Cronos price is proof of a breakdown in correlation as another 10% pullback looms

- Cronos price moves sideways to lower, while US equities book a new nine-month record high.

- CRO sees its price consolidating in a bearish squeeze.

- Expect to see another leg lower with CRO dropping below $0.06.

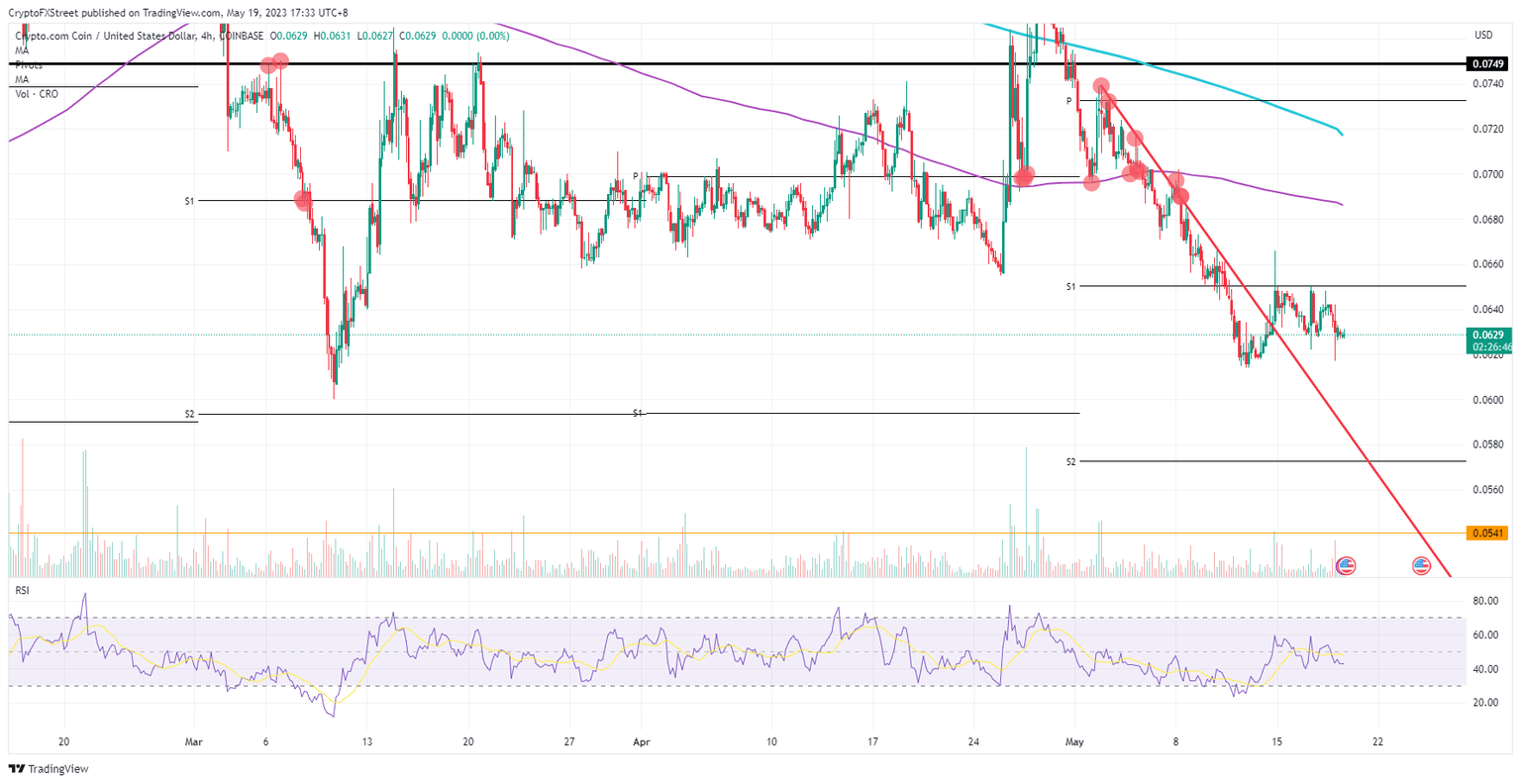

Cronos (CRO) price has broken its steep decline that started in early May by breaking through the red descending trendline. Unfortunately, no real rally was formed then, while in the meantime US equities have been advancing substantially. A fresh nine-month high for the S&P 500 was even formed on Thursday. This paints a gloomy picture for altcoins as clearly the tailwinds from the equity market only has limited influence on CRO’s price action.

Cronos price action selling pressure build

Cronos price is going nowhere as bulls have burned all their energy to break through that red descending trendline that has been dictating price action for the better part of May. A few false breaks add to the mix, and it has become clear that bulls are really heading nowhere. More downside is thus at hand as that sideways action has helped the Relative Strength Index (RSI) to move away from oversold territory and is now showing room again to head lower.

CRO is currently trading in a very narrow consolidation as bulls are being squashed against the current floor at $0.062. Once that level gives way, expect to see a quick slide to $0.061, which was the low of May. Another leg lower points to $0.057 with the monthly S2 support as the end of the line and the RSI heading into the oversold area by then.

CRO/USD 4H-chart

More upside potential would be seen if bulls can overcome past rejections on the topside. That means a break above $0.065, which falls in line with the monthly S1 support pivot. Once bulls break that area, expect to see a further jump higher toward $0.068.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.