Chinese investors are growingly concerned that Polkadot fails amid EOS-like fraudulent activity

- Polkadot price has experienced unprecedented growth in the past week hitting a market capitalization of $16 billion.

- Many investors, however, are concerned about a potential massive crash like happened to EOS.

Polkadot is known as the Ethereum Killer and although started trading in 2020, quickly reached a market capitalization of $4 billion. This blockchain protocol offers a high throughput and low-cost transactions, but what does make DOT different than any of the other Ethereum competitors like EOS?

EOS is a platform that was designed to allow developers to build decentralized applications on it. The digital asset had an amazing start reaching a market capitalization of $17 billion in April 2018. Nevertheless, shortly after, its price plummeted down to $1.8 from the $21 all-time high and never managed to recover.

New report states Polkadot’s fate will be similar to EOS

According to a recent Chinese report published on the WeChat platform, Polkadot might be just hyped up from China just like EOS. The article states:

We conducted some surveys based on the Polkadot ecological project summary compiled by Bikan, and found that in addition to DOT and Kusama, the remaining 11 ecological projects include ANKR, ChainX, Polar Region, Celer, Darwinia/KTON, Phala, MantraDAO and Eight projects, including Crust, have Chinese capital behind them, which can be said to account for half of the current Polkadot ecological hot projects.

Additionally, it seems that MantraDAO has been already investigated for serious fraud. The article also references EOS price growth back in 2017 and 2018 and its similarities to the current price action of Polkadot.

It’s also important to note that Polkadot markets itself as an Ethereum Killer. However, ETH 2.0 should be released within the next two years which would make Polkadot somewhat useless.

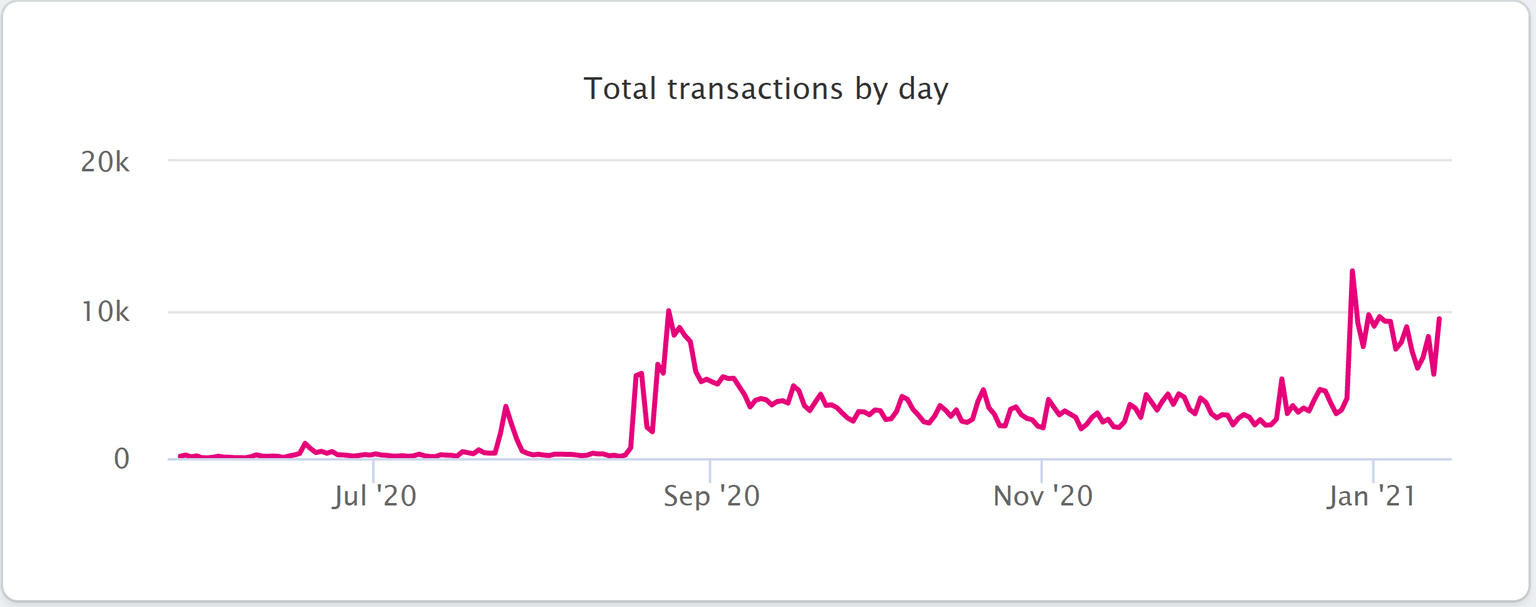

Polkadot Transactions chart

What’s even more interesting is the number of transactions on the Polkadot network. Despite hitting a new high on December 28, 2020, at 12,619 transactions in a day, this number is still minuscule in comparison to Ethereum’s transactions, seeing an average of 1.1 million per day.

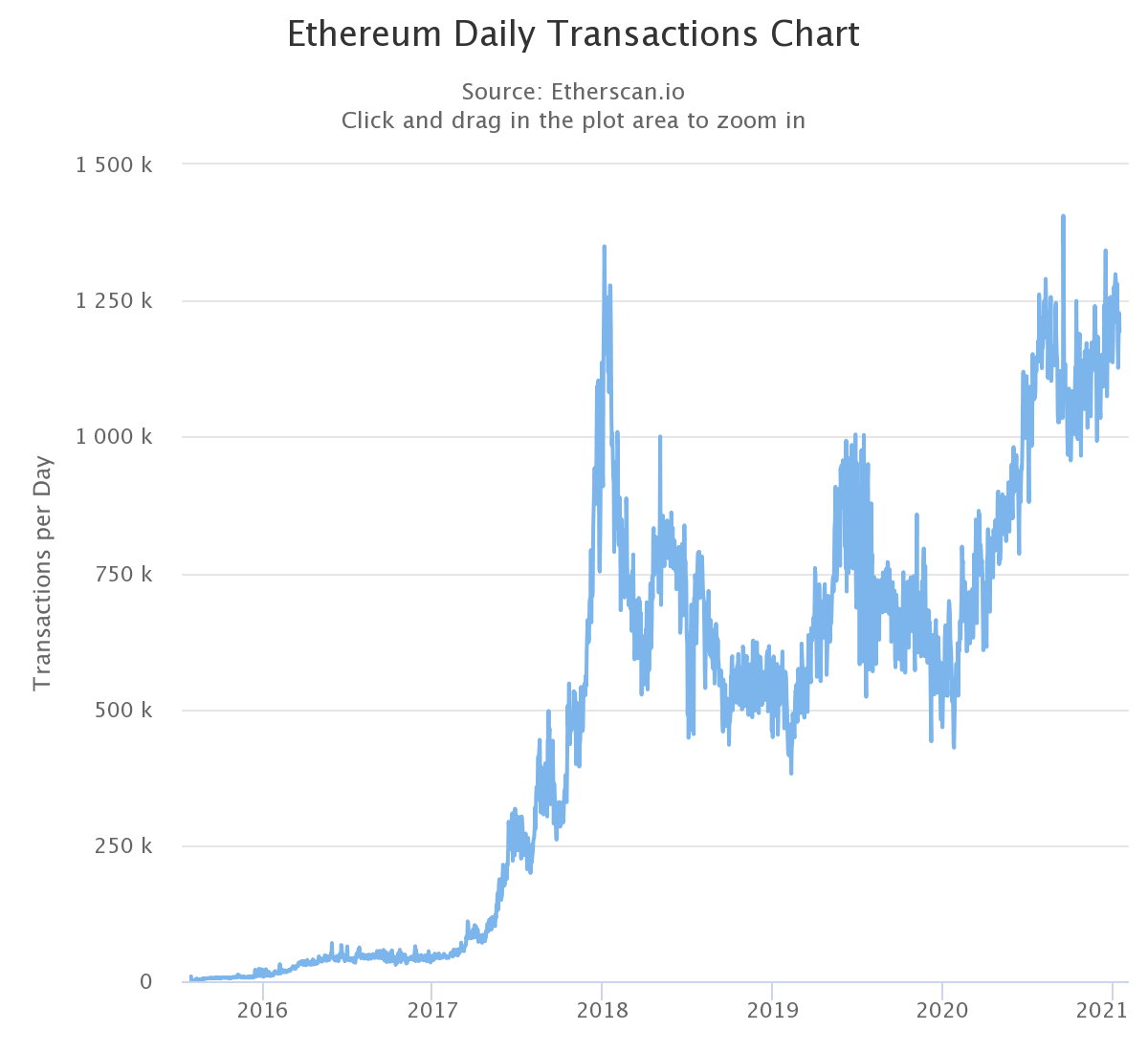

Ethereum transactions chart

In fact, even in January 2017, when Ethereum price was roughly $10 with a market capitalization of $1 billion, the network still had an average of 50,000 transactions per day, which is almost five times higher than Polkadot’s best day.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.