BNB Chain’s X account hacked, CZ issues warning

- BNBChain’s X account was compromised, with a hacker posting multiple Airdrop posts linked to phishing websites.

- CZ issues a warning, requesting that Wallet Connect details not be provided.

- There are no reports of potential losses in the hack and phishing attack.

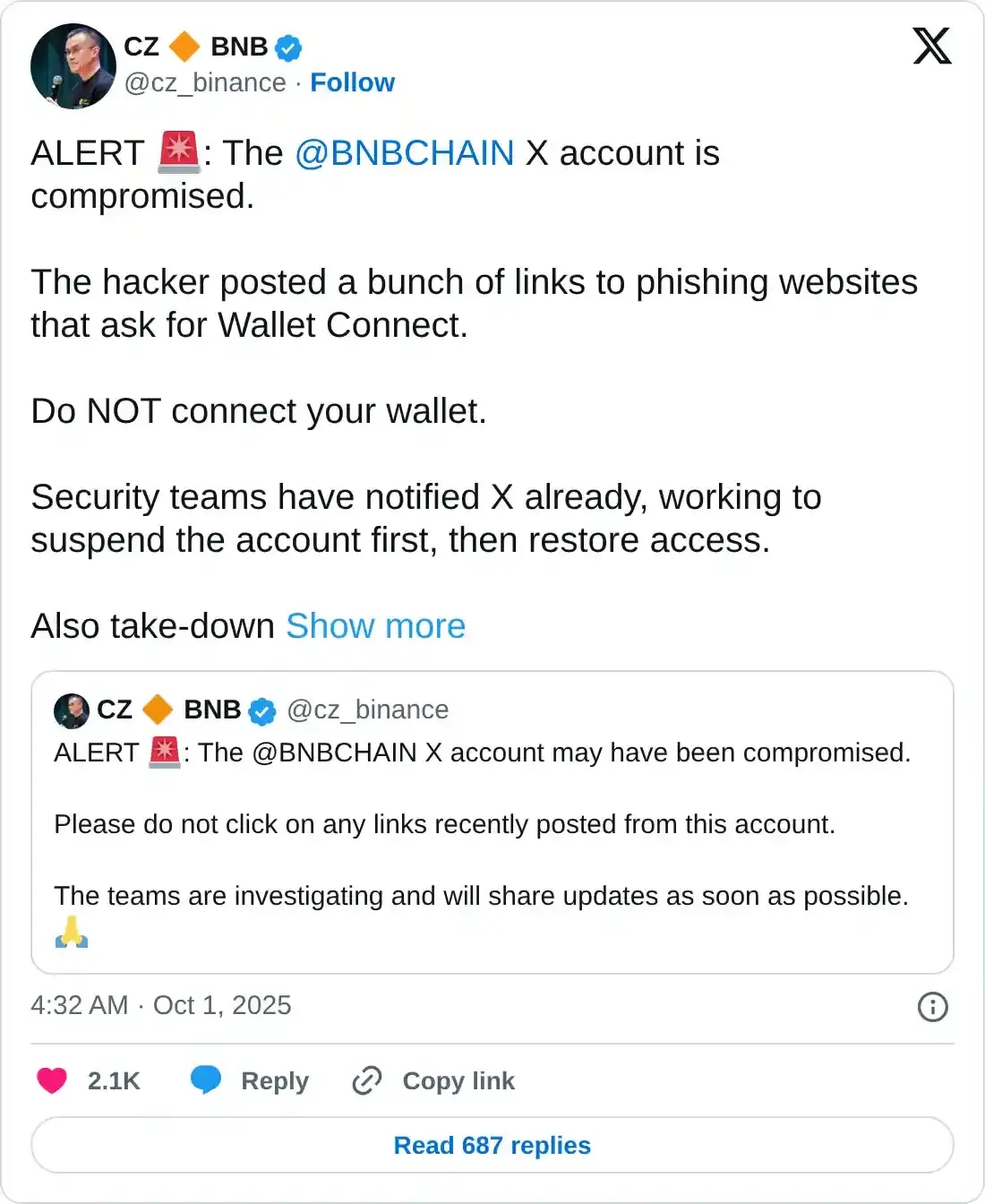

BNB Chain’s, previously known as Binance Smart Chain, X account was compromised earlier on Wednesday, with hackers driving a phishing attack to scam BNB Chain followers. Changpeng Zhao, commonly referred to as CZ, the former CEO of Binance, confirms the attacks with a warning.

BNB Chain’s X account compromised

Multiple posts from the BNB Chain’s X account about a mysterious Airdrop announcement on Wednesday raised alarm bells, with Changpeng Zhao issuing an early warning of a potential risk.

BNBChain's compromised post. Source: X

The links shared with the Airdrop announcement redirect to a fake BNB Chain website with a different domain name, which makes it a “Phishing attack” where hackers can obtain personal information and credentials from a user trying to log in.

CZ has asked users not to connect the requested Wallet Connect feature to phishing websites. Furthermore, take-down requests are raised to deactivate the website.

Users are advised to always verify the domain names when attempting to log in from a redirected link, even from official sources, to prevent such attacks.

BNB price remains unaffected

BNB, previously known as Binance Coin, remains largely unaffected by the recent hack. The token holds above the $1,000 psychological level at press time on Wednesday, following a 2% drop from the previous day.

Furthermore, the upcycle in motion within a rising channel pattern on the daily chart indicates upside potential, which could reach the record-high of $1,083 set on September 21.

BNB/USDT daily price chart.

However, an extension in Tuesday’s pullback could test the support trendline at $950.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.