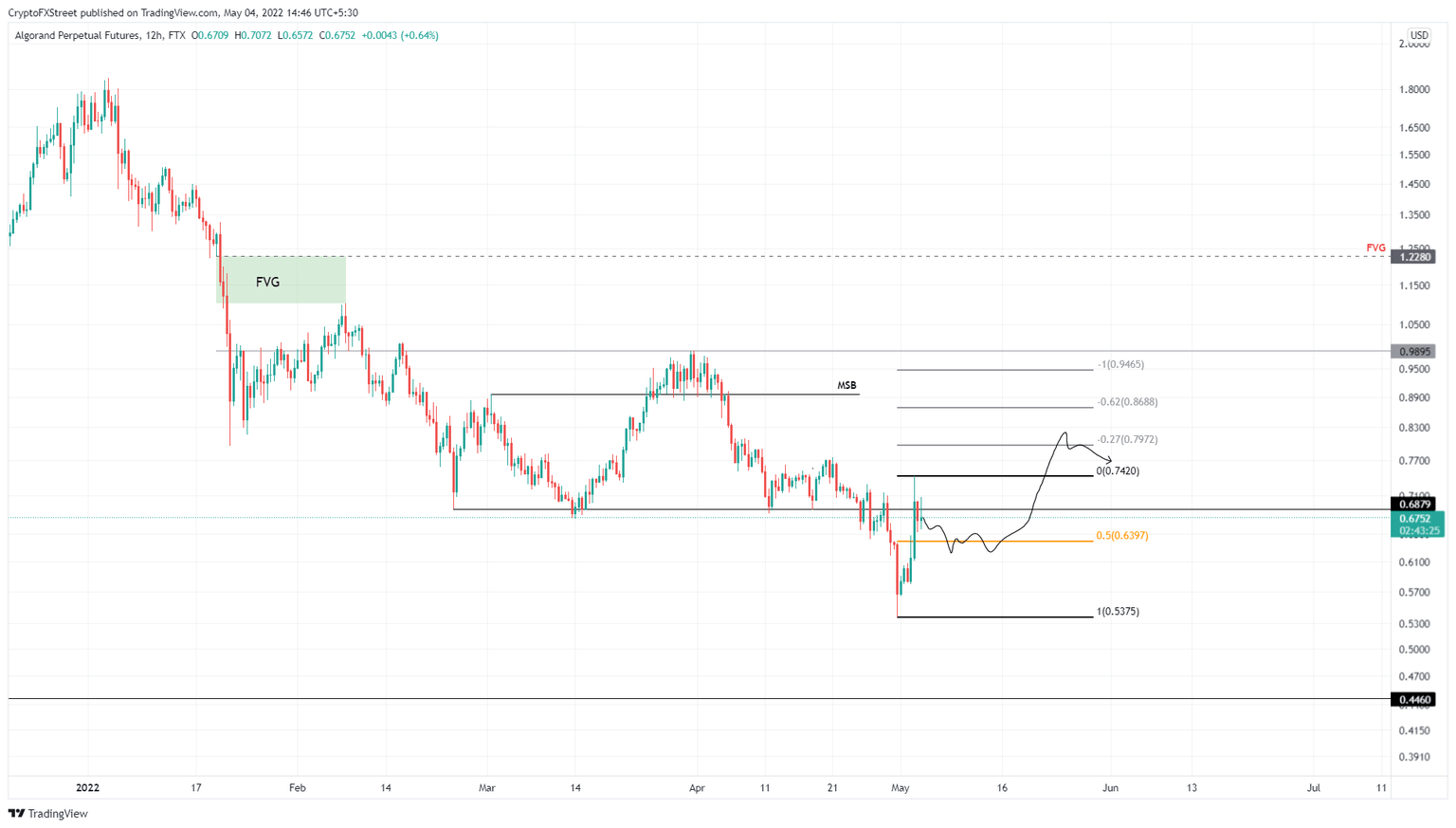

Can Algorand price bounce, triggering a 25% rally

- Algorand price approaches the key 50% retracement level at $0.639.

- A bounce off this barrier could trigger a 25% upswing to $0.742.

- If ALGO breaks below the $0.537 support level, it will invalidate the bullish thesis.

Algorand price is at a significant point in its recovery after the recent downswing, and it could be preparing for a new leg-up. A bounce off the midpoint of the decline will be key and decide the directional bias for ALGO.

Algorand price readies for a new leg-up

Algorand price crashed 25% between April 28 and April 30 and set a range low at $0.537. This move was followed by a 38% ascent that set the range high at $0.742. As ALGO kick-starts its pullback, there is a good chance for ALGO to retest the 50% retracement level at $0.639.

This level is key support for Algorand price and needs to hold for an upswing to emerge. Considering the bullish outlook seen in the Bitcoin price, which tends to influence the whole crypto market, there is a high probability that this move will occur soon.

A bounce of the 50% barrier will likely propel Algorand price to the range high of $0.742. However, there is a good chance that the run-up will extend to the 27% retracement level at $0.797, to collect the liquidity resting above the highs.

This level is likely where the upside is capped for ALGO and would be a good place for investors to step back and reevaluate.

ALGO/USDT 1-day chart

On the other hand, there is a good chance Algorand price could breach the $0.639 barrier and drop lower to sweep the range low at $0.537. In such a case, a daily candlestick close below this foothold without a swift recovery will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.