Crypto assets consolidate amid more and more money-printing

Bitcoin’s (BTC, Tech/Adoption Grade “A”) third halving is behind us, and crypto assets continue to adjust to a market changed by another hard-coded supply limit imposed on its biggest player.

But the long-term viability of an increasingly hard digital currency amid softer and softer fiat money is becoming more and more apparent by the day.

As for the moment at hand, most cryptos, including Bitcoin, have been treading water in May, stuck in a range established right before and right after the halving.

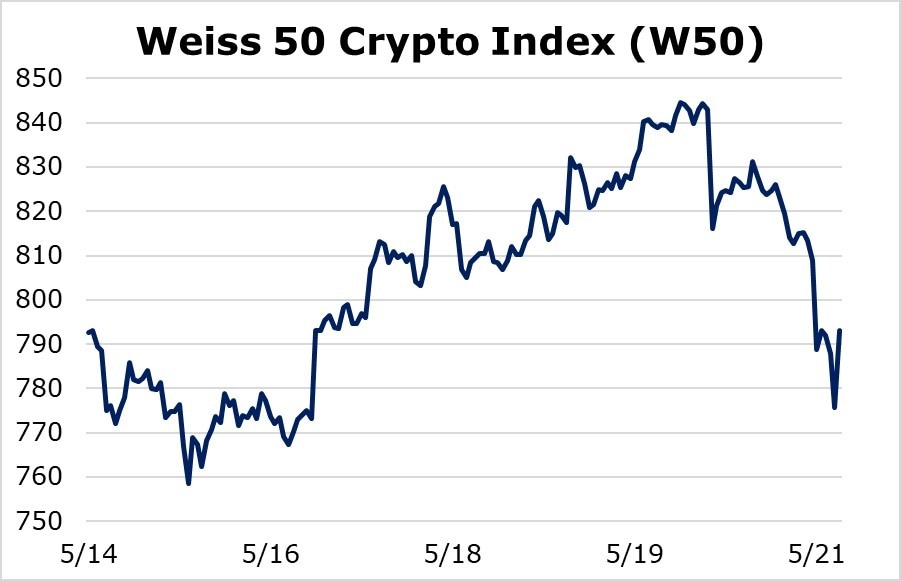

The Weiss 50 Crypto Index (W50) — a broad benchmark of crypto-asset performance — was virtually unchanged during the week ended Thursday, May 21, up just0.07%.

Zeroing in on the altcoins, the Weiss 50 Ex-BTC Crypto Index (W50X) posted a gain of 4.40% on the week, showing a little more strength than big Bitcoin.

Let’s split the sector by market capitalization …

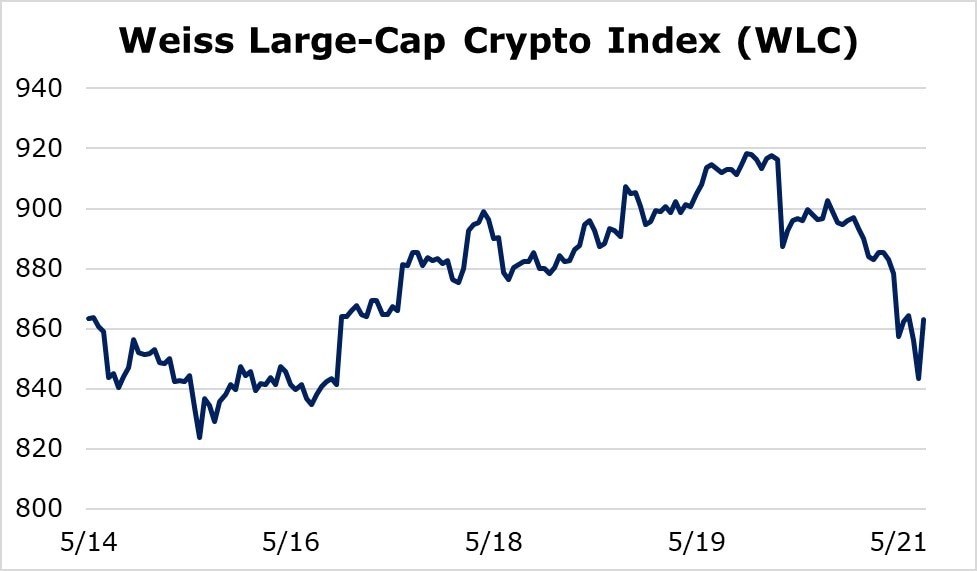

The Weiss Large-Cap Crypto Index (WLC) was basically unchanged, down -0.04% on the week.

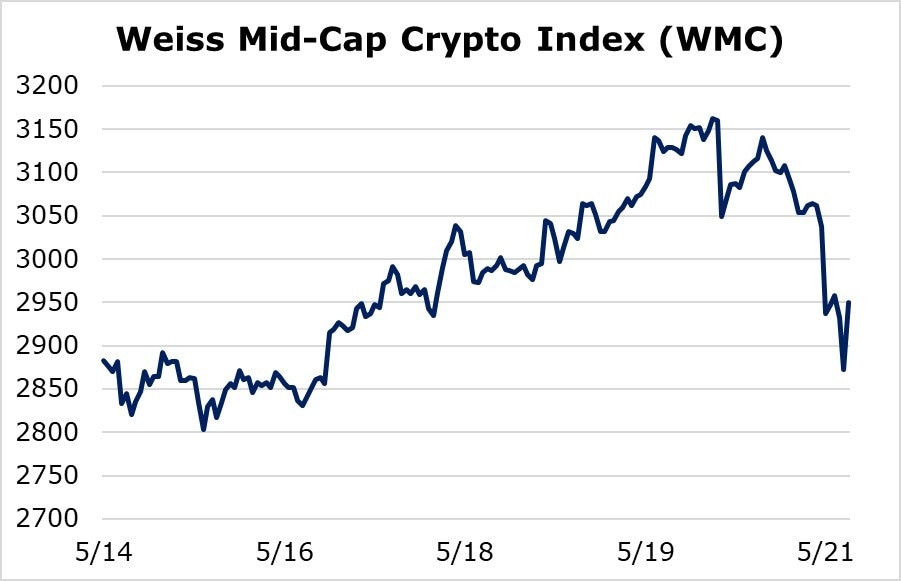

The Weiss Mid-Cap Crypto Index (WMC) posted a gain of 2.33% on the week.

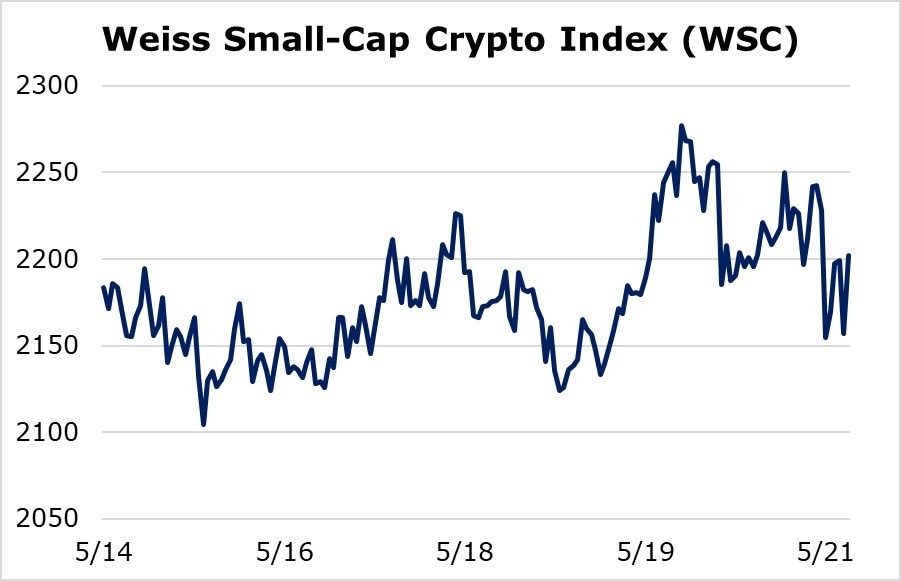

Finally, the Weiss Small-Cap Crypto Index (WSC) moved up 0.83% during the seven-day stretch ending May 21.

Despite some intra-week volatility and isolated attempts to break out of the post-halving consolidation range in both directions, nothing notable materialized from a trading action perspective.

Now, let’s pull back a bit for a bigger-picture, investment perspective …

Crypto assets appreciated considerably from March 13 into early May. Speculators who “bought the rumor” did sell the May 11 halving news, and we’ve seen sideways action for much of the month. But our timing model continues to indicate a potential breakdown from this range.

It’s this pause that will refresh crypto assets for another run higher.

Indeed, the longer-term view must take into account the promise by global central banks to use extraordinary monetary policy to inflate prices of traditional financial assets even further in pursuit of fleeting “wealth effects.” Federal Reserve Chair Jerome Powell has hinted at another round of some $3 trillion of freshly printed liquidity to contain the damage caused by pandemic fears.

That’s regardless of the fact that such stimulus packages have poor track records when it comes to helping the real economy. Time and again, though, these increasingly desperate measures provehighly effective at boosting prices of safe-haven assets like gold … and Bitcoin.

This is the ultimate reasonto own crypto. And it’s never been more obvious than it is right now.

Author

Juan Villaverde

Weiss Crypto Ratings

Juan Villaverde is an econometrician and mathematician devoted to the analysis of cryptocurrencies since 2012.