Correct: Chainlink price set for further falls after 5% drop

-637336005550289133_XtraLarge.jpg)

(This story was corrected at 08:07 GMT to remove the content about an alleged Chainlink airdrop announcement, which wasn't released by official sources and thus can be subject to scams. The corrected version follows.)

- Chainlink price has succumbed to selling pressure, falling 5%.

- LINK likely to head south toward $5.808 support level.

- Still, investors leveraging the slump to buy the dip could send Chainlink price north.

Chainlink (LINK) price is trading with a bearish inclination, having lost all the ground covered during the August 29 rally that was fueled by the Grayscale asset manager’s resounding victory in its longstanding case against the US Securities and Exchange Commission (SEC).

Chainlink has earned its place among the go-to networks for decentralized finance (DeFi) developers and projects. The popularity attributes to its unique ability to link smart contracts to off-chain data sources.

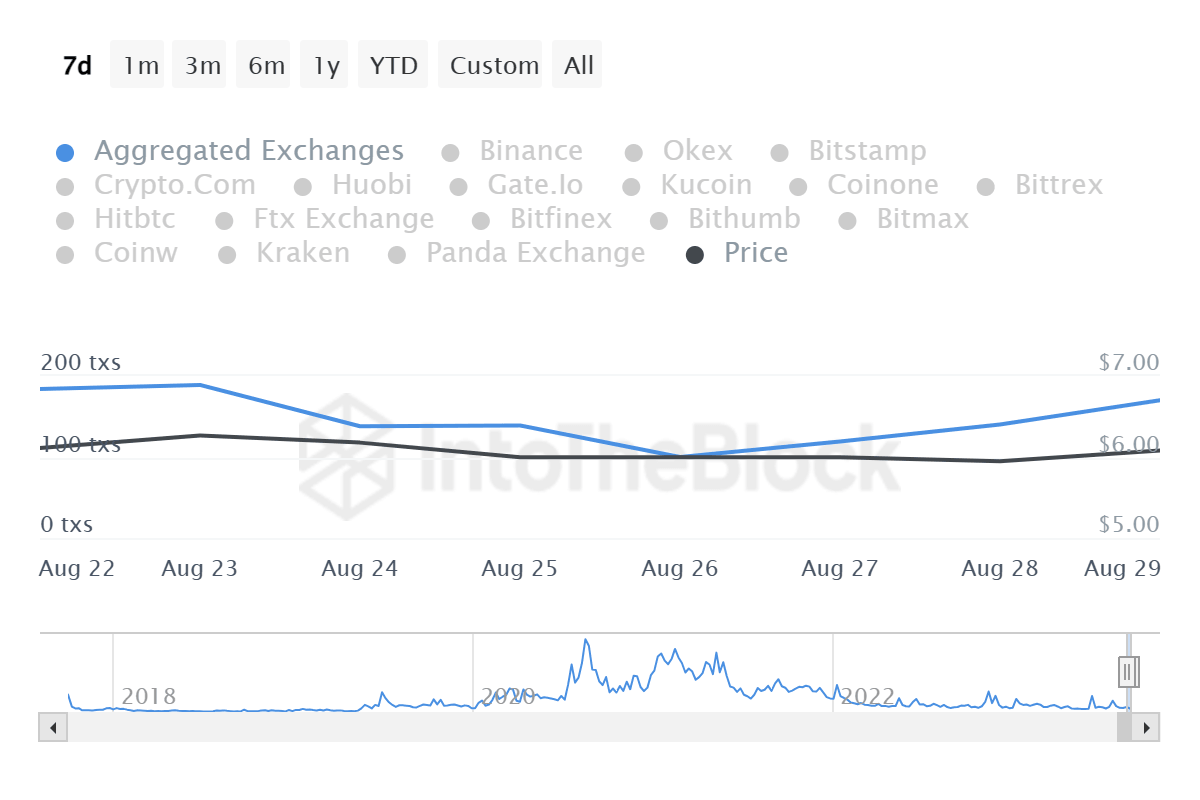

Data from IntoTheBlock shows that inflows into exchanges have been on a steady rise since August 26, suggesting intention to sell as investors sought to avoid the value drop.

LINK price forecast amid increasing selling pressure

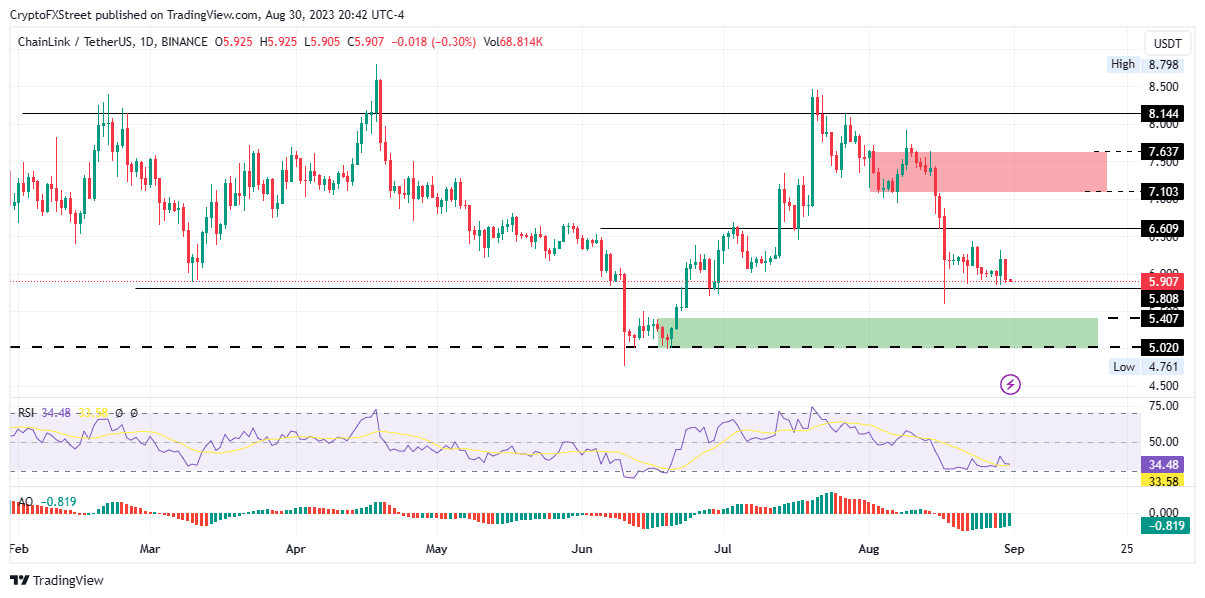

At the time of writing, Chainlink price is at $5.907 while working out the next move. Momentum indicators such as the Relative Strength Index (RSI) and the Awesome Oscillator favor the downside, meaning LINK could continue south, potentially losing the $5.808 support level before dipping into the demand zone at $5.407.

Considering a demand zone is characterized by aggressive buying, Chainlink price could bounce from this order block. However, if it fails to hold as a support level, the altcoin could break below the support floor at $5.020.

Conversely, investors leveraging the slump to buy the dip could send Chainlink price north, possibly clearing the $6.609 barricade for a chance to test the supply zone at $7.103. LINK could also correct around this zone, where aggressive sellers abound. However, if it fails to hold as a resistance level, an extension north could ensure, confirmed by a decisive daily candlestick close above $7.637.

In a highly bullish case, Chainlink price may extrapolate to the $8.144 supplier congestion zone, levels last seen in late July. This would indicate a 5% ascension against what would then be a bullish breaker.

Author

FXStreet Team

FXStreet