Cardano Price Prediction: ADA defies gravity as on-chain metrics promise more gains

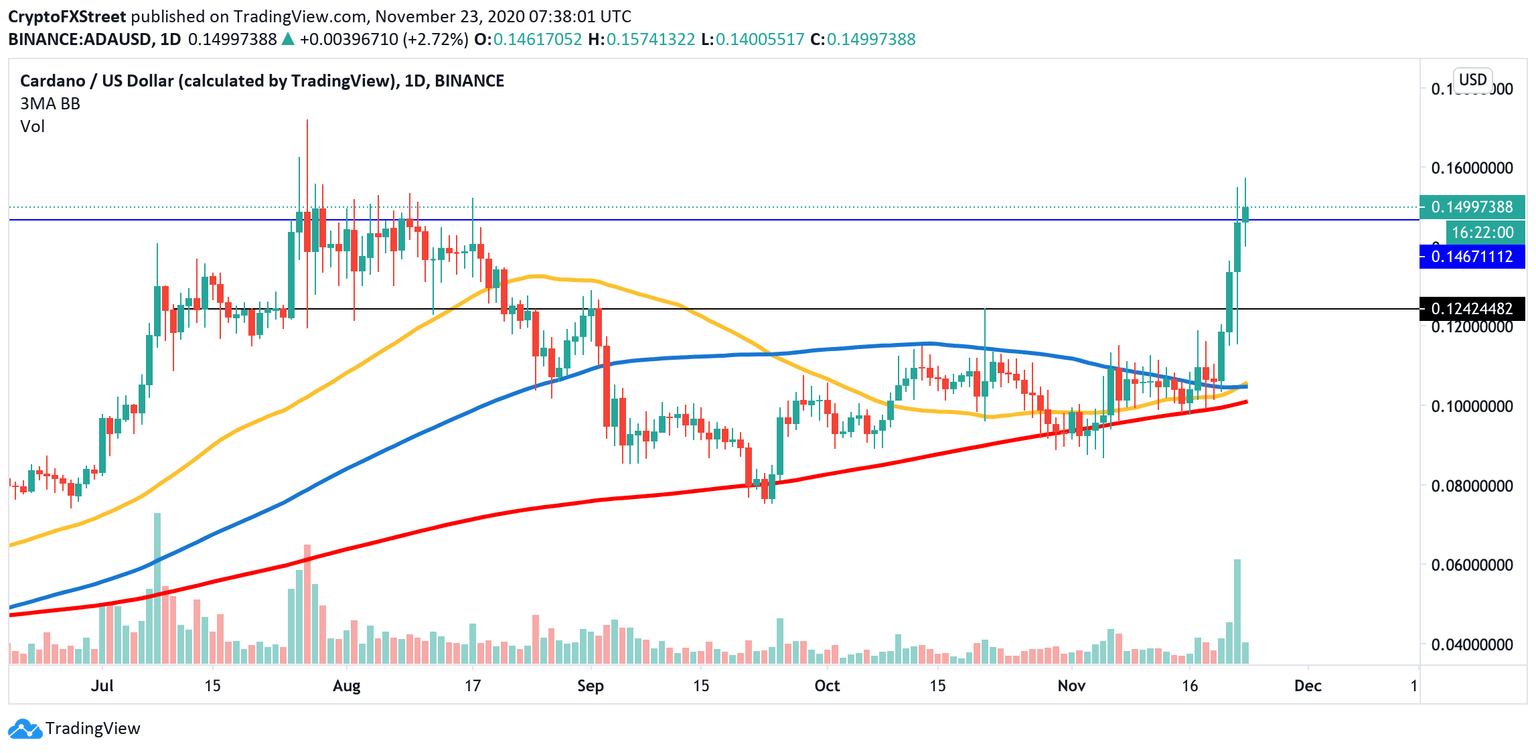

- Cardano's bullish momentum skyrocketed after the price broke above the critical resistance level.

- The on-chain metrics imply that the coin is well-positioned to retest $0.17.

Cardano (ADA) climbed to the 9th position in the global cryptocurrency market rating. The coin hit $0.1574, the highest level since July 2020 during early Asian hours. At the time of writing, ADA/USD is changing hands at $0.1489. Despite the retreat, the token is still over 20% higher on a day-to-day basis. In the past seven days, the ADA's price nearly doubled.

Cardano's current market capitalization is registered at $4.6 billion, while its average daily trading volumes settled at $2.3 billion.

ADA reached the bottom at $0.08 on September 23 and has been moving higher ever since. However, the upside momentum started building up after the coin broke above the local resistance of $0.11.

While the price looks overbought, the technical and on-chain metrics imply that the bullish trend is set to continue.

Cardano's network is on fire

Cardano's network growth gives additional credence to the bullish outlook. The number of new addresses doubled in the past few days and hit the highest level since the beginning of August. According to Intotheblock's data, over 12,500 new addresses were created on Cardano's blockchain on November 22 against 5,600 addresses on November 19. The growth coincides with the price increase and implies that the bullish momentum remains strong.

ADA's new addresses

ADA sits on top of a healthy support level

Meanwhile, IntoTheBlock's "In/Out of the Money Around Price" (IOMAP) model estimates that $0.146 plays a crucial role in Cardano's near-term price movements. The chart shows that it stopped the recovery in July and served as a strong resistance during the summer months. It can be verified as a support area as nearly 131,000 addresses had previously purchased more than 3 billion ADA. This area could absorb the selling pressure from a potential downside correction, preventing Cardano from falling further.

ADA's IOMAP data

However, even if this support level breaks, ADA's bears will have a hard time pushing the price lower as the way to the South is cluttered will supply walls. On the other hand, there is little to no resistance above the current price, meaning that ADA is well-positioned for the further price increase with the initial target at $0.17.

ADA/USD, daily chart

Despite the optimistic bullish scenario, the cryptocurrency market's unpredictability means the bearish outlook cannot be disregarded. The charts show that the sell-off below $0.12 will speed up the correction and bring more sellers to the market. In this case, $0.1 will come into focus. This psychological barrier is reinforced by a combination of 50,100 and 200-day EMA. a sustainable move below this area will invalidate the bullish scenario.

Author

Tanya Abrosimova

Independent Analyst

%20new%20addresses-637417141496316834.png&w=1536&q=95)

%20IOMAP-637417141801583159.png&w=1536&q=95)