Chiliz price crashes by 24% in a day as FIFA fan tokens lose appeal after World Cup kick-off

- Chiliz price declined to monthly lows, trading at $0.185.

- Top FIFA fan tokens of Portugal, Brazil and Argentina’s football teams have also crashed by 25% in value.

- CHZ closing a daily candlestick below $0.165 would invalidate the bullish thesis, leaving the price to tag $0.150.

Chiliz price has been noting a lot of fluctuation over the last couple of days in anticipation of the FIFA World Cup Qatar 2022. Due to the cryptocurrency's affiliation with the fan token platform Socios.com, CHZ has taken a hit as traders' interest in these fan tokens seems to have declined.

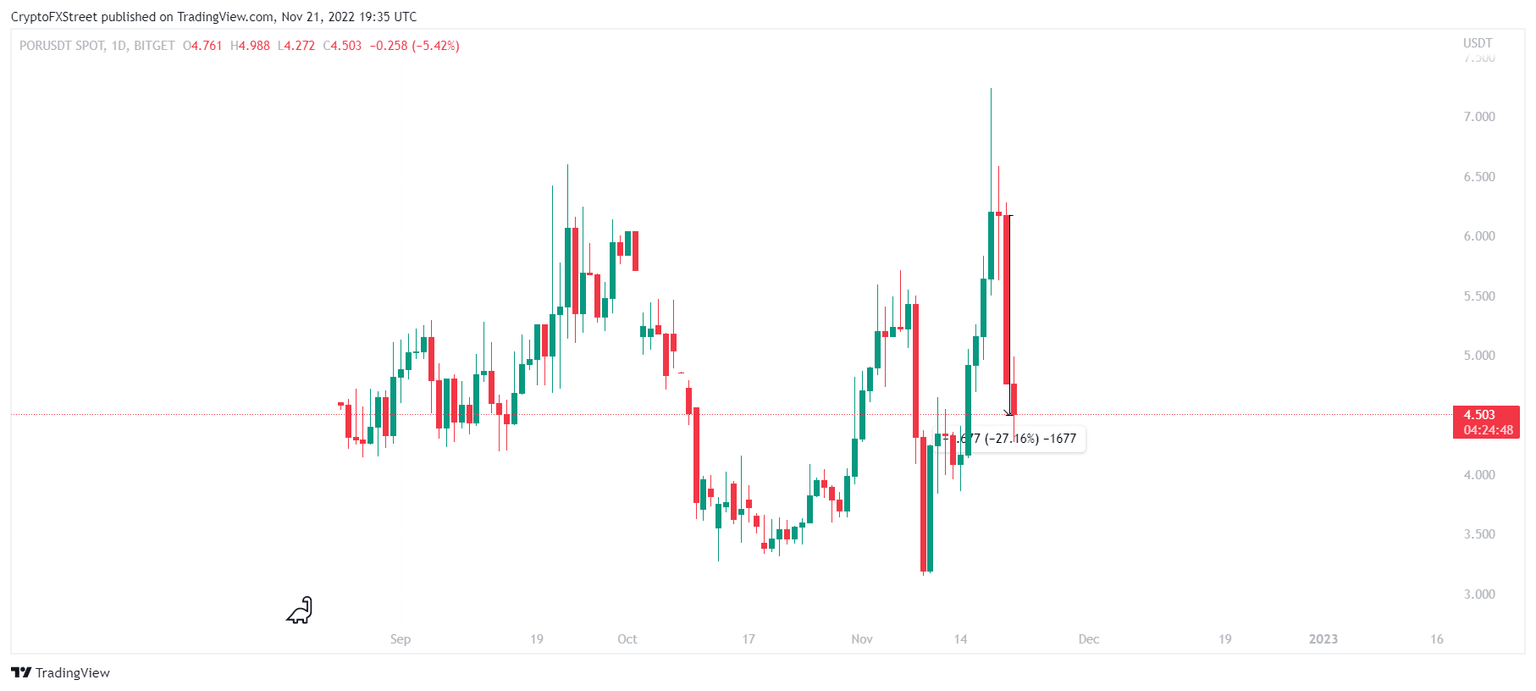

Some of the top fan tokens by market capitalization, such as the tokens of Portugal, Brazil and Argentina's football teams, were leading the space with their appeal. However, in less than 48 hours since FIFA World Cup's kick-off, the value of these tokens fell immensely. Currently, the Portugal National Team fan token (POR) is down by over 27%, having fallen from a price of $6.1 to $4.5.

POR/USDT 1-day chart

The case is the same with the Brazil National Football team fan token (BFT). The token slipped from $0.97 to $0.72, generating 25% losses to its holders. The Argentine Football Association fan token followed suit, declining by over 20% in the same 24 hours to trade at $6.55. Consequently, Chiliz price has taken a hit as well.

Chiliz price slips on the chart

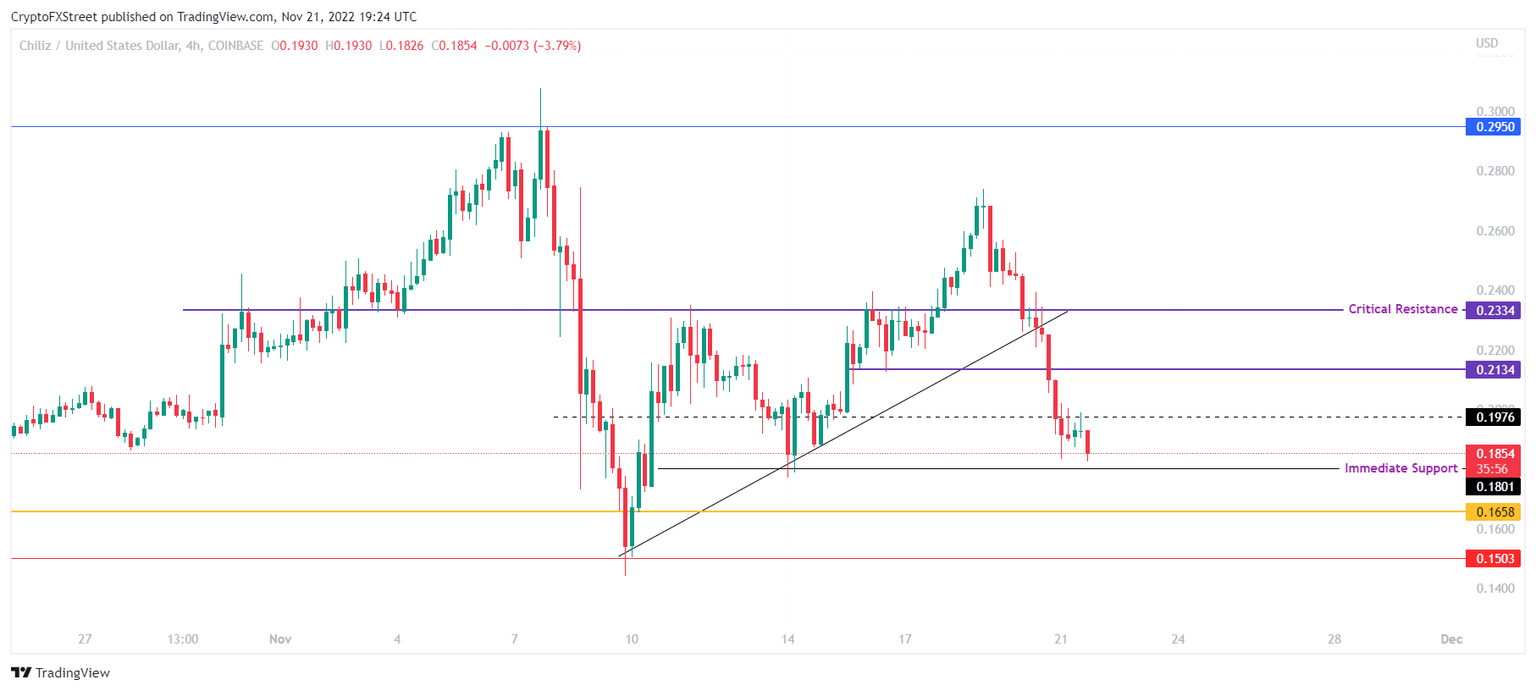

Chiliz price sunk to trade at $0.185 in the later hours of November 21. Treading right above the immediate support at $0.180, CHZ seems closer to losing all current possibilities of recovery.

Although there is still some chance for a bounce off of the immediate support if Chiliz price or the broader market observes bullishness. This would place CHZ back on track to tag and flip $0.197 and $0.213 into support levels. If the FIFA excitement revives and the cryptocurrency finds buyers, it could tag the critical resistance at $0.233, reinstating the uptrend.

CHZ/USD 4-hour chart

However, if the football World Cup event fails to generate more interest or buying pressure, Chiliz price could tag the immediate support at $0.180. Losing this could set CHZ on the path of tagging $0.165. A daily candlestick close below $0.165 would invalidate the bullish thesis and leave the cryptocurrency to fall to November 9 crash lows around $0.150.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.