Can Cardano price recovery trigger the return of 100,000 investors that fled after the 15% crash?

- Cardano price has recovered 8% over the last 24 hours following the broader market cues.

- The total addresses fell to 4.35 million after over 110,000 addresses exited the market as ADA dipped on the charts.

- ADA shares a high correlation of 0.85 with BTC, which means that Bitcoin price flipping $30,000 into a support level would help Cardano price new 2023 highs.

Cardano price has performed exceptionally throughout Q1 and April, reinvigorating the investors’ lost confidence in the project. But as it appears, this confidence was relatively weak as investors dipped out as soon as the altcoin began painting red on the charts.

Cardano price drop triggers terror

Cardano price slipping from $0.452 to $0.383 resulted from the bearishness witnessed by the entire crypto market, initiated by the Bitcoin price falling to $27,000. This was the second biggest drop of the year following the crash noted from mid-February to the beginning of March.

ADA/USD 1-day chart

Surprisingly despite falling by nearly 27% in those two weeks, the investors did not tap out, but they did when Cardano price dipped by 15% over the last week. The reason behind this was profits, as always. Since ADA was yet to breach November 2022 back in February, investors held on until a profitable level was achieved.

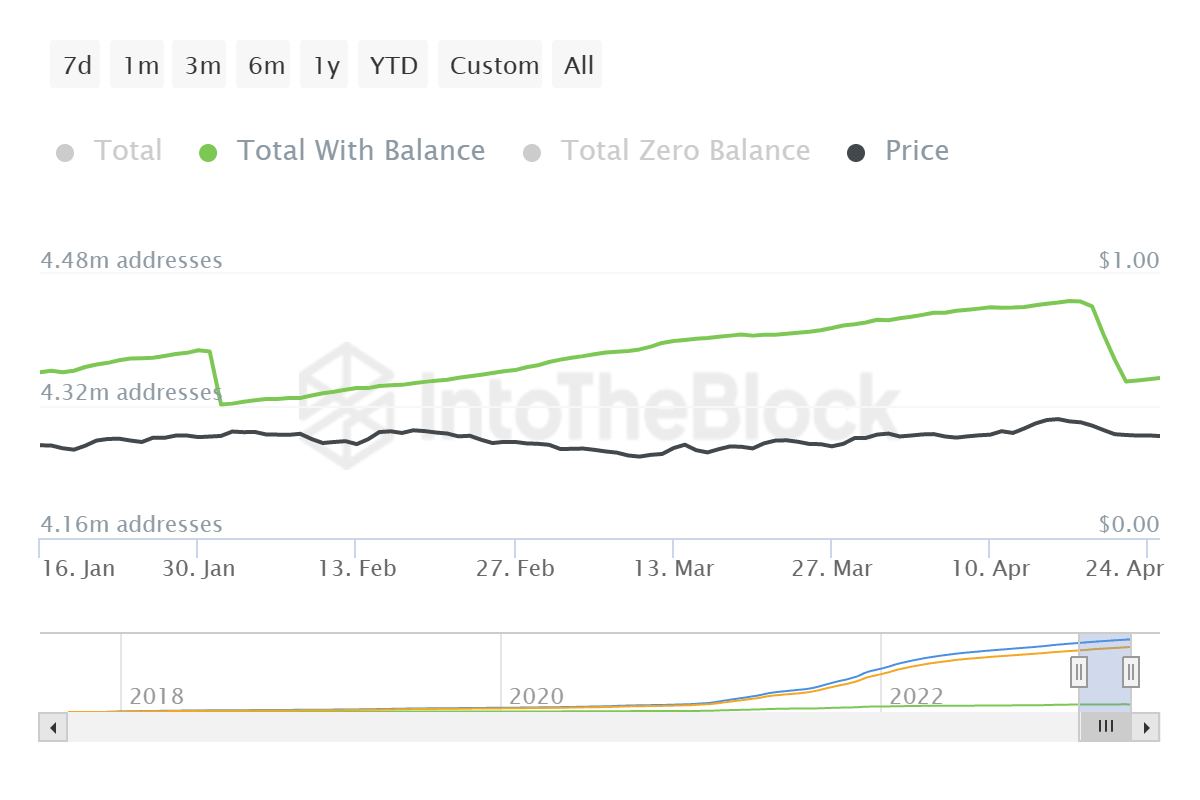

This came on April 15 when Cardano price closed at $0.452, marking a seven-month high. But investors began exiting the network as the third-generation cryptocurrency began trending downwards. Consequently, in four days, the total addresses holding any amount of ADA fell by 100,000 from 4.44 million to 4.35 million.

Cardano addresses holding a balance

The aforementioned lack of confidence is also visible in the social aspect of the altcoin. Up until the dip, the “Ethereum-killer” was observing interest across the social channels, with Cardano bearing a mention in every 2 out of 100 queries regarding crypto. Since the crash, though, the social volume fell by 50% from 3,009 to 1,528, increasing concern for a sustained recovery.

Cardano social volume

To add to the worries, Cardano price is set to be highly impacted by the Bitcoin price action given their high correlation of 0.85. Thus, BTC’s fluctuation will result in ADA charting a gain or registering more red candles.

Cardano’s Correlation to Bitcoin

For now, the altcoin could note a recovery provided the biggest currency in the world also flips $30,000 into a support floor. Trading at $29,700 presently, BTC climbing back to April highs seems highly likely, which would translate to ADA also potentially recovering to 2023 highs of $0.452.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B23.33.10%2C%252026%2520Apr%2C%25202023%5D-638181294784969676.png&w=1536&q=95)