Chiliz Price Forecast: CHZ jump to $1 is inevitable, according to technicals

- Chiliz price had a breakout from a bull pennant on the 12-hour chart

- The digital asset faces only one key resistance level on the way up, according to on-chain metrics.

- The only concerning factor is a sell signal posted by the TD Sequential indicator.

Chiliz (CHZ) had a massive 30% move in the past two days, cracking a key resistance level and breaking out from a parallel channel. CHZ had a lot of momentum since the beginning of 2021 thanks to fan tokens.

Chiliz price targets $0.65 in the short term

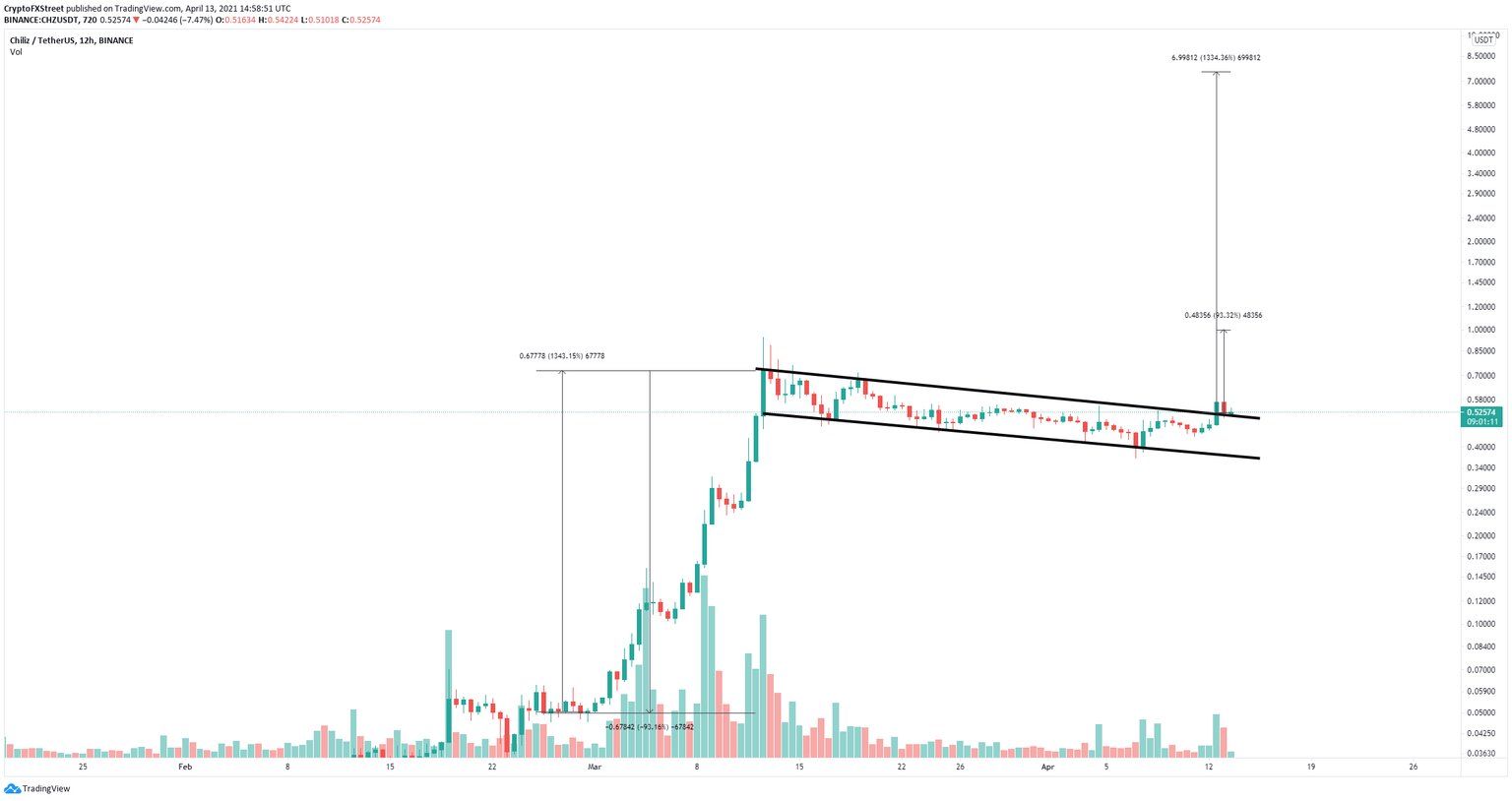

On the 12-hour chart, Chiliz established a bull pennant and had a breakout above it on April 12. This massive pattern has two significant price targets, one conservative at $1, which would be a 93% move, and a colossal one at $7.5, which would mean a 1,300% surge.

CHZ/USD 12-hour chart

The digital asset has already re-tested the previous resistance trendline and only faces one key resistance level before a jump to yearly highs at $1.

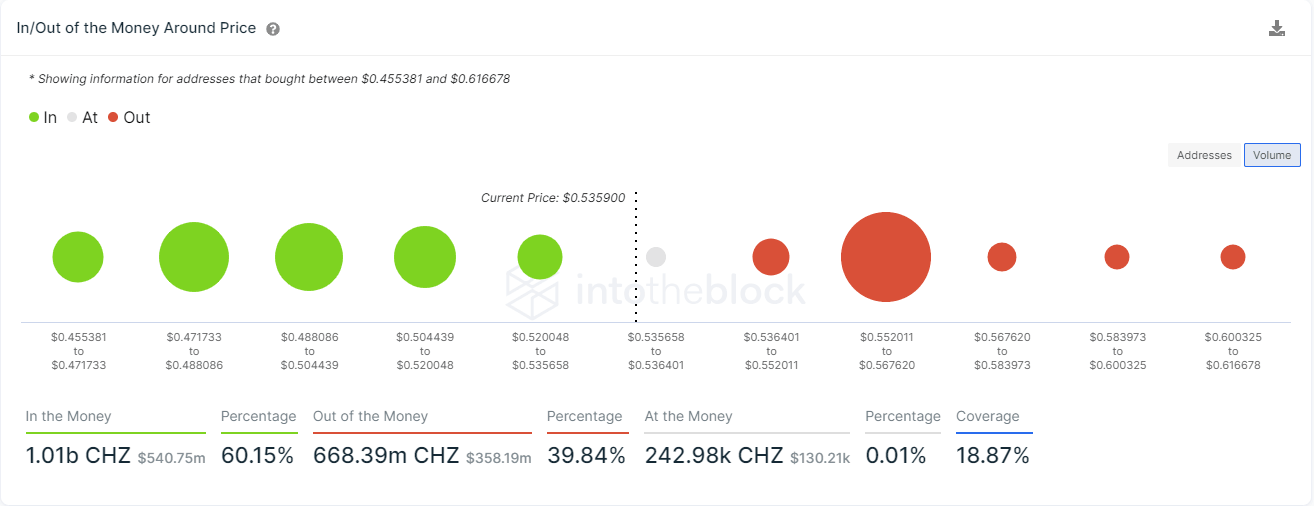

CHZ IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows only one critical resistance area between $0.55 and $0.567 where 182 addresses purchased 619,000 CHZ. Moving above this point should quickly push Chiliz price towards $0.65.

CHZ Holders Distribution

Additionally, the number of whales holding 10,000,000 CHZ or more has increased by six since April 4. This gives even more credence to the bullish outlook outlined above.

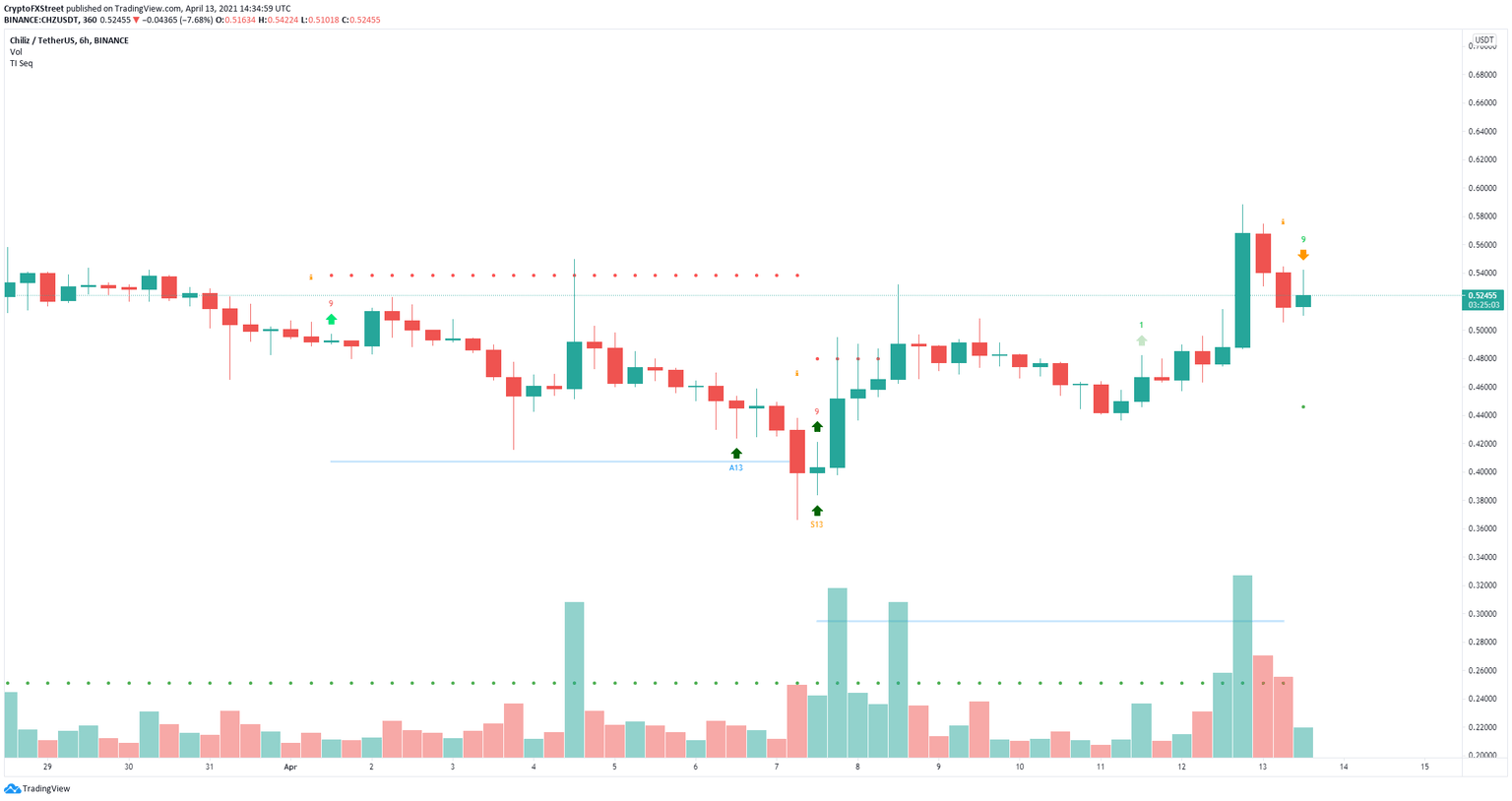

CHZ/USD 6-hour chart

However, on the 6-hour chart, the TD Sequential indicator has just presented a sell signal which could easily drive Chiliz price down to $0.50 which is a significant support level according to the IOMAP model.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.33.37%2C%252013%2520Apr%2C%25202021%5D.png&w=1536&q=95)