Can Bitcoin (BTC) follow the rise of the altcoins?

The market has almost recovered after the recent sharp dump; however, not all coins have come back to the green zone. Mainly, DOGE is the top loser from the list, going down by 20%.

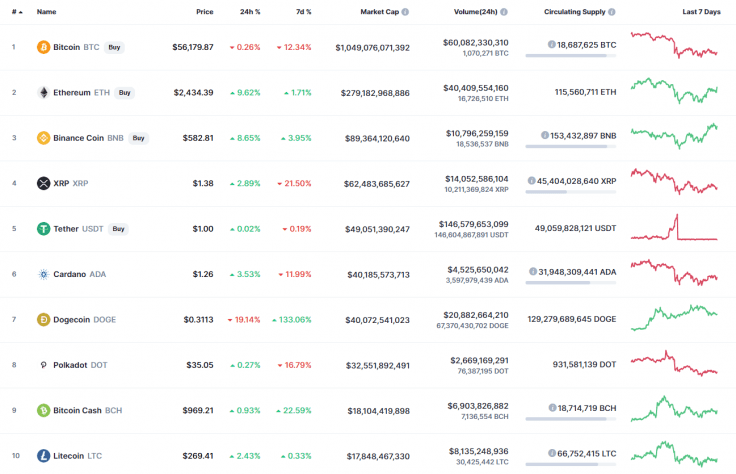

Top 10 coins by CoinMarketCap

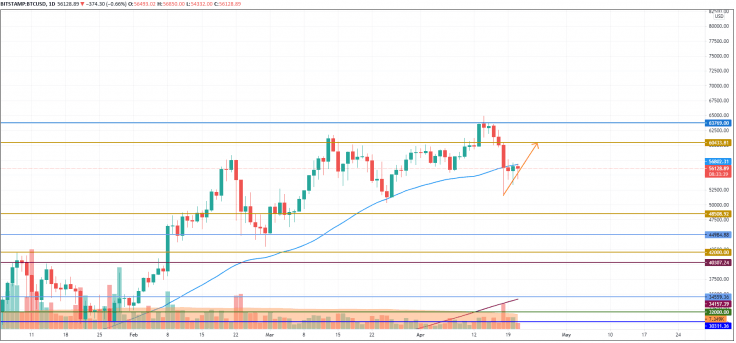

BTC/USD

Bitcoin (BTC) is the only coin from the list that is located in the red zone. The rate of the main crypto has down by 0.13%.

BTC/USD chart by TradingView

Despite the decline, the long scenario is more likely than a bullish one as the coin is accumulating power at the moment for a rise to the next level at $61,400.

Bitcoin is trading at $55,970 at press time.

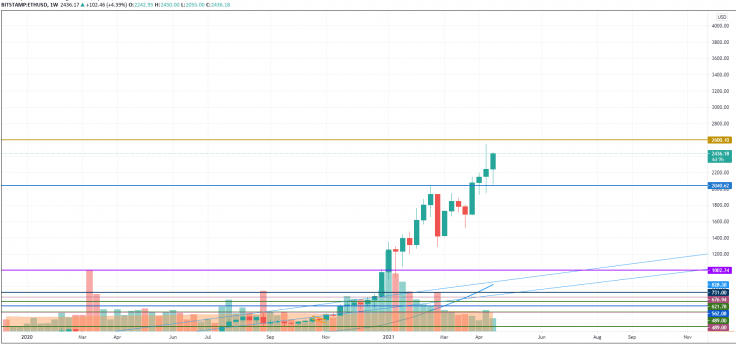

ETH/USD

Ethereum (ETH) is the main gainer today as the rate of the chief crypto has gone up by almost 10%.

ETH/USD chart by TradingView

On the weekly chart, Ethereum (ETH) is about to set the new peak as the altcoin has successfully bounced off the support at $2,100.

In this case, one may expect a test of the area around $2,600 shortly.

Ethereum is trading at $2,423 at press time.

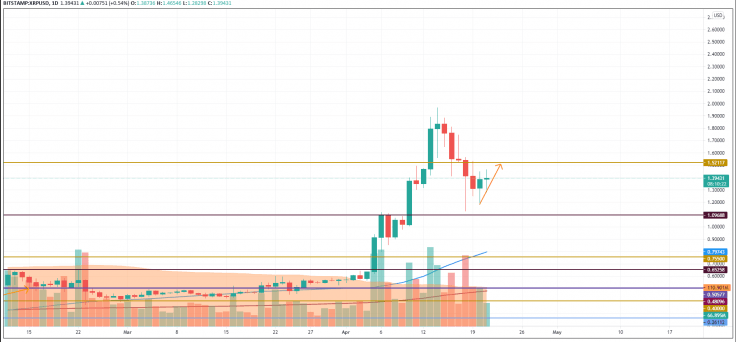

XRP/USD

XRP is not an exception to the rule, even though the growth only amounts to 3.70%.

XRP/USD chart by TradingView

XRP is also looking bullish with a potential target around $1.52. The coin is about to accumulate power in that area to make a breakout and keep the rise to the peak at $1.96.

XRP is trading at $1.41 at press time.

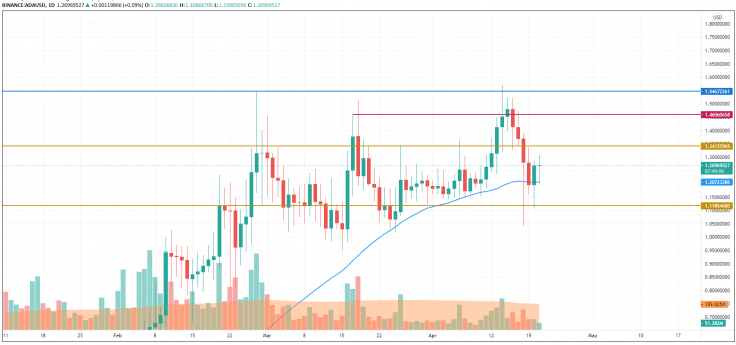

ADA/USD

Cardano (ADA) has shown 3% growth over the last 24 hours.

ADA/USD chart by TradingView

Cardano (ADA) has bounced off the daily MA 50 that has confirmed the bullish power. In this regard, the altcoin is also looking bullish, potentially about to attain the mark of $1.34 shortly.

Cardano is trading at $1.2679 at press time.

BNB/USD

Binance Coin (BNB) is trying to reach the mark of $600 on the daily chart. If bulls fix above it, there are high chances of seeing a new peak around the zone of $700 within the next few days.

BNB is trading at $583 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.