ChainLink Price Update: LINK/USD bulls make a comeback following three bearish days

- LINK/USD is currently consolidating below $15.

- The MACD shows increasing bearish momentum.

-637336005550289133_XtraLarge.jpg)

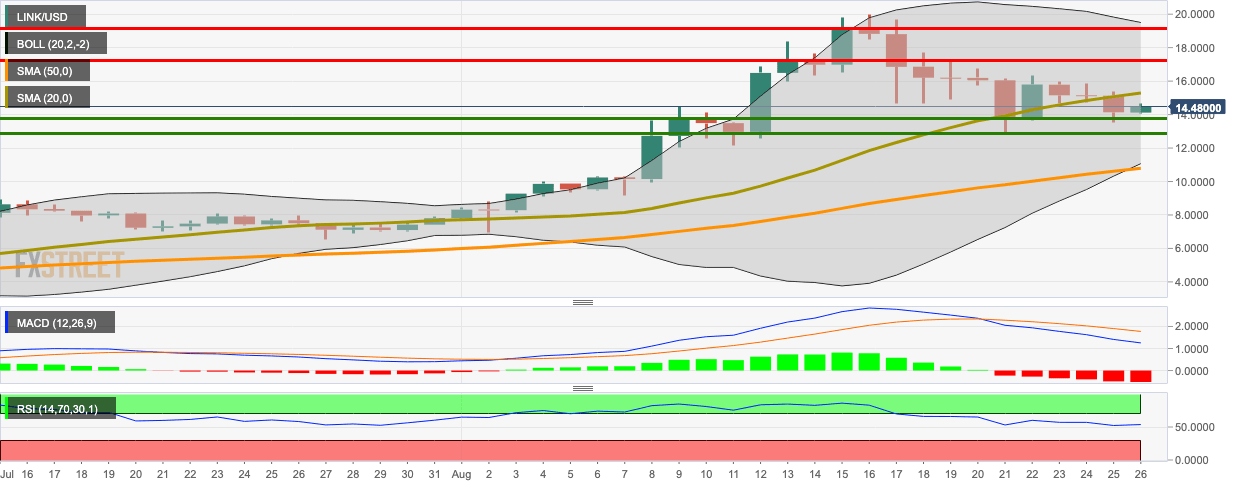

LINK/USD daily chart

LINK/USD bulls made a comeback following three consecutive bearish days. The price has gone up from $14.27 to $14.53 as it trends in the lower half of the 20-day Bollinger Band. The MACD shows increasing bearish momentum. The chart shows three strong resistance levels at $15.40 (SMA 20), $17.20 and $19.05. On the downside, we have three healthy support levels at $13.75, $12.89 and $10.80 (SMA 50).

An Altcoin trader who goes by the name “Crypto Krillin” has predicted that the price of Chainlink (LINK) will fall further and consolidate before the next move up. LINK spiked from under $2 to about $20 at the beginning of 2020. However, after that, the coin fell to as low as $13 before reaching its current price of about $15.

For those who are planning to make some gains from LINK in the next upward move, Crypto Krillin said:

$LINK

— Crypto Krillin ॐ (@LSDinmycoffee) August 23, 2020

update: yep was not the place to long, so far following the break down squiggly pretty well, ~$13 double bottom on 4h could be an interesting entry. pic.twitter.com/afM1o6nPDk

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.