Bloody Tuesday turned into blissful Wednesday for Stellar, NEO, and LEO

- XLM, NEO, and LEO experienced a sharp recovery after the recent sell-off.

- The existing channels may limit further recovery.

The cryptocurrency market can be wild. Sometimes it is cruel and brings painful losses to coin holders, but the next day comes and rewards those who did not panic-sell. Many digital assets suffered from massive losses on Tuesday, but some of them managed to stage s spectacular comeback. Not only did they fully recovered, but they also gained ground in comparison to Tuesday's opening levels.

We have chosen three altcoins out of top-30 with the most spectacular reversal in the recent 48 hours to find out what is in store for them and if the technical and on-chain metrics support the further price increase.

Stellar lives up to its name

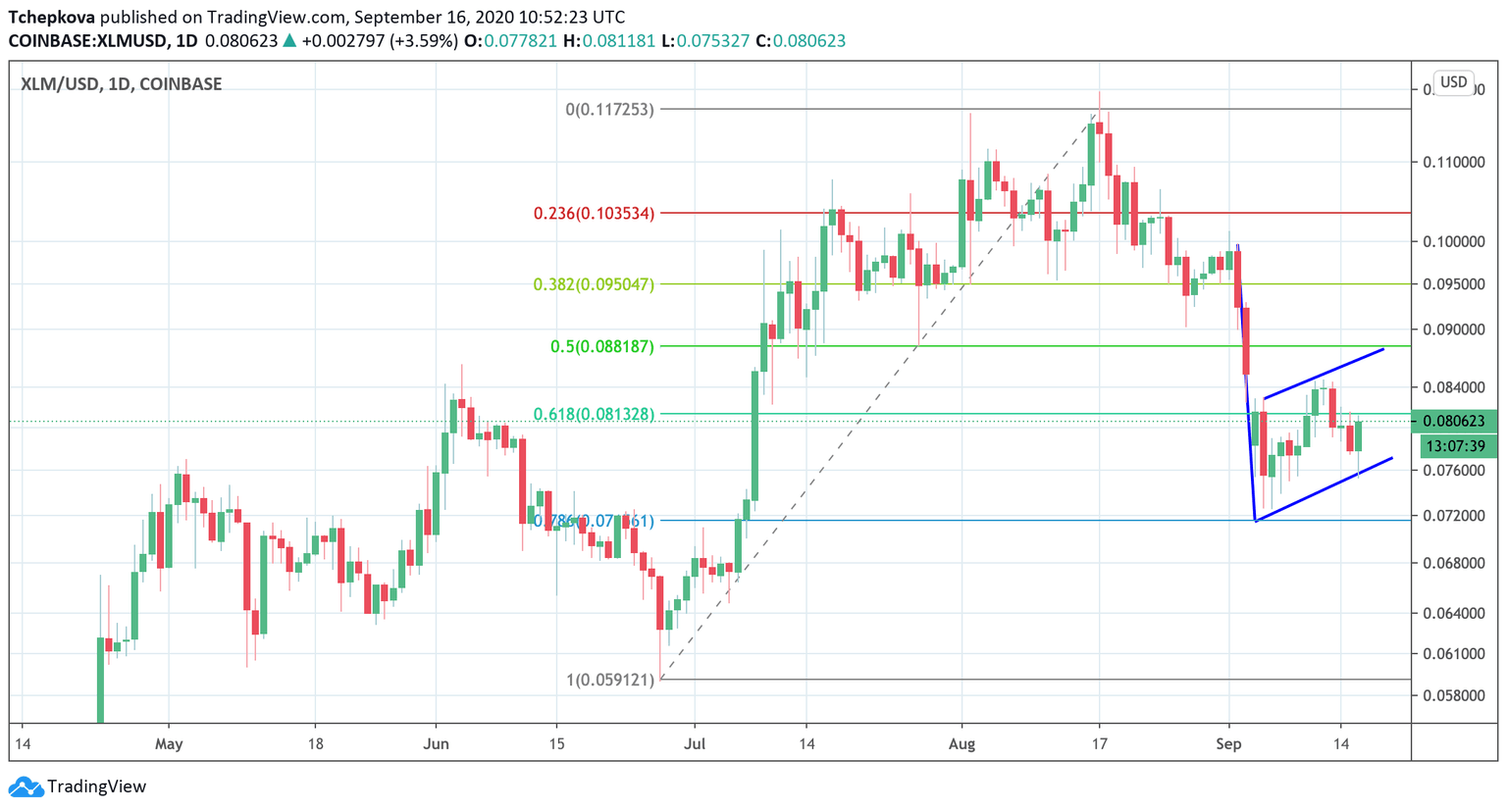

Stellar (XLM) dropped to $0.077 on Tuesday and extended the decline to $0.075 during early Asian hours. However, a strong buying interest clustered around this barrier and triggered a sharp recovery, pushing prices above $0.08. At the time of writing, XLM/USD is changing hands at $0.0805.

On the daily chart, Stellar has reversed from the lower boundary of the bear flag pattern. The next recovery target comes at $0.09, which coincides with the flag's upper boundary. A sustainable move higher will negate the bearish outlook and bring $0.10 into play.

XLM/USD daily chart, Flag formation

A break below $0.076, however, will confirm the downward trend's continuation and increase the chances for a steeper decline towards $0.071. This is the lowest price level recorded since September 4, which is reinforced by the 0.78% Fib.

NEO finds bullish inspiration after the sell-off

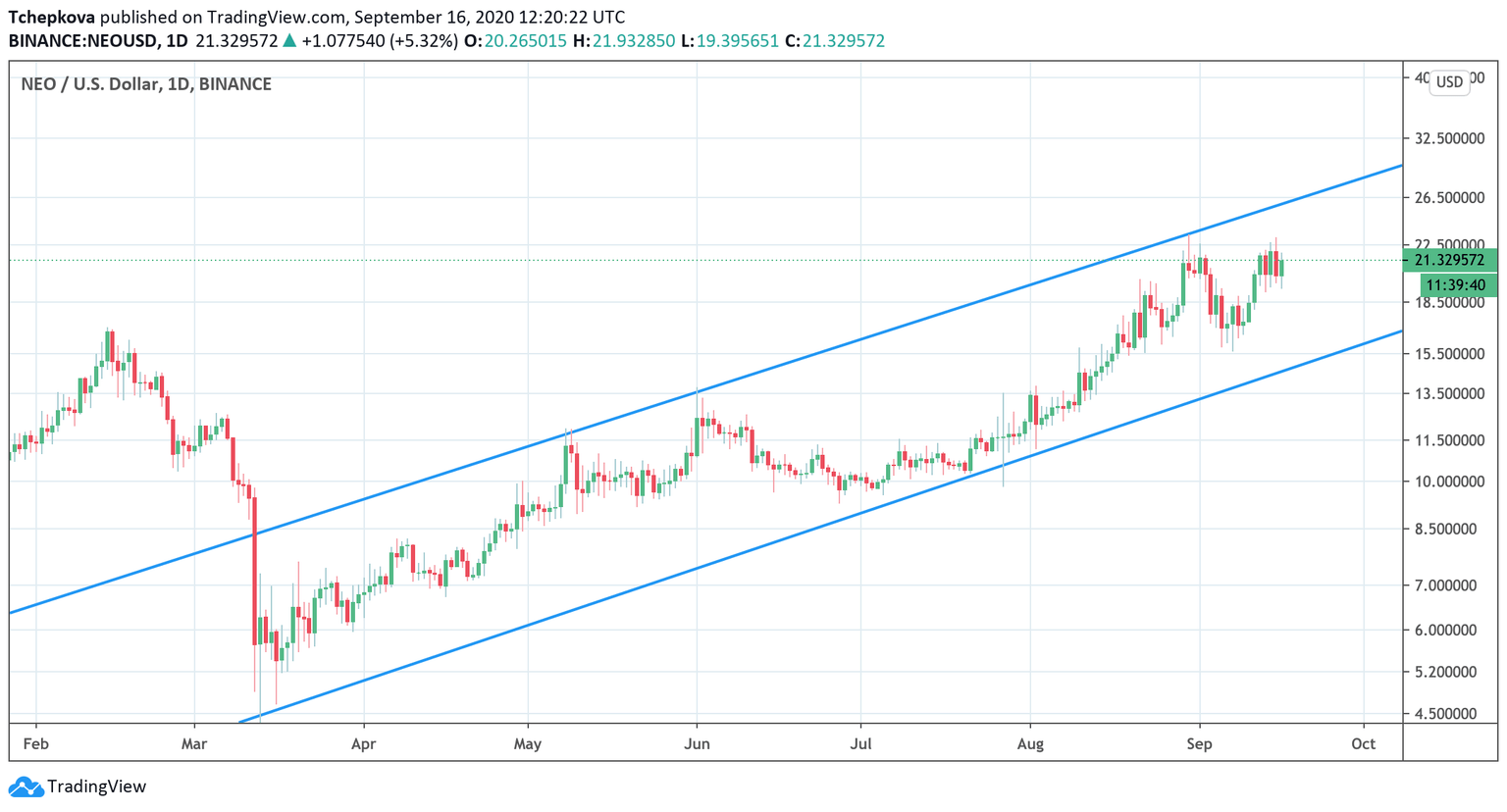

NEO/USD bottomed at $3.92 on March 12 at has been recovering ever since. The coin is moving within a long-term ascending channel limited by the $14.50 support on the downside and $26 resistance on the upside. At the time of writing, NEO is changing hands at $21.24. This altcoin has recovered after Tuesday's sell-off to $19.39 to trade at $21.25, at the time of writing.

Despite the recovery, this cryptocurrency is still moving within a consolidation pattern. A sustainable move above the recent high of $23 will help create bullish momentum and bring the above-mentioned channel resistance of $26 into focus.

NEO/USD daily chart, bullish channel

On the downside, the price is supported by the psychological barrier of $20, as all recent attempts to settle below this hurdle have failed. A daily close below it will likely bring more bears into the market, pushing prices to $19 or lower.

LEO is growing like there's no tomorrow

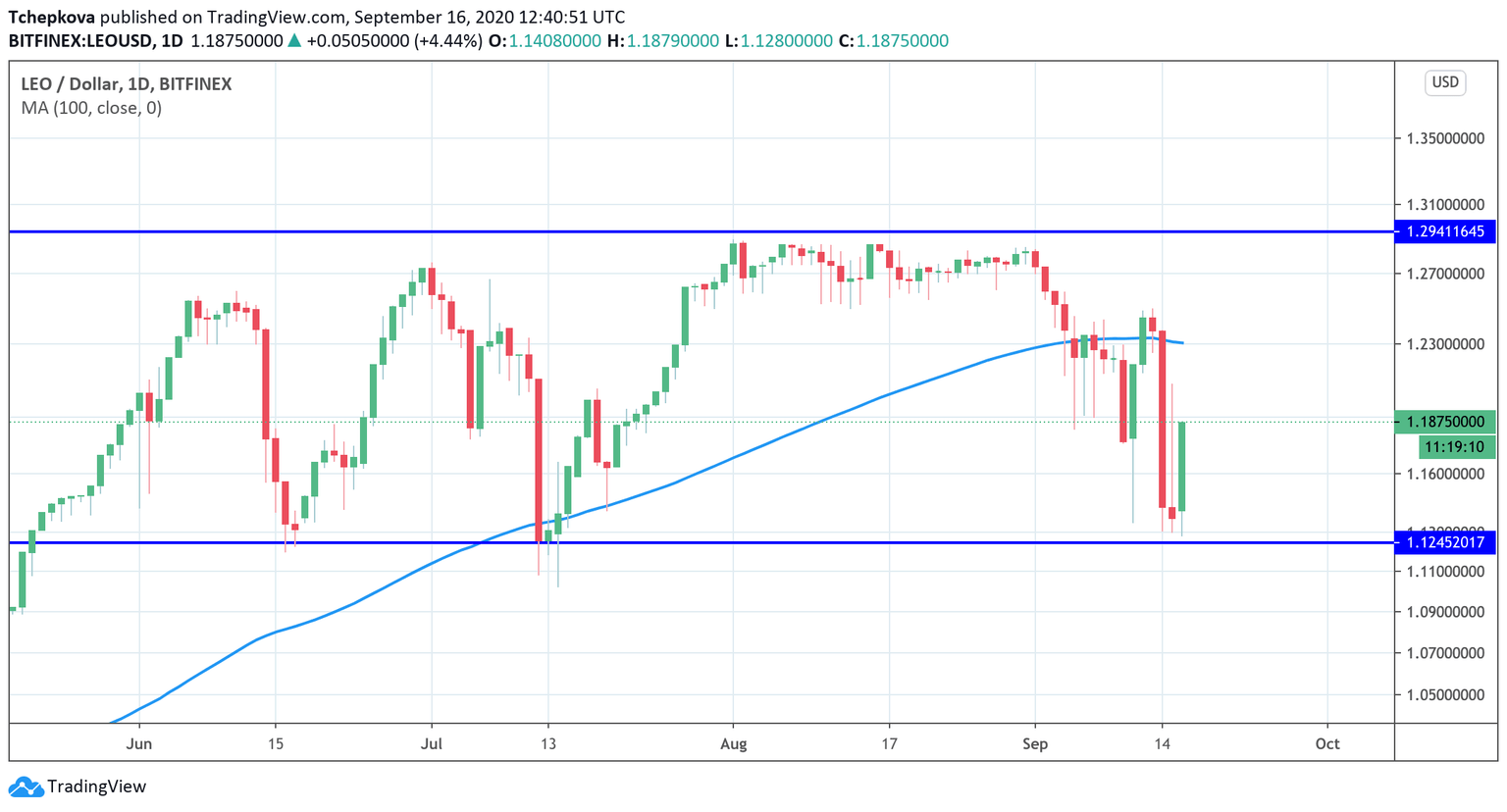

LEO is the native token of cryptocurrency exchange Bitfinex. The altcoin dropped to $1.13 on Tuesday only to recover to $1.18 by press time. The digital asset has been oscillating in a broad range of $1.12-1.29 since late May. The recent sell-off to the lower boundary of the parallel channel was followed by a sharp upswing, adding credibility to its strength.

From the technical point of view, the initial recovery target is created by the daily SMA100 at $1.23. Once it is broken, the price will proceed with the recovery until it bumps into the upper boundary of the channel at $1.29.

LEO/USD daily chart, a wide range

On the downside, $1.12 has been tested on several occasions since May, meaning that a daily close below this level will become a strong bearish signal that will open the door for a substantial increase in sell orders. If so, LEO could drop to the next supply barrier at $1.

To conclude: Stellar, NEO, and LEO recovered the losses incurred during the recent sell-off and may continue moving higher within the current ranges. The long-term picture remains uncertain as XLM is stuck in a bear flag pattern, while NEO and LEO are range-bound.

Author

Tanya Abrosimova

Independent Analyst