Chainlink whale addresses reach all-time high in September amid rising demand for cross-chain WLFI

Chainlink (LINK) has entered one of its most favorable phases of the year, fueled by positive developments that strengthen investor sentiment. On-chain data shows a steady rise in LINK whale wallets, while discussions around the altcoin continue to grow.

Analysts believe LINK’s price rally may not stop soon. The following analysis highlights the key drivers supporting LINK’s bullish momentum.

Chainlink (LINK) whale addresses hit ATH in September

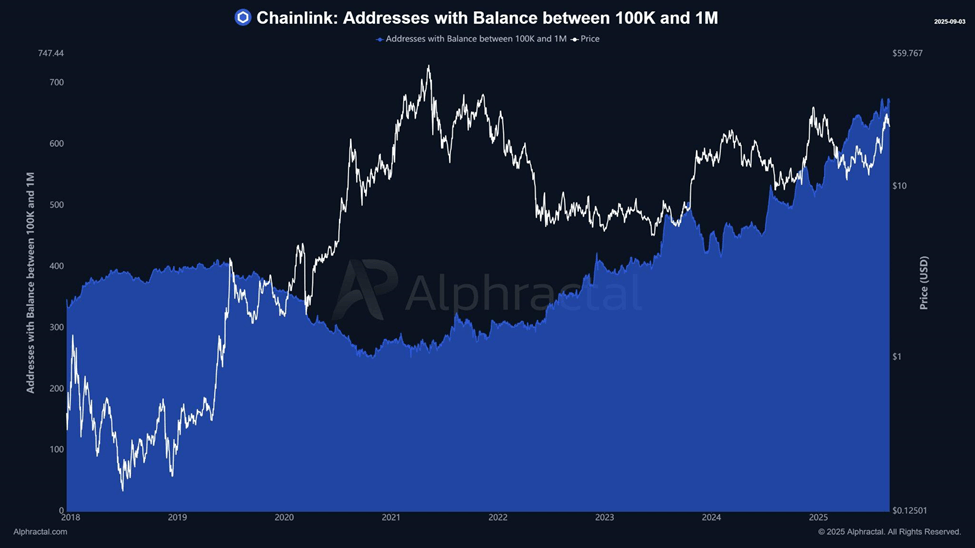

On-chain data from Alphractal reveals that wallets holding between 100,000 and 1 million LINK and those holding over 1 million LINK have steadily increased. The total has surpassed 600 wallets, setting a new all-time high (ATH) this month.

Santiment data also shows that during the first two days of September, these whale wallets accumulated 1.25 million LINK.

Chainlink Addresses with Balance Between 100,000 and 1 million. Source: Alphractal

This trend signals sustained interest from institutional investors and large holders, creating a strong outlook for LINK’s long-term value.

“With many addresses still sitting in profit, the data suggests whales and sharks remain confident in Chainlink’s long-term outlook — a potential backbone for the next bull market,” Alphractal forecasted.

CoinMarketCap data shows that LINK’s daily trading volume over the past month has consistently ranged between $1 billion and $2 billion. This is far above the average of around $500 million daily in July, reflecting strong trading demand for LINK.

Currently, LINK trades around $23. However, LINK’s realized price remains at approximately $15.1.

The realized price represents the average purchase cost of all circulating LINK tokens and often acts as a strong support level during market corrections.

Rising demand for cross-chain WLFI fuels LINK

Another major factor driving interest in LINK is the impressive performance of Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which enables seamless interaction between different blockchains.

Chainlink said CCIP processed over $130 million in cross-chain transfers in a single day. More than $106 million of this volume came from transactions linked to World Liberty Financial (WLFI), the DeFi project backed by Trump’s team.

The growing demand for WLFI has reinforced the practicality of CCIP and strengthened Chainlink’s role as a key bridge within the DeFi ecosystem.

Earlier, Chainlink partnered with the US Department of Commerce to bring GDP, PCE, and consumer spending data on-chain, opening doors for DeFi applications connected to real-world economic metrics.

These moves demonstrate Chainlink’s expanding collaboration with enterprises and government-related agencies. This further boosts confidence in a future approved Chainlink ETF.

Meanwhile, technical analysts have also issued optimistic forecasts for LINK’s future. Some predict that LINK could retest its all-time high (ATH) by late 2025.

LINK’s current ATH stands at about $53, recorded at the peak of 2021. This means the token would need to gain another 130% to establish a new ATH.

Author

BeInCrypto

BeInCrypto

Since 2018, BeInCrypto has grown into a leading global crypto news platform. Through our award-winning journalism and close ties with industry leaders, we deliver trusted insights into Web3, AI, and digital assets.