Crypto Today: $275M in short liquidations as BTC, BCH, and ADA rally on Trump’s tariff U-turn

- The cryptocurrency market capitalization surged 4% on Wednesday, crossing the $2.9 trillion mark.

- The $112 billion crypto rebound is driven by speculation that Trump may ease recently imposed tariffs on Canada and Mexico.

- Bitcoin, Cardano and Bitcoin Cash led the rally, posting the largest gains among the top 20 crypto assets.

- With $275 million positions closed, short liquidations exceeded long liquidations for the first time this week, signaling a positive momentum shift.

Why is Bitcoin price going up today?

Bitcoin price surged 9% after United States (US) Commerce Secretary Howard Lutnick told reporters on Tuesday that President Donald Trump will "probably" announce a trade compromise on the 25% tariffs imposed on Canada and Mexico.

- Optimistic traders anticipating a full U-turn redirected capital towards risk assets, driving up BTC prices.

- BTC moved from Tuesday’s lows around $81,480 to hit $90,000 at press time on Wednesday.

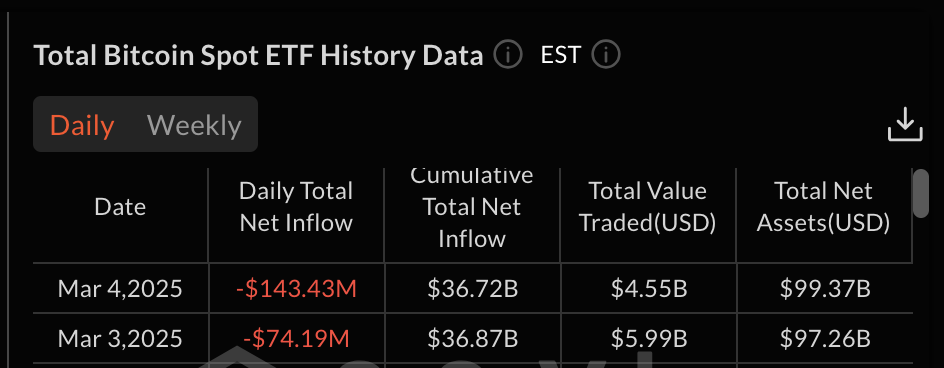

- Bitcoin ETFs sell-offs continued with another $143 million in outflows recorded on Tuesday, making $217 million total outflows this week.

Bitcoin ETF Flows, March 4 | Source: SosoValue

It remains to be seen if the anticipated Trump tariff easing could spark the first inflows for this week.

Altcoin market updates: Cardano, Bitcoin Cash and Hedera in early lead as Trump administration continues to sway investor sentiment

Since Trump’s inauguration in January, critical news from his administration has heavily swayed altcoin market movements. Over the past week, three key US-related events have had the most impact on investor sentiment.

ETF filings are under review with US regulators, along with Trump’s crypto strategic reserve order and discussions on tariffs for Canada and Mexico. Price trends observed on Wednesday suggest each of these catalysts remain active.

- Hedera price rose nearly 20% in the last 24 hours and news of Nasdaq filing to list Grayscale’s spot HBAR ETF product coincided with speculations that Trump could ease tariffs.

Crypto Market Performance, March 5 | Coinmarketcap

- Cardano (ADA) rose 100% to emerge as the biggest gainer among the five assets featured on Trump’s crypto strategic reserve bucket.

- ADA repeated the feat again on Wednesday, with its 24% rebound tripling BTC’s 7% gains on the day.

- Ethereum and XRP posted 5% gains apiece but are currently facing key hurdles at the $2,200 and $2.50 psychological resistance levels, respectively, at press time.

Chart of the day: Analyst Cole Garner hints at next BTC breakout

Analyst Cole Garner identified a key trading signal hinting at a potential near-term recovery for BTC price action.

“Binance & Coinbase max bidding corn.

Have watched these patterns for years.

Smart money buys fear, before the next big move.

What do they know that we don't?”

- Cole Garner, March 4.

As seen in the chart he posted on X on Tuesday, Garner highlights Bitcoin’s historical correlation between deep bid-side liquidity surges and explosive price rallies.

The lower panel displays the cumulative sum delta of order book depth, where green spikes indicate aggressive bid-side accumulation.

Notably, each time bid-side liquidity surged past the highlighted threshold (yellow boxes), Bitcoin entered a strong uptrend, as seen in the corresponding green-shaded areas on the price chart.

Bitcoin Price Forecast | Source; Cole Garner via X.com

Currently, order book data shows another major bid-side liquidity spike, signaling that institutional buyers are stepping in at key support levels.

This pattern, consistent with previous pre-rally phases, suggests that smart money is absorbing supply before a potential breakout.

From a bullish perspective, if Bitcoin maintains support above $85,000 and liquidity absorption continues, a breakout toward $92,000 is likely, with an extended rally to $100,000 if accumulation remains strong.

Conversely, if BTC fails to hold key liquidity levels and bid-side support dries up, history suggests a sharp reversal could follow.

A breakdown below $81,500 could expose $76,800 as the next key demand zone, with further downside risk toward $72,500 if sell-side dominance takes over.

The coming sessions will be crucial in confirming Bitcoin’s next major move.

Crypto news updates:

-

SlowMist uncovers critical encryption flaw that could expose private keys

Blockchain security firm SlowMist has identified a critical vulnerability in a widely used elliptic encryption library, posing a severe risk to digital asset security.

The flaw allows attackers to extract private keys from a single digital signature by crafting specific inputs, potentially compromising wallets and cryptographic systems.

SlowMist's warning has sparked immediate concerns across the crypto community, as the flaw could be exploited to bypass key security mechanisms in blockchain transactions.

Industry experts are calling for urgent audits of affected systems and swift updates to prevent potential breaches.

Users are advised to stay alert for official patches and avoid signing transactions on vulnerable platforms until a fix is implemented.

-

Australia announces crypto crackdown with new compliance rules for exchanges

Australia’s financial intelligence agency, AUSTRAC, has introduced stricter regulations for crypto exchanges and custody services, requiring them to capture and verify user information by March 2026.

The new rules mandate reporting of financial transactions and suspicious activities, impacting over 400 service providers, including crypto ATMs (CATMs).

Smaller exchanges may struggle with the added operational burden, while larger platforms are expected to integrate enhanced KYC (Know Your Customer) and AML (Anti-Money Laundering) measures.

The regulatory update marks a significant shift in Australia’s approach to crypto governance, increasing compliance requirements for industry participants.

-

SEC drops lawsuit against Cumberland DRW in latest enforcement reversal

The US Securities and Exchange Commission (SEC) has agreed to dismiss its case against Cumberland DRW, marking another reversal in its recent crypto enforcement actions.

Cumberland confirmed that a joint filing was signed for the case’s dismissal, with the agreement initially reached on February 20 and currently awaiting final Commission approval.

The decision emphasizes a softening stance in the SEC’s approach to crypto regulation, having dropped charges against Ripple, Robinhood and Uniswap in recent weeks.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.

-638767847486249679.jpeg&w=1536&q=95)