Cardano price eyes a drop towards $1.85 as ADA bulls face a wall of stiff resistances

- Cardano’s path of least resistance appears to the downside.

- Bearish crossover and RSI point to more weakness in ADA price.

- ADA sellers target 100-DMA at $1.85 on a firm break below $2.

Cardano price is once again on the slippery slope this Sunday, kicking off a new week on the wrong footing, as ADA bulls lack follow-through recovery momentum.

ADA/USD staged a temporary reversal on Saturday after Friday’s wild moves, which lead to a test of the $2 psychological magnate.

However, a failure to sustain ground near mid-$2s recalled the ADA sellers for another run southwards.

The third most favorite crypto coin is up about 2% over the week, currently supported above the $2 mark.

Cardano price could see an extension of the downswing

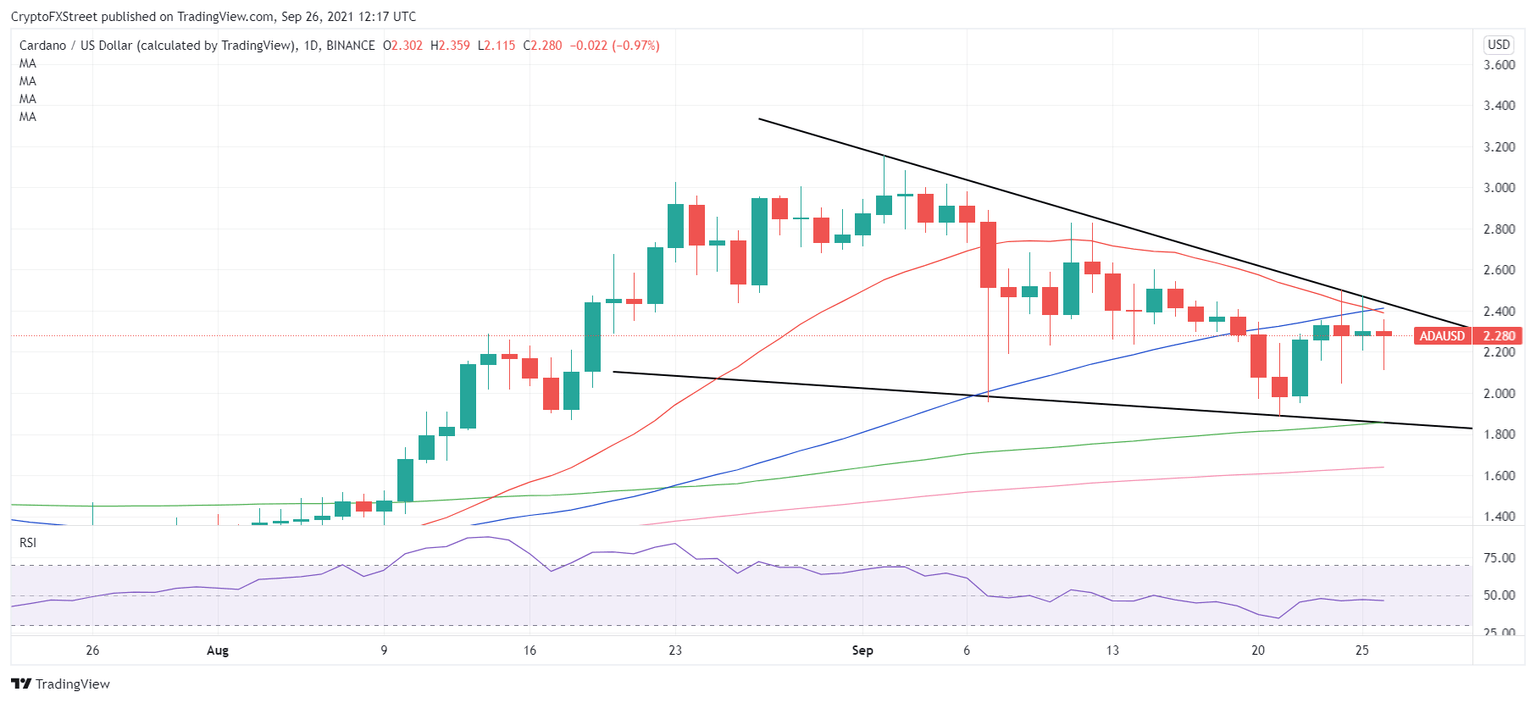

As observed on Cardano’s daily sticks, ADA price continues to face strong offers at the upper boundary of a three-week-old falling wedge formation.

The confluence of the falling trendline resistance, 21-Daily Moving Average (DMA) and 50-DMA around $2.45 acts as a powerful supply zone.

A daily closing above the latter is critical to validating the falling wedge upside break, opening doors for a test of intermittent resistance near $2.80.

Further north, ADA bulls would strive to retest the $3-mark en-route the all-time highs of $3.16.

ADA/USD: Daily chart

However, with the 14-day Relative Strength Index (RSI) hovering below the midline and bear cross confirmed, the downside seemingly opens up towards the $2 psychological support should the daily lows of $2.11 yield in.

Note that the 21-DMA cut the 50-DMA from above on Saturday, flashing the bearish signal.

Fierce cap at $1.85 will be the level to beat for ADA bears on an acceleration of the downward momentum. That level is the intersection of the falling trendline support and mildly bullish 100-DMA.

The next relevant support is seen at the critical 200-DMA at $1.63.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.