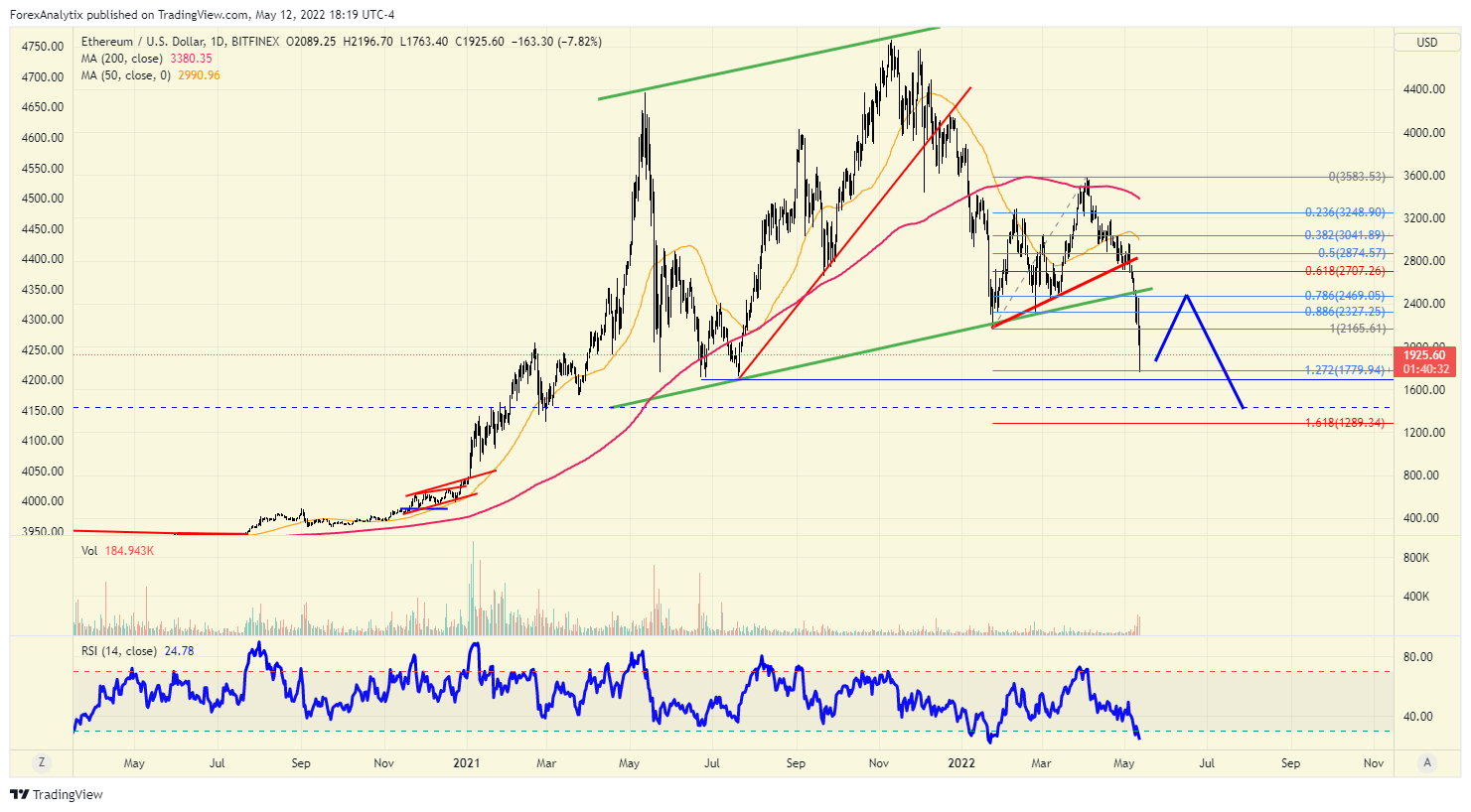

Chart of the day: ETH/USD

Now that the ETHUSD Ethereum market has broken out of the long term ascending channel (2021-2022) the market looks poised to make a move to the 1300-1430 level. However, the Ethereum market did challenge (and hold) key support today at the 1779 level which is a 127% Fibonacci extension of the last move higher (which failed at the 200dma). The daily RSI is oversold, and considering we may hold the horizontal support from June/July 2021, my preferred trade would be to sell any rally nearing the 2400 level in the coming days/weeks. Some may want to play counter trend long, but with the sentiment so bearish in cryptos at this time, the better trade may be to “sell rallies” instead.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.