CFTC Chair says DeFi crypto exchanges can be regulated, here’s the good, the bad and the ugly of regulation

- Commodities Future Trading Commission’s Chair Rostin Behnam says DeFi crypto exchanges can be regulated by US law.

- Behnam believes a cryptocurrency may be launched as a security and later devolve into a cash substitute when traded on a decentralized exchange.

- CFTC’s treatment of crypto assets as cash substitutes when traded on DEXes could fuel a rally in native tokens of decentralized exchanges.

Rostin Behnam, Chair of the US Commodities Future Trading Commission (CFTC), believes cryptocurrencies and decentralized exchanges (DEXes) can be regulated with the existing legal precedents. The Chair of the independent US federal agency commented on an undecided area of law around crypto, the question of whether a token can be treated as a security at its launch and as a cash substitute when traded on decentralized exchanges.

Behnam’s comments on crypto regulation could make users turn to decentralized exchanges to trade cryptocurrencies, given they could be treated as non-securities by US law.

Also read: Binance Coin likely to outperform competitors as Wrapped Beacon ETH gets warm welcome

CFTC Chair comments on DeFi, opens doors of opportunity for DEXes

The Chair of the CFTC slams comments like DeFi (decentralized finance) and decentralized exchanges cannot be regulated for lack of human involvement or assets just being “lines of code.” Behnam argues that based on what US customers are being offered and who the assets are being exposed to, who is the entity offering these products, crypto and exchange platforms can be regulated.

Behnam’s most interesting take was that the one area where crypto could be lightly regulated is decentralized exchanges where crypto assets might be treated as cash substitutes, but this remains an open question. The CFTC does not regulate cash markets and has limited authority to police such markets for fraud or manipulation.

He added that as digital assets hold unique characteristics, they will demand a unique set of policy ideas.

Further, cryptocurrencies could be treated as securities when they are issued and when trading on centralized crypto exchanges.

How DEX tokens could benefit from regulation

Native tokens of decentralized exchanges could benefit from regulation if cryptocurrencies are treated as cash substitutes on DEXes.

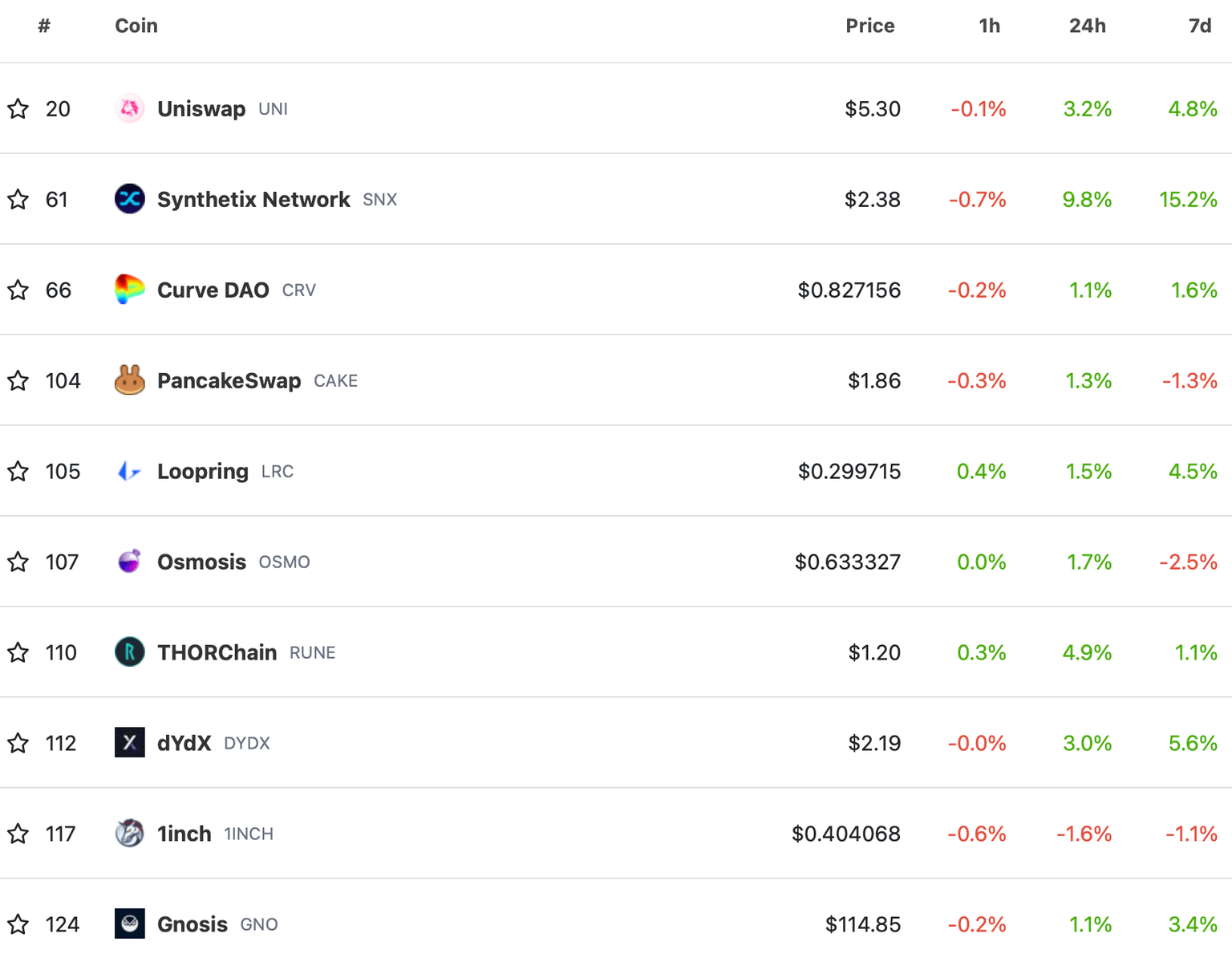

Top 10 DEX tokens

Decentralized exchange’s native tokens yielded up to 10% gains in response to Chair Behnam’s comments. DEXes like Uniswap, Curve DAO, PancakeSwap and dYdX are likely to see an increase in the number of active users and trade volume in the days leading up to clarity in crypto and DeFi regulation.

The CFTC’s decision to regulate cryptocurrencies could therefore have a direct impact on the prices of native tokens. On the lines of Chair Behnam’s stance on regulation, DEXes have the upper hand when compared to centralized exchanges like Binance, which are likely to be subject to securities laws for the trade of crypto assets.

Therefore, the CFTC’s regulation of crypto could negatively influence the prices of native tokens of centralized exchanges like Binance Coin (BNB) and Huobi Token (HT).

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.