Cardano investors not ready to ‘sell the news,’ ADA price skyrockets before Alonzo hard fork

- Cardano hit a new all-time high within three hours of smart contract launch on the testnet.

- Input Output Hong Kong confirms that final integrations are on track for the September 12 mainnet upgrade.

- 97% of wallet addresses holding Cardano are currently profitable, a sign of support.

- Institutions remain bullish on Cardano as weekly inflows in ADA investment products hit an all-time high.

Institutional interest in Cardano has hit a new peak as inflow in Cardano funds exceeded Bitcoin by 165%. The altcoin is heading closer to the Alonzo hard fork scheduled for September 12.

Cardano explodes ahead of mainnet rollover, price rally to continue

Cardano price has surged in the past week. Input Output Hong Kong (IOHK), the company that developed the altcoin, has consistently shared updates of smart contract deployment on the testnet.

Yesterday, we upgraded the #Cardano testnet, successfully deploying #Plutus #smartcontracts capability. The focus now is on final component testing & exchange integrations, ahead of the #Alonzo mainnet upgrade, still on track for deployment on 12 September #Cardano $ADA pic.twitter.com/lrdiYIiNKD

— Input Output (@InputOutputHK) September 2, 2021

In the run-up to the launch of smart contract capabilities on the Cardano testnet, the altcoin has rallied 140%. Over the past 90 days, Google searches associated with Cardano and its price hit a peak. At the same time, the profitability of wallet addresses holding the altcoin has increased.

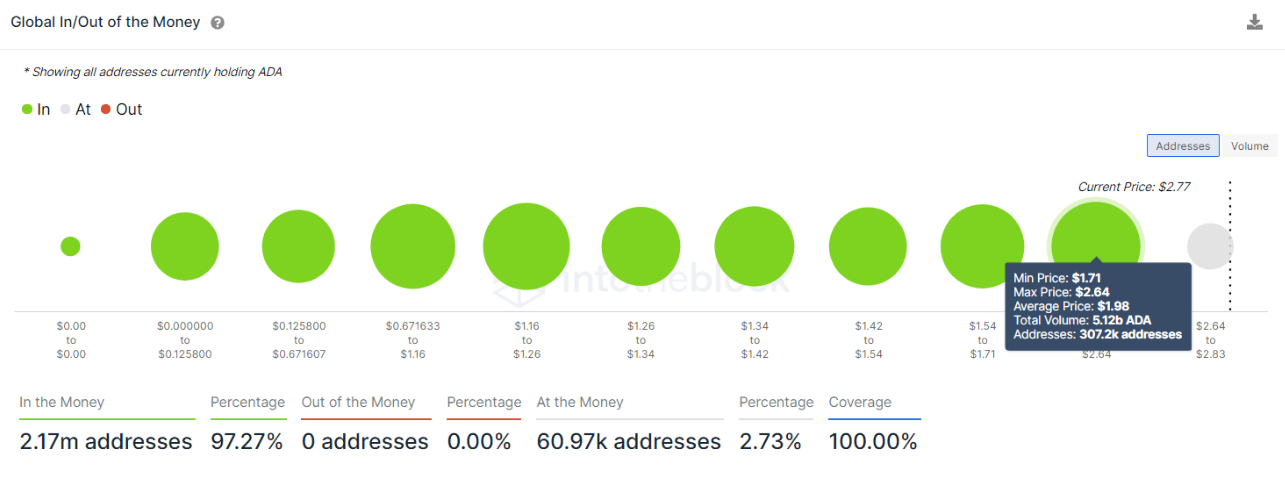

A key indicator, the Global In/Out of the Money (GIOM) model, classifies addresses based on whether they are profiting, breaking even or losing money on their positions at the current price.

According to GIOM, 97% of wallet addresses holding Cardano are currently profiting. This depicts the meteoric rise in activity between $1.68 and $2.24. Approximately 307K addresses have traded Cardano between these price levels, which builds up support for the altcoin here.

Global In/Out of the Money (Cardano).

Institutional investors have noted the rise in popularity of the altcoin, and more capital has been injected into Cardano funds than ever before. Cardano-based funds witnessed an inflow of $10.1 million against $3.8 million that flowed out of Bitcoin.

FXStreet analysts have a bullish outlook on the altcoin. Cardano is expected to continue its upward trend to $4 since the altcoin has overcome stiff resistance at $2.97.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.