Bitcoin whales resume holding despite increased long-term holders' spending

- Bitcoin whale inflows to Binance have declined as prices picked up, indicating reduced selling activity.

- Bitcoin's realized cap has grown by 3%, increasing by $30 billion in April, yet it remains below the highs reached in November and December.

- BTC long-term holder supply has seen a slight drop for the second time in May, indicating increased spending from this cohort.

Bitcoin (BTC) is trading around $103,600, down 0.5% on Wednesday amid a decline in the general crypto market. Bitcoin whale inflows to Binance have dropped, signaling a shift toward holding despite increased spending among long-term holders (LTH).

Bitcoin whales resume holding amid decline in LTH supply

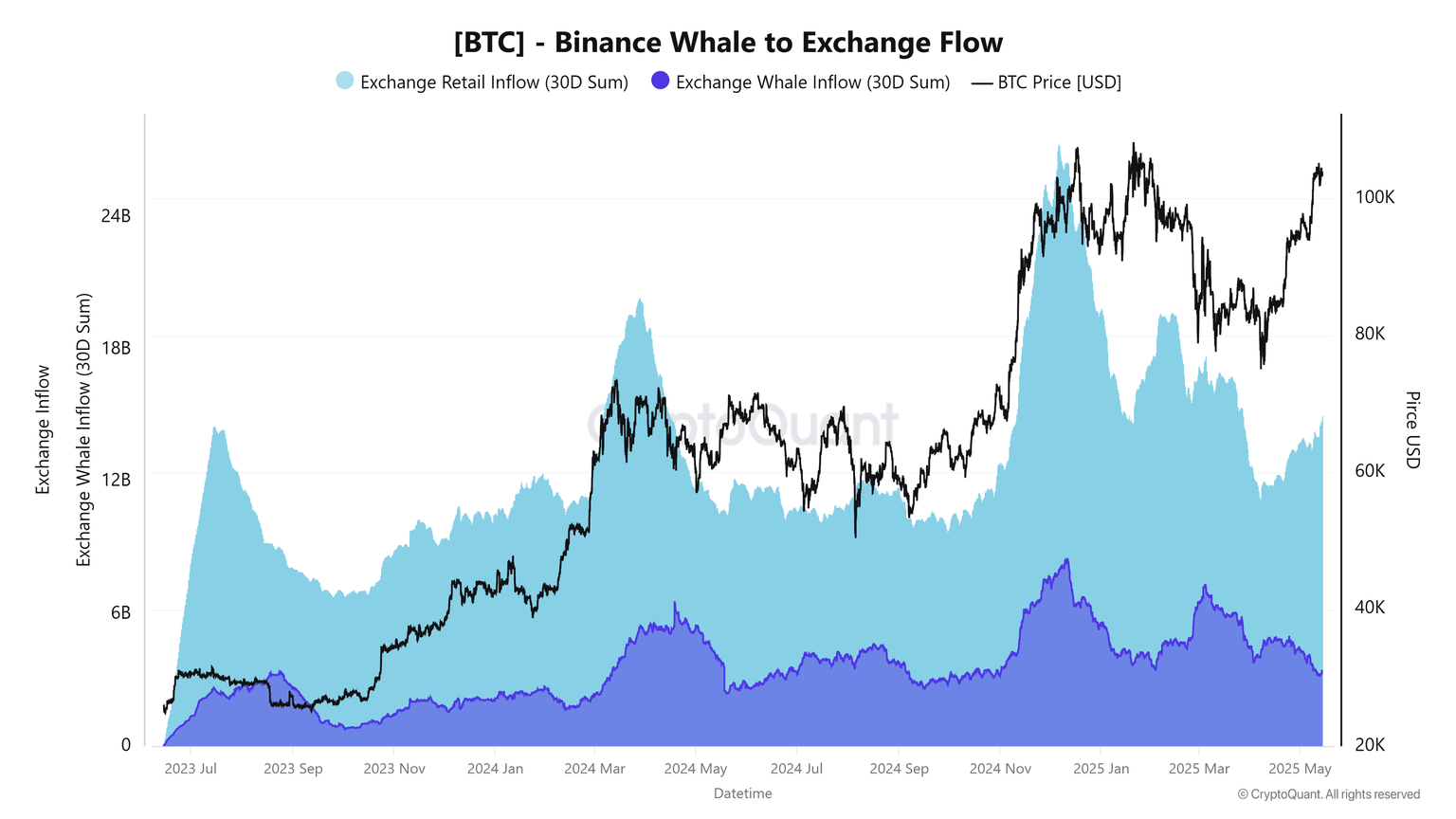

Bitcoin inflows from whale addresses on crypto exchange Binance have experienced a consistent decline in the past month.

Whale inflows on the exchange were $5 billion in April, coinciding with the start of Bitcoin's price recovery. However, it plunged to $3 billion in May, reflecting a notable decrease in large-holder activity. The decline in whale inflows suggests a shift toward holding among this group.

BTC Binance Whale to Exchange Flow. Source: CryptoQuant

However, retail inflows increased from $12 billion to $15 billion over the same period, still below levels seen during previous market peaks.

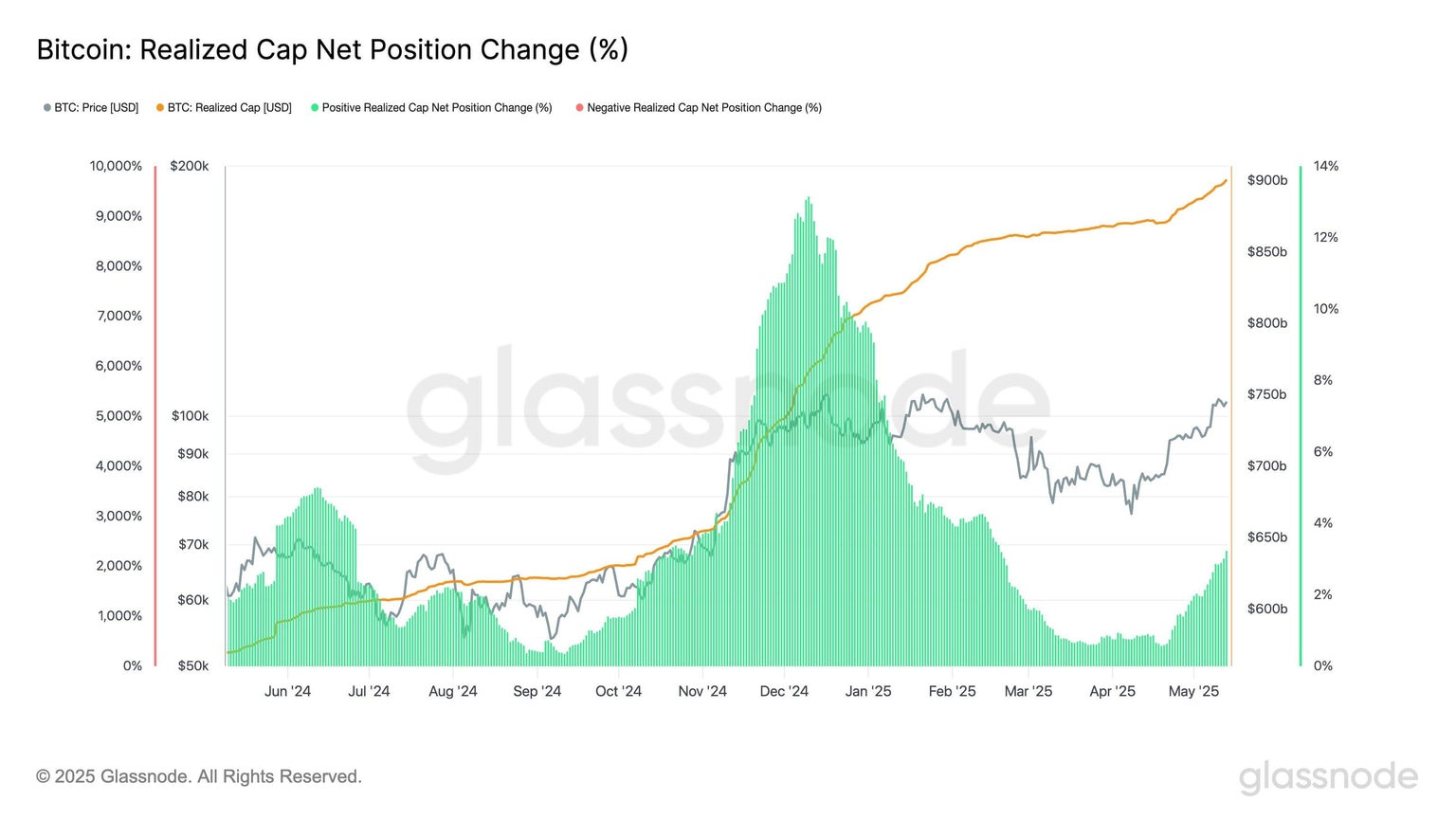

The downtick in whale selling pressure aligns with the growth of Bitcoin's realized cap, which maintained a 3% monthly increase, adding $30 billion in April, according to data from Glassnode.

BTC Realized Cap Net Position Change. Source: Glassnode

This trend suggests that Bitcoin's buying activity has risen, contributing to the recent rebound in its price. However, the realized cap increase remains below the aggressive accumulation observed in November and December, indicating that strong market momentum has not returned.

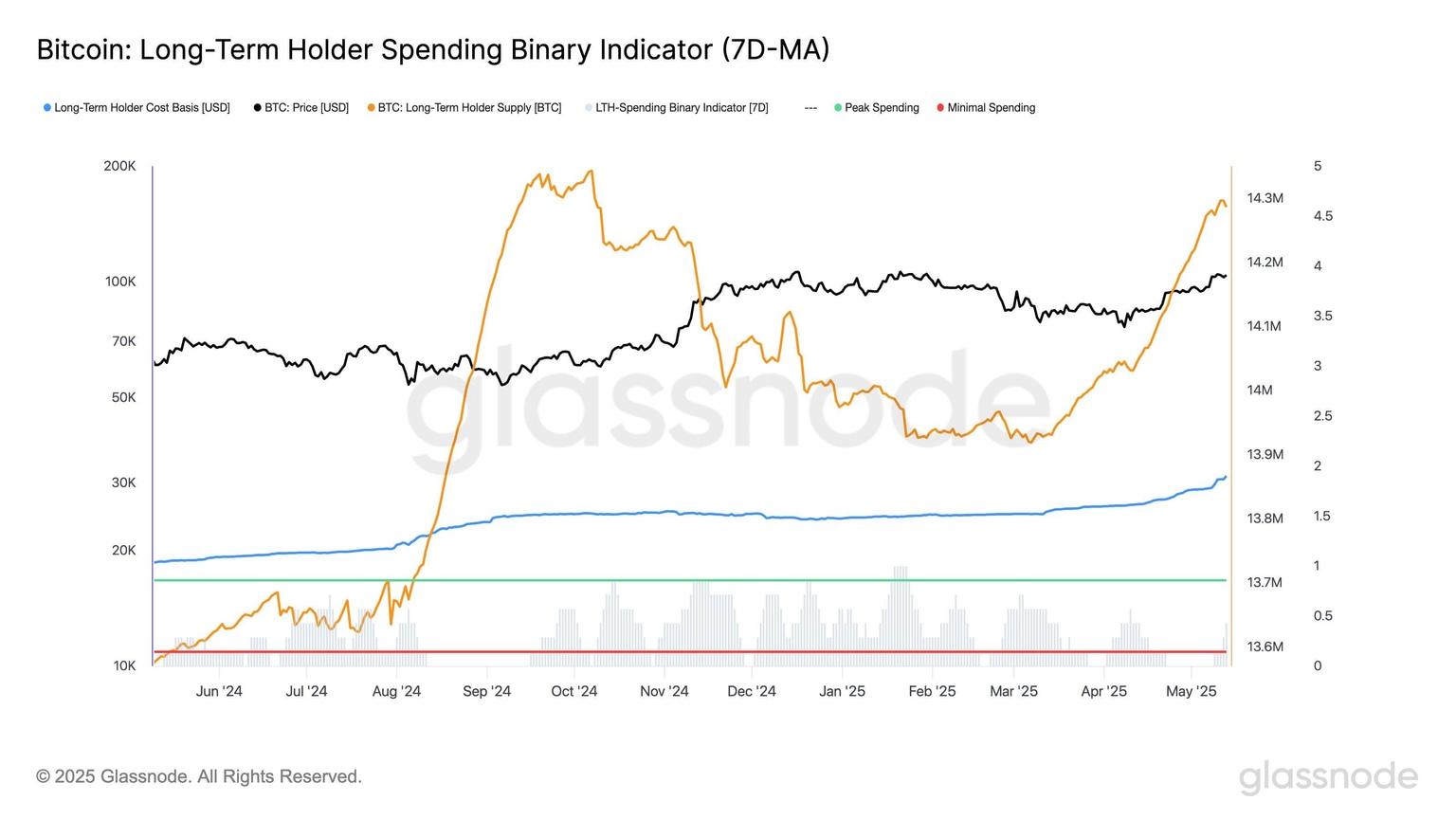

On the contrary, the supply held by long-term holders decreased slightly for the second time in May, reversing the upward trend that began in mid-March. This shift points to increased spending activity within this cohort.

According to Glassnode, if this change in long-term holder behavior accelerates rapidly, it could serve as an indicator of a potential local market top. A continuation of this trend could place downward pressure on Bitcoin.

BTC LTH Spending Binary Indicator. Source: Glassnode

BTC is trading around $103,600, down 0.5% on Wednesday following a 3.4% decline in the broader crypto market.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi