Can the market keep growing against a falling Bitcoin (BTC)?

The market may have entered a long-term correction—at least regarding Bitcoin (BTC) and Ethereum (ETH), as the other coins are looking less bearish.

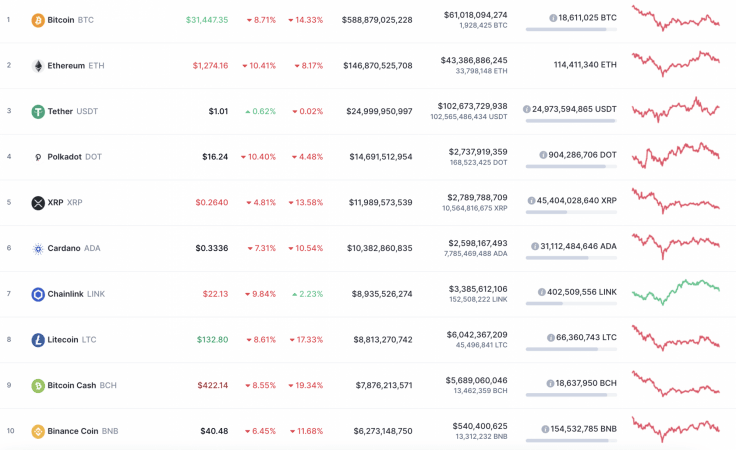

Top 10 coins by CoinMarketCap

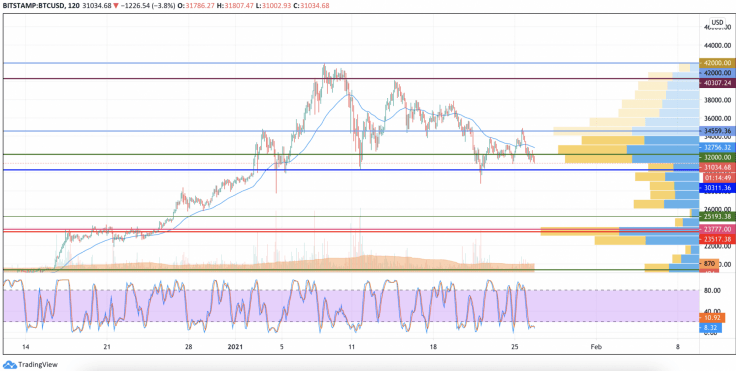

BTC/USD

Yesterday morning, buyers were able to overcome the level of average prices and, during the day, the recovery continued to the daily maximum at $34,888.

BTC/USD chart by TradingView

However, by the end of the day, the pair failed to consolidate above the two-hour EMA55 and returned to the support of $32,600. Until this morning, the pair remained in a tight consolidation at the level of this support. On the daily time frame, the Stoch RSI indicator lines were in the oversold zone and gradually reached the border with the neutral zone.

Bitcoin is trading at $30,990 at press time.

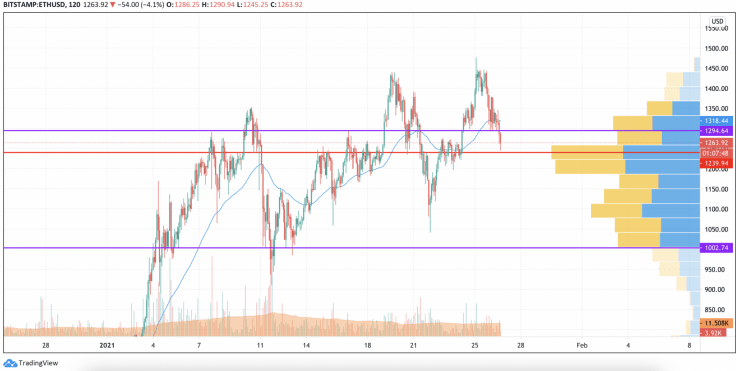

ETH/USD

Yesterday, Ethereum's (ETH) price held above $1,400 for a long time but, at the end of the day, the bears pushed this support and rolled back the pair to the area of average prices ($1,300).

ETH/USD chart by TradingView

If the two-hour EMA55 keeps the Ether price from further decline, bulls will try to continue the run in the near future and renew the absolute maximum in the area of $1,530.

Otherwise, the price correction may continue to the support of $1,250.

Ethereum is trading at $1,265 at press time.

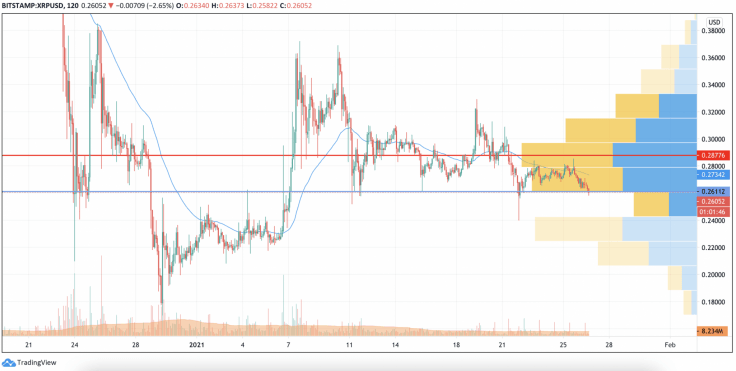

XRP/USD

Yesterday, buyers unsuccessfully tried to overcome the resistance of the lower border of the $0.280-$0.310 side channel. At the end of the day, the pair rolled back below the average price level. Today, it can test the support of $0.260.

XRP/USD chart by TradingView

Soon, the pair may widen the sideways channel, pushing the lower border to the support area of $0.240.

XRP is trading at $0.2612 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.