Cardano Price Analysis: 10,000 new investors acquire ADA ahead of Trump inauguration

- Cardano price opened trading at $1.05 on Monday, having consolidated below the $1.10 resistance over the last 3 days.

- The Cardano blockchain network has recorded 10,000 new funded wallets since December 19.

- ADA technical indicators suggest buyers remain dominant despite prolonged sideways movement.

Cardano’s price opened trading at $1.05 on Monday after consolidating below the $1.10 resistance over the last three days. On-chain data shows ADA has attracted a significant number of new buyers since the 30-day countdown to Donald Trump’s inauguration began.

Cardano price holds $1 support amid early profit-taking

As the cryptocurrency sectors’ positive start to 2025 intensified on Monday, Bitcoin price grazed the $100,000 mark, while top altcoins like Cardano (ADA) and Solana (SOL) faced considerable headwinds.

With the likes of BTC, AVAX and XRP having hit new milestone peaks at $100,000, $45 and $2.50 respectively, ADA price remained below the $1.10 market over the weekend.

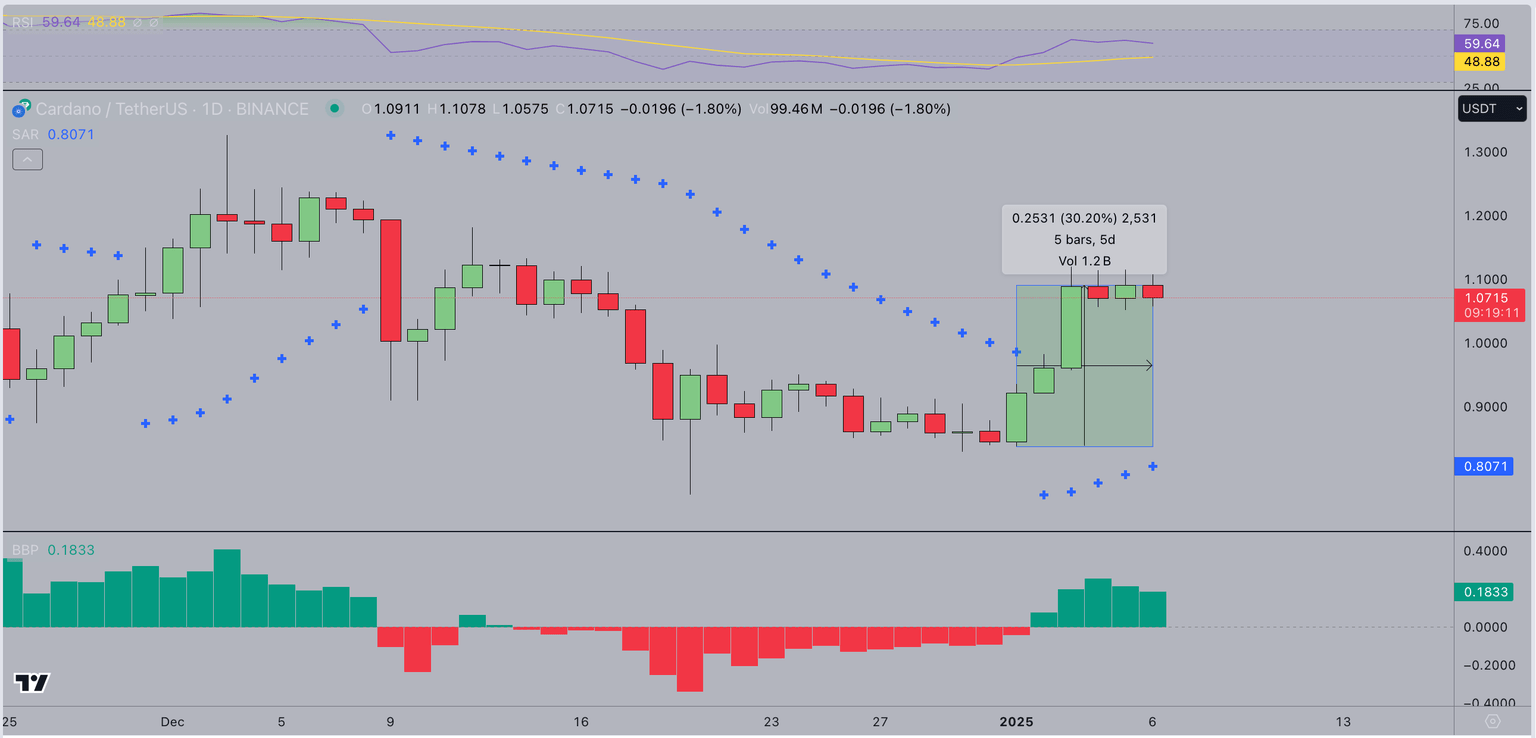

As seen above, ADA price has consolidated within the $1.05 to $1.10 narrow range since its 30% rally peaked on Friday.

ADA remains rooted at the $1.09 mark at press time on Monday, despite bullish sentiment dominating the broader crypto market.

This signals mild profit-taking among short-term traders, nullifying market demand surge and keeping Cardano’s price stagnant.

10,000 new investors join Cardano network 30 days from Trump's inauguration

Promising zero crypto taxes and a flurry of appointments hinting at a friendlier regulatory stance, Trump's upcoming inauguration on January 20 has dominated crypto traders’ mindshare in recent weeks.

Trump’s proposed crypto tax legislation is rumored to eliminate taxes on cryptocurrencies founded in the United States (US).

This has improved investors' sentiment around the crypto projects with firm US roots such as Bitcoin (BTC), Ripple (XRP) and Cardano (ADA).

Recent transaction trends show the Cardano network has recorded an unusual increase in new investors since December 20, coinciding with the 30-day countdown to Trump’s inauguration.

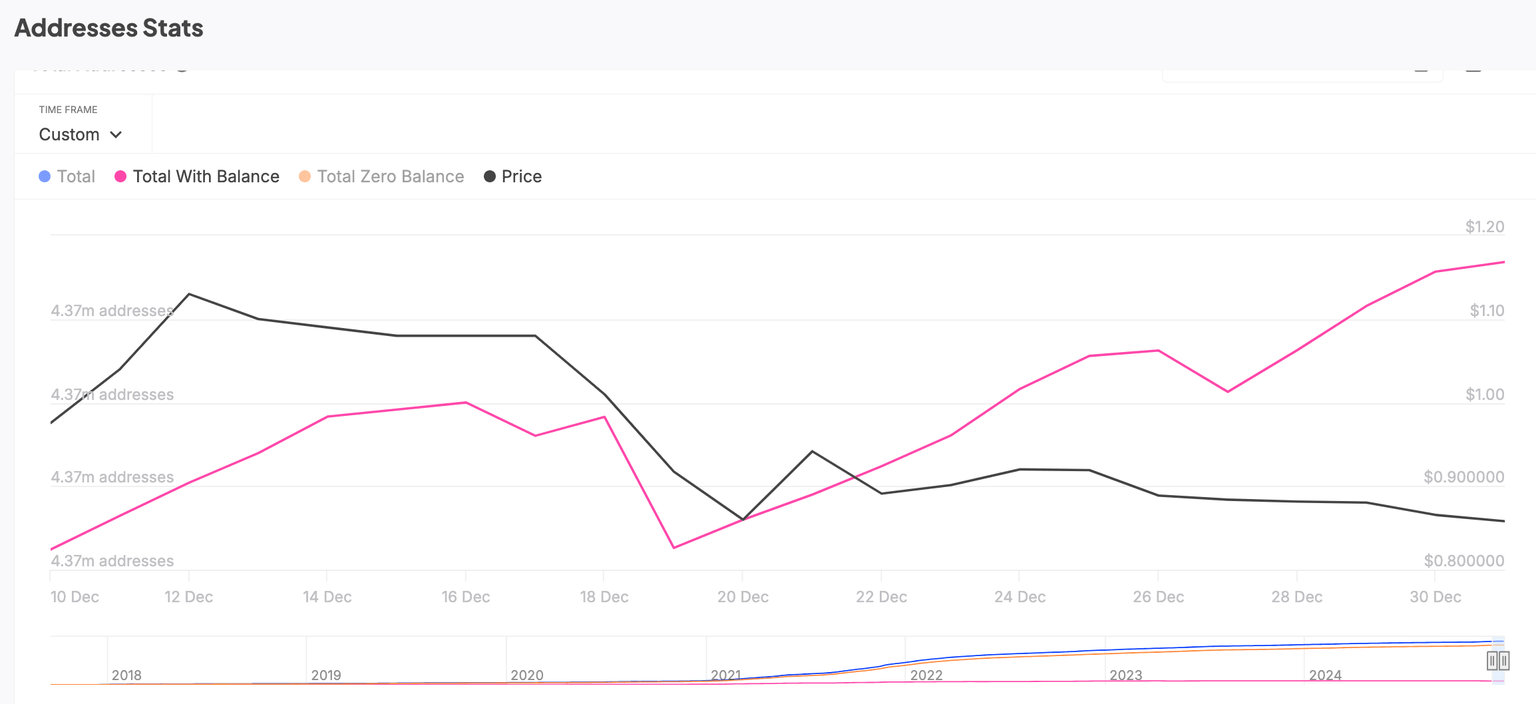

The IntoTheBlock chart below tracks daily changes in total funded wallets existing on the Cardano blockchain network.

This provides clear insights into the rate at which new investors are joining or exiting the ADA market.

As depicted above, the Cardano blockchain hosted 4.37 million funded wallets as of December 19.

Since then, investors have opened 10,000 new ADA wallets, bringing the total funded wallets count to 4.38 million on Monday.

Strategic investors interpret such a persistent influx of new wallets as a signal for imminent bullish price action for two reasons.

As the newly funded wallets conduct economic transactions on the Cardano network, it could lead to increased on-chain activity, driving higher network value.

Additionally, the steady growth in new wallets signals rising confidence among retail investors, often a precursor to a positive shift in market momentum.

Cardano Price Forecast: $1.20 breakout in focus after 3-day consolidation

Cardano has entered a 3-day price consolidation near the $1.07 mark. However, considering the recent influx of 10,000 new investor wallets and positive sentiment surrounding Trump’s inauguration, ADA appears to be building momentum for a breakout toward $1.20.

The Donchian Channels set resistance at $1.20 as a critical level to watch if bullish momentum continues.

Supporting this outlook, the Bull-Bear Power indicator has turned positive, reflecting strong buyer dominance in the current market phase.

More so, ADA Parabolic SAR is trending firmly below the current price levels, further confirming bullish momentum and suggesting a continuation of the upward trend.

Conversely, a failure to breach the $1.20 resistance level could trigger a bearish scenario.

In this case, the immediate support lies at $1.00, which aligns with the lower Donchian Channel.

A breach below $1.00 would expose ADA to further downside risks, with $0.92 acting as the next key support level.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.