Crypto options volume on CME rose to nearly $1B in July: CCData

Derivatives giant Chicago Mercantile Exchange (CME) recorded double-digit growth in crypto options trading volume in July, helped by investor appetite for hedging tools.

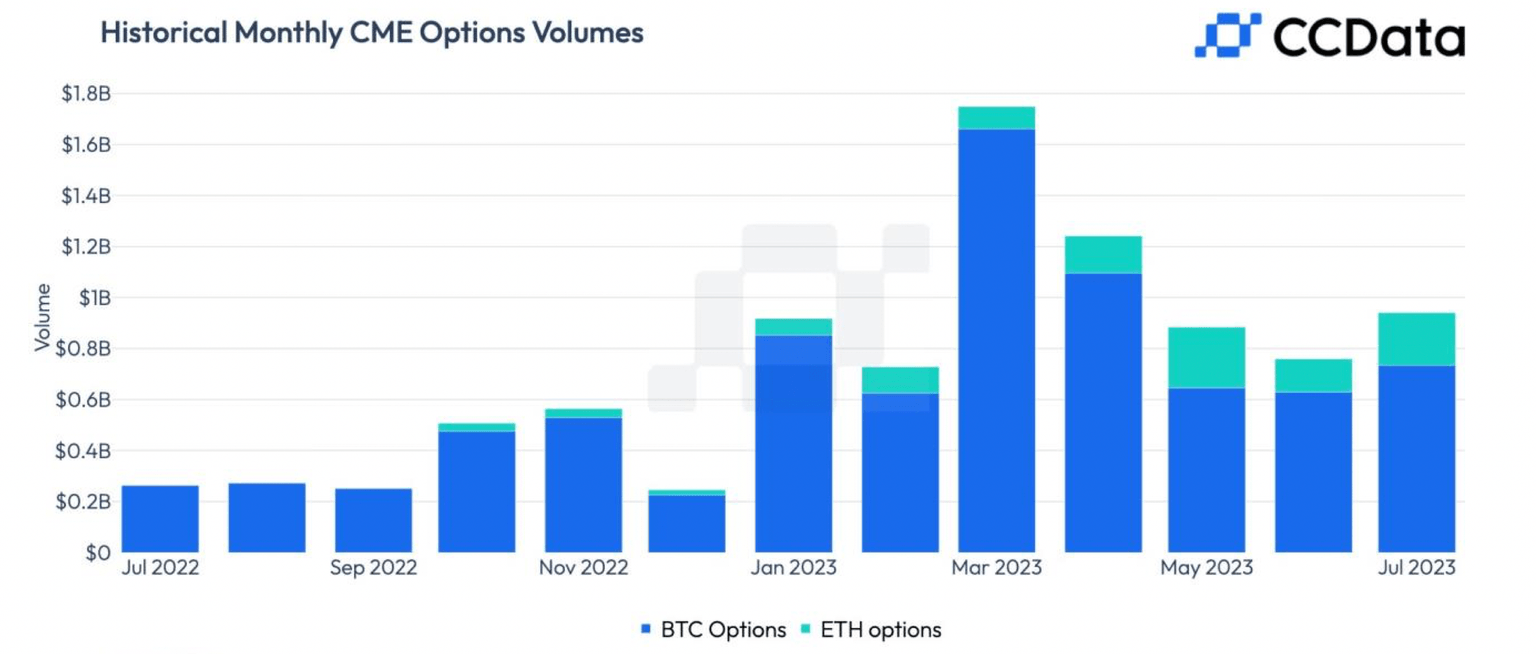

Trading activity rose 24% to $940 million, registering the first increase in four months, according to data tracked by CCData. Volumes in bitcoin (BTC) options rose 16.6% to $734 million, while ether (ETH) options registered a 60% increase to $207 million.

"The increase in BTC options volume on the CME suggests that institutions might be hedging their positions with options as uncertainty remains in the market," CCData said in a report shared with CoinDesk.

Options are derivative contracts that give the purchaser the right to buy or sell the underlying asset at a predetermined price on or before a specific date. A call option gives the right to buy and a put option confers the right to sell.

CME's options give the buyer of the call/put the right to buy/sell one cryptocurrency futures contract at a specific price at some future date. CME offers Bitcoin and ether options based on the exchange's cash-settled standard and micro BTC and ETH futures contracts. Standard contracts are sized at 5 BTC and 50 ETH. The micro ones are one-tenth of 1 BTC and one-tenth of 1 ETH.

Customer business in the options segment picked up in July for the first in four months. (CCData) (CCData)

Bitcoin and ether fell by 4% in July as optimism from the potential launch of bitcoin-spot ETF faded and regulatory uncertainty and DeFi hacks roiled sentiment. Bitcoin traded alongside stocks and gold a little more than it did in the second half of June, warranting the use of options to hedge directional exposure in the crypto market.

The combined activity in CME BTC and ETH futures cooled in line with the global slowdown. Futures volume on CME registered a 17.6% decline to $39.1 billion, while total derivatives trading volume (futures and options) fell 17.0% to $40.1 billion, according to CCData.

The combined crypto spot and derivatives trading volume on centralized slipped 12% in July to $2.36 trillion. "This was the second-lowest combined volume on centralised exchanges since December 2020, only eclipsed only by December 2022," CCData noted.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.