Can Bitcoin (BTC) rise faster than Binance Coin (BNB) and Cardano (ADA)?

The market has slightly increased after a fall, and only some coins are in the red zone. Mainly, Solana (SOL) and Polkadot (DOT) remain under a bearish mood.

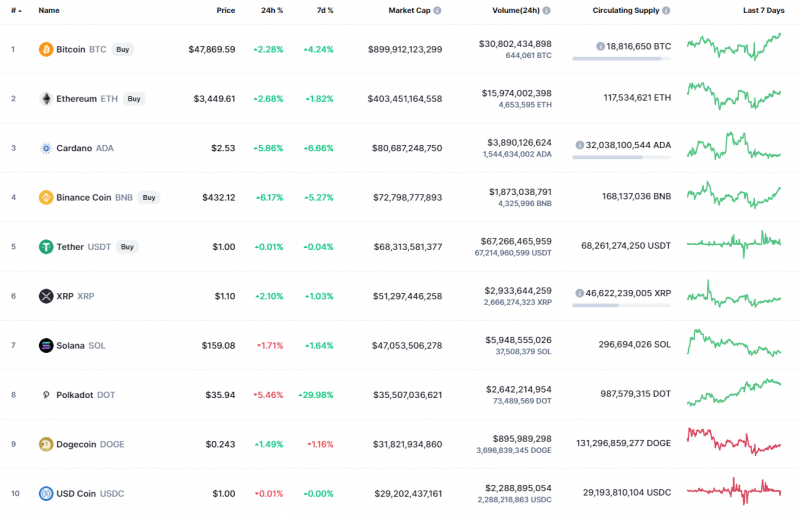

Top coins by CoinMarketCap

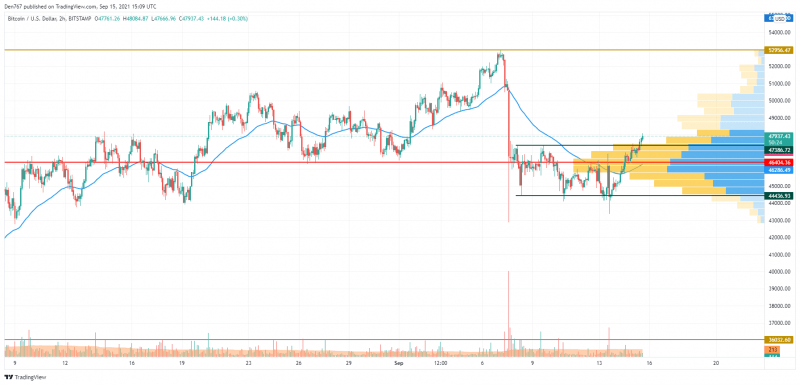

BTC/USD

Yesterday, buyers were able to break through the two-hour EMA55 resistance and restore the Bitcoin price above the POC line. The volumes decreased tonight, but the price continued to rise and came close to the 61.8% fibo level ($47,745).

BTC/USD chart by TradingView

It should be noted that the daily trading volumes were at an average level, and if bulls manage to increase the volumes, they may be able to break the $43,800 resistance.

Bitcoin is trading at $48,050 at press time.

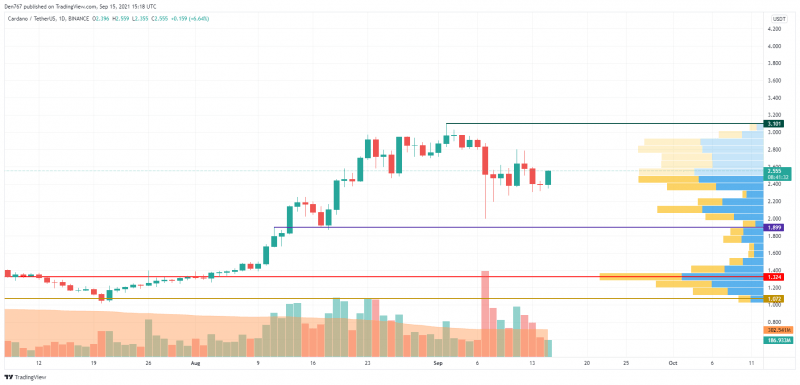

ADA/USD

The rate of Cardano (ADA) has risen by 6.55% over the last 24 hours.

ADA/USD chart by TradingView

Cardano (ADA) has fixed above the $2.40 level, which means that bulls are trying to seize the initiative in the mid-term scenario. However, one may think about the trend reversal when ADA fixes above the vital $3 mark.

ADA is trading at $2.54 at press time.

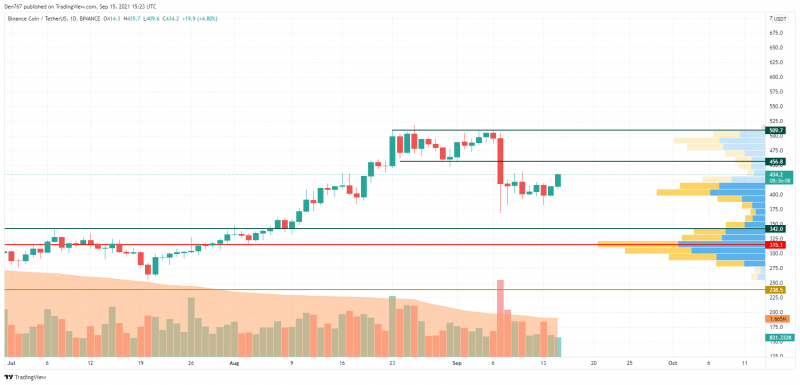

BNB/USD

Binance Coin (BNB) has gained less than Cardano (ADA), with growth accounting for 5.77%.

BNB/USD chart by TradingView

Despite the ongoing rise, Binance Coin (BNB) has not entered the long zone yet.

At the moment, one needs to pay close attention to the $456 level, where buyers have the chance to seize the initiative. If they manage to do that, the rise may continue to $500.

BNB is trading at $434.7 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.