Chainlink Price Analysis: LINK ready for 30% price increase if this support holds

- Chainlink (LINK) is hovering above the vital support created by the ascending triangle pattern.

- Onchain metrics imply that the token is poised for strong growth.

-637336005550289133_XtraLarge.jpg)

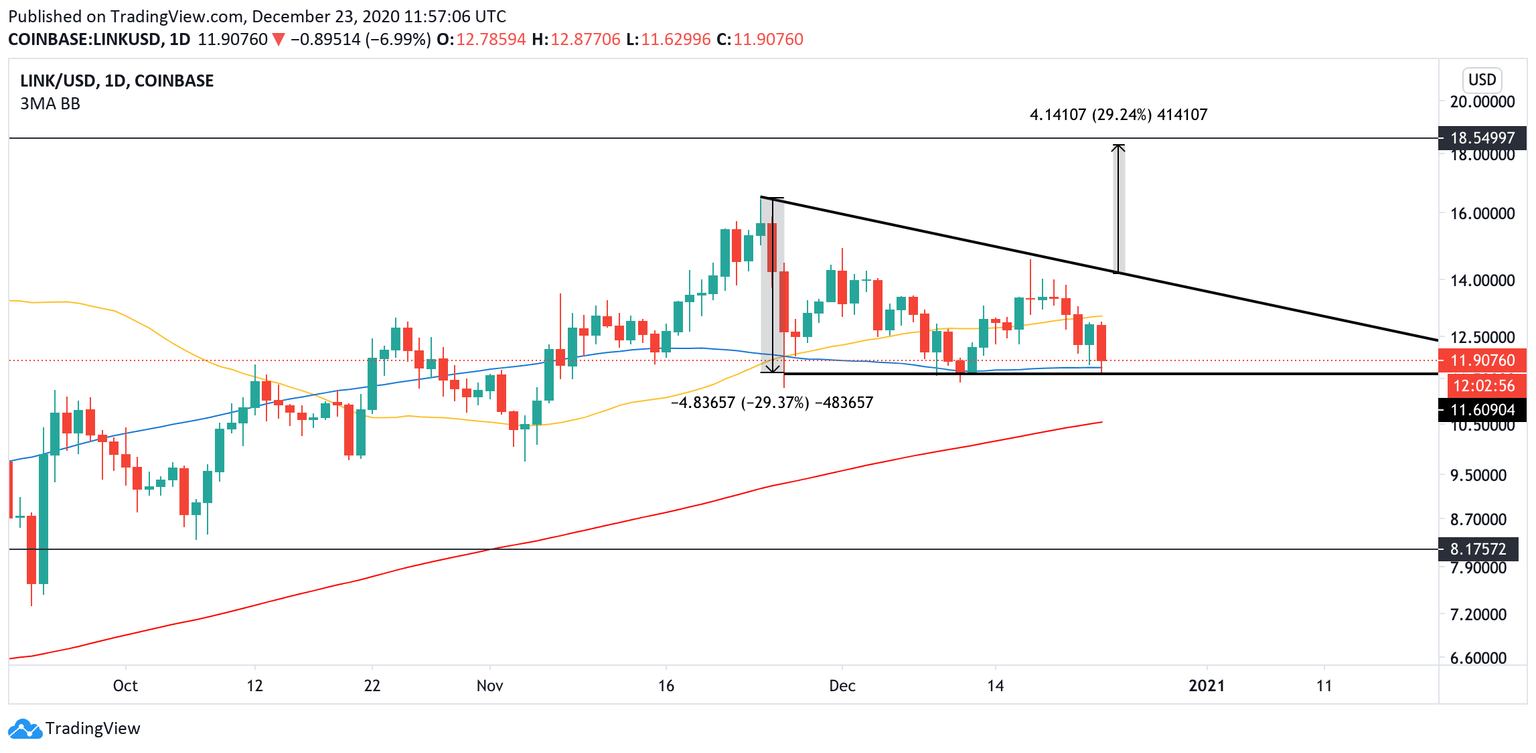

Chainlink topped at $14.56 on December 17 and started the downside correction within the long-term bullish trend. By the time of writing, LINK retreated to $11.86. The coin has lost over 2% on a day-to-day basis and nearly 6% on a weekly basis.

LINK tests critical support

From the technical point of view, LINK reached the vital support created by the daily EMA100 at $11.7, coinciding with the x-axis of an ascending triangle.

If it gives way, the sell-off may be extended with the next focus at the psychological $10 reinforced by the daily EMA200. The price has been moving above this technical line since the end of April, so now it has the potential to absorb the downside pressure and create a new bullish impulse.

LINK, daily chart

Meanwhile, if the support of $11.7 holds, LINK may re-test the hypotenuse of the above-mentioned triangle pattern currently at $14. As the ascending triangle is considered a bullish pattern, a sustainable move above this level may trigger a massive 30% price increase with an estimated target at $18.3.

On-chain metrics support the bullish view

Meanwhile, on-chain metrics imply that the coin may be poised for stellar growth. According to the data provided by the behavioral analytical company Santiment, the LINK's supply on the cryptocurrency exchanges dropped to 7%, which is the lowest level since the token's ICO in September 2017. This bullish signal implies that LINK holders are not inclined to sell their assets in the foreseeable future.

LINK's supply on the exchanges

This bullish setup is confirmed by a significant LINK's outflow from the exchanges. Over 2 million LINKs were taken from the exchanges on December 23.

LINK's outflow from the exchanges

Despite the retreat, LINK is well-positioned for further growth. A sustainable move above $14 will trigger a massive bullish momentum and send the price above $18. On the other hand, the bullish scenario will be invalidated if the support of $11.7 gives way.

Author

Tanya Abrosimova

Independent Analyst

%2520%5B14.57.58%2C%252023%2520Dec%2C%25202020%5D-637443222003490782.png&w=1536&q=95)

%2520%5B15.03.47%2C%252023%2520Dec%2C%25202020%5D-637443222328805336.png&w=1536&q=95)