BitMEX adds future markets for two new cryptocurrencies

- BitMEX exchange has added futures markets for LINK and XTZ.

- The new altcoin futures will be paired with USDT instead of BTC.

- The last time BitMEX listed a new token was in June 2018.

Cryptocurrency derivatives exchange BitMEX has recently announced the introduction of futures markets for two digital assets - Chainlink (LINK) and Tezos (XTZ). It has also introduced new contracts for EOS and ADA, two coins already traded in BitMEX.

Notably, BitMEX has enabled Tezos trading in the past. Before the project’s initial coin offering (ICO) in 2017, XTZ/BTC futures were listed on BitMEX and settled at the sale price of 0.0002 BTC per XTZ. The last time BitMEX exchange listed a new token was in June 2018, when it announced a TRON/BTC futures market.

The newly-introduced altcoin futures will be paired with USDT instead of BTC. Citing the reason for this, BitMEX said:

USDT pairs account for over 60% of overall altcoin volume. [By listing tether pairs], we are providing users with the trading options to better meet their needs.

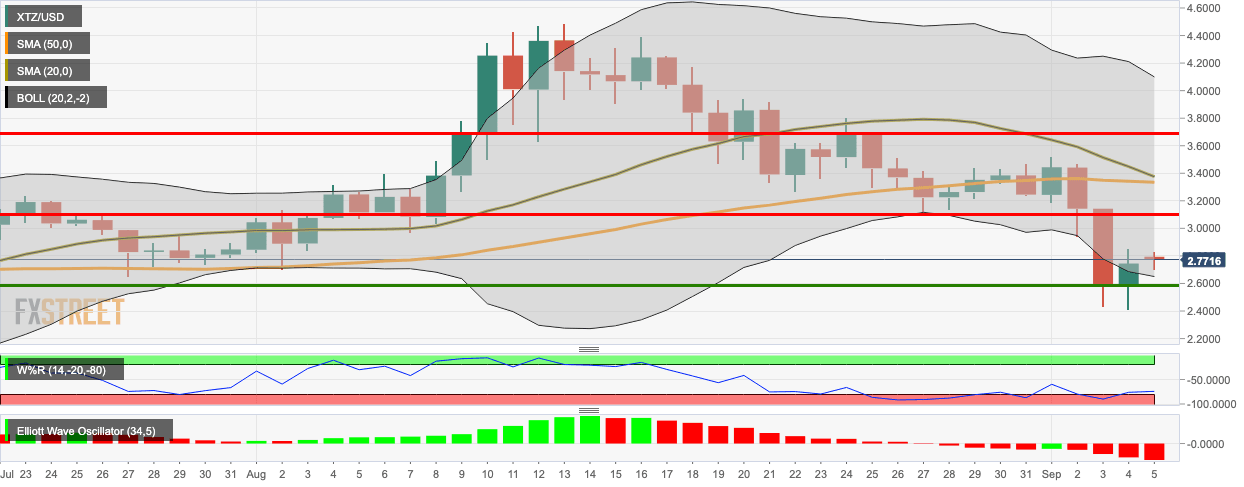

XTZ/USD daily chart

XTZ/USD bears regained control after a bullish Friday. The price has gone down from $2.79 to $2.783. The relative strength index (RSI) is hovering next to the oversold zone, so more downward action isn’t expected. The SMA 50 is looking to cross over the SMA 20 curve to chart the bearish cross.

XTZ/USD has strong resistance at $3.11, $3.35 (SMA 50), $3.37 ( SMA 20) and $3.67. On the downside, healthy support lies at $2.58.

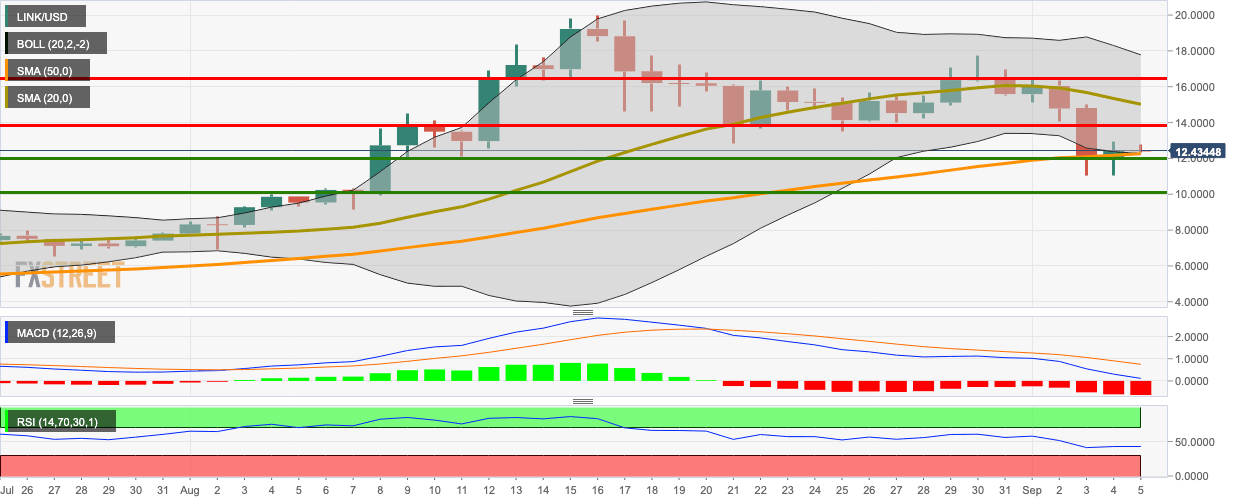

LINK/USD daily chart

LINK/USD bears have also taken control of the market in the early hours of Saturday after a bullish Friday. The price has gone down to $12.43 and is sitting on top of the SMA 50 curve. The price faces strong resistance at $13.95, $15 (SMA 20) and $16.50. On the downside, we have three healthy support levels at $12.20 (SMA 50), $11.85 and $10.12.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.