Chiliz Technical Analysis: CHZ/USD breaches $0.0146 with a 9% bull move

- CHZ/USD is currently in a major daily uptrend.

- Chiliz has been holding daily EMAs for months but the RSI is overextended.

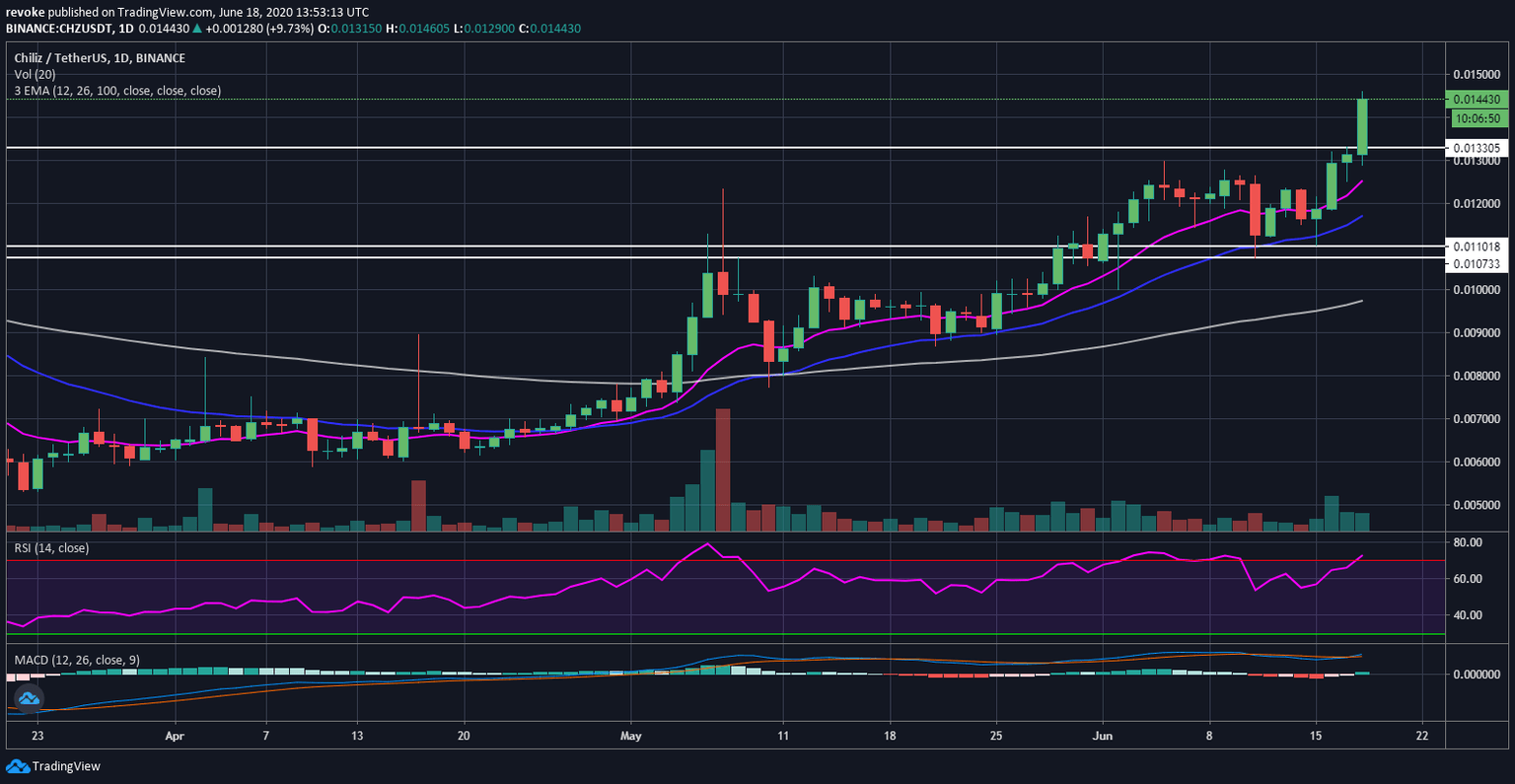

Chiliz has been one of the best-performing coins this year and it’s currently trading at $0.0143 after climbing to a high of $0.0146 on June 18. Buyers are comfortably placed above both EMAs but the daily RSI could signal a short-term pullback.

CHZ/USD daily chart

Clearly, bulls are in control and the 12-EMA at $0.0125 will serve as the next support level. If the 12-EMA is lost, buyers can use the 26-EMA at $0.0117 as the next support point before the low at $0.011 and the $0.01 psychological level.

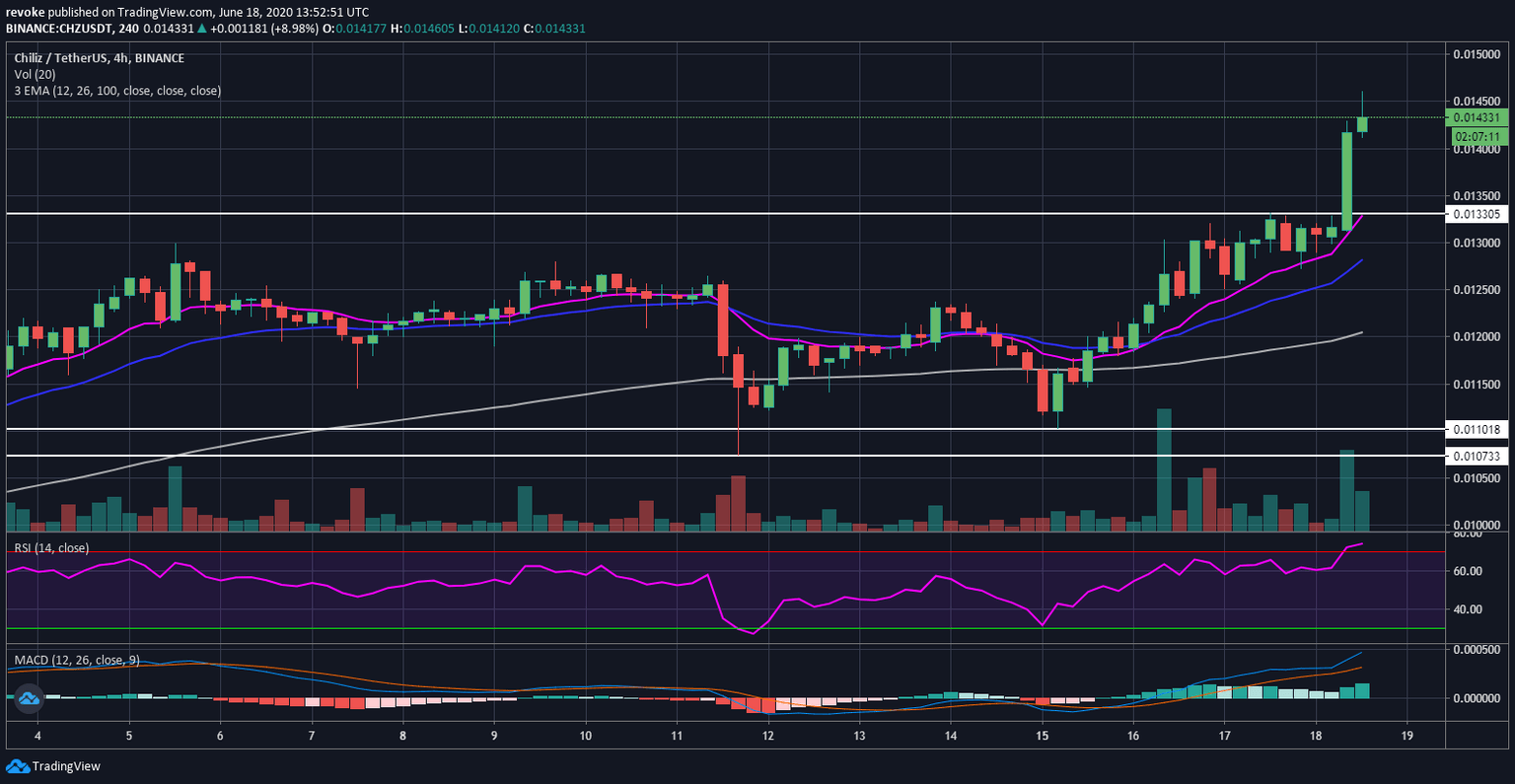

CHZ/USD 4-hour chart

The 4-hour chart bull flag has been confirmed with a substantial follow-through by the buyers. The RSI is overextended but it doesn’t mean CHZ can’t see another leg up considering the strength of the current move.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.