Cosmos community passes proposal to slash ATOM inflation, seeks long-term profitability

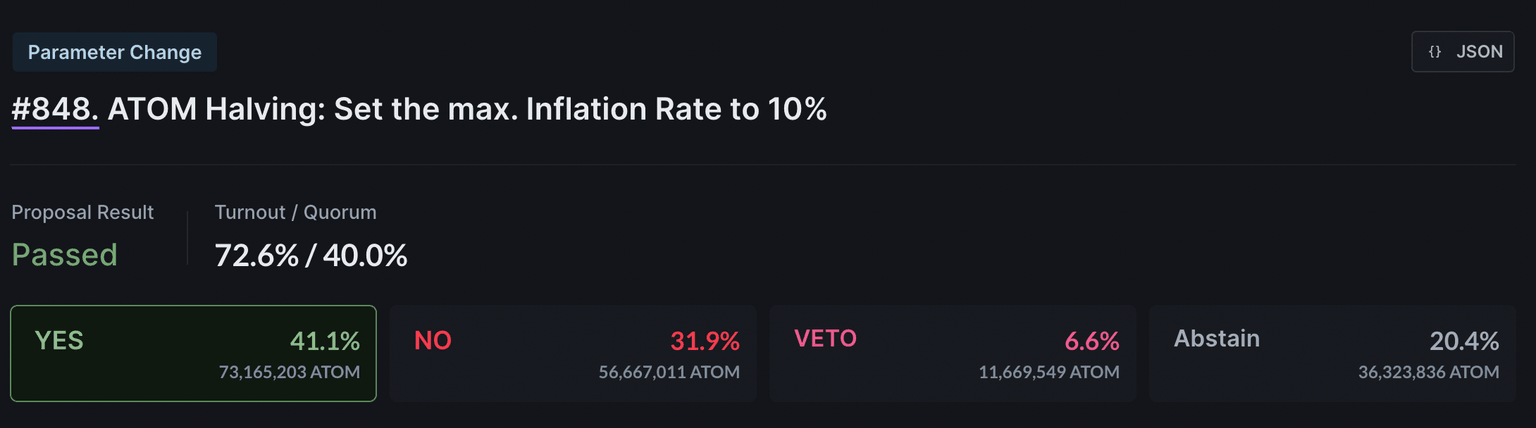

- The Cosmos Hub community has passed the ATOM Production Reduction proposal with 41.1% support.

- The maximum inflation of the token will be slashed in half, to 10%.

- ATOM price is up nearly 6% on the day, yielding 40% monthly gains for holders.

A Cosmos proposal to reduce ATOM’s inflation rate and improve its security was passed by the Cosmos Hub community. The proposal will reduce the annual interest rate for stakers, in exchange for long term profitability and price growth in ATOM.

Also read: Ethereum whale activity could pave way for ETH price to hit new yearly highs

Cosmos community agrees to slash ATOM inflation in half

A proposal to reduce ATOM’s inflation rate from 14% to 10% and slash staking yield from 19% to 13.4%, received a go-ahead from the community of voters. The support rate for the proposal os 41.1% and opposition was 31.9%. The community members agreed to slashing inflation for the token to ensure better staking incentives and improve Cosmos network’s security.

The proposal was inspired by research firm Blockworks’ report that ATOM is overpaying for security. Transitioning to a set supply schedule was suggested to improve security and nearly all validators were at break-even profitability, they agreed at a maximum of 10% inflation.

Validators were given the option of increasing their commission rate for covering operational expenses.

Cosmos proposal to reduce ATOM inflation rate

With approval on the ATOM halving proposal, the community can now expect higher profitability and likely appreciation of the token’s price in the long term. At the time of writing, ATOM price is $9.9220 on Binance. The token is up 6% on the day and 7.50% on the week.

In the past month, ATOM holders observed double-digit gains, nearly 40%.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.