%), Electroneum (ETN) $0.0034 (-5.8%), Seele (SEELE) $0.1407 (-5.4%).

Chart of the day:

ETH/USD, 4-hour chart

Hong Kong police provided Bitcoin supporters with just another reason to buy and hold digital coins. The authorities froze $9 million raised by a group that supported arrested and injured protesters.

Peter Schiff, the head of Euro Pacific Capital, believes that Bitcoin will hit $4,000 until the end of the year. He is sure that the first digital currency will repeat the fate of XRP and ETH - both altcoins dropped below the levels registered at the beginning of 2019.

Industry:

Binance, of the world's largest cryptocurrency exchange, reportedly started to block withdrawals for customers who use privacy-focused cryptocurrency wallet Wasabi. The exchange explained the ban by "risk management" considerations as the wallet had a built-in coin mixing tool. Now the customer is requested to disclose personal information, including his current occupation and annual income, and explain the nature of his transactions.

According to Dune Analytics, the trading volume on Ethereum-based decentralized exchanges (DEX) surpassed $2.3 billion in 2019. Moreover, in the recent seven days, the trading volume on DEX jumped by 63% and hit $49 million, which may be partially related to the fact that centralized trading platforms like Binance gravitate to strict KYC procedures.

Libra Association is determined to launch Libra coin in 2020, even though the team has no clear strategy on how to roll out the project. Patrick Ellis, one of five board members for the Geneva-based Libra Association, admitted that the project's roadmap and the scope of the roll-out would depend on talks with regulators.

Regulation:

Germany will have a new set of rules related to the custody services of cryptocurrencies as of January 1, 2020. The new rules will bring radical changes to the way the industry operates in the country. Namely, all cryptocurrency exchanges will have to obtain a license from the German financial regulator BaFin. The legislators have taken the EU Anti-Money Laundering Directive as an opportunity to introduce strict regulation for the companies that provide cryptocurrency custody services.

In France, the financial regulator (Autorité des Marchés Financiers (AMF) has granted the first-ever approval for the Initial Coins Offering (ICO). The permission was given to a company that developed a platform for raising cryptocurrency financing for projects. As it was reported earlier, AMF was in talks with several candidates for ICO, which means new approvals may be on the way.

Quote of the day:

Author

Tanya Abrosimova

Independent Analyst