Bitcoin whales feast as BTC price and the wider market melt down

Panic selling crushes the entire crypto market, sending Bitcoin's price to $30,000 for the first time since February, but data shows BTC whales bought the dip.

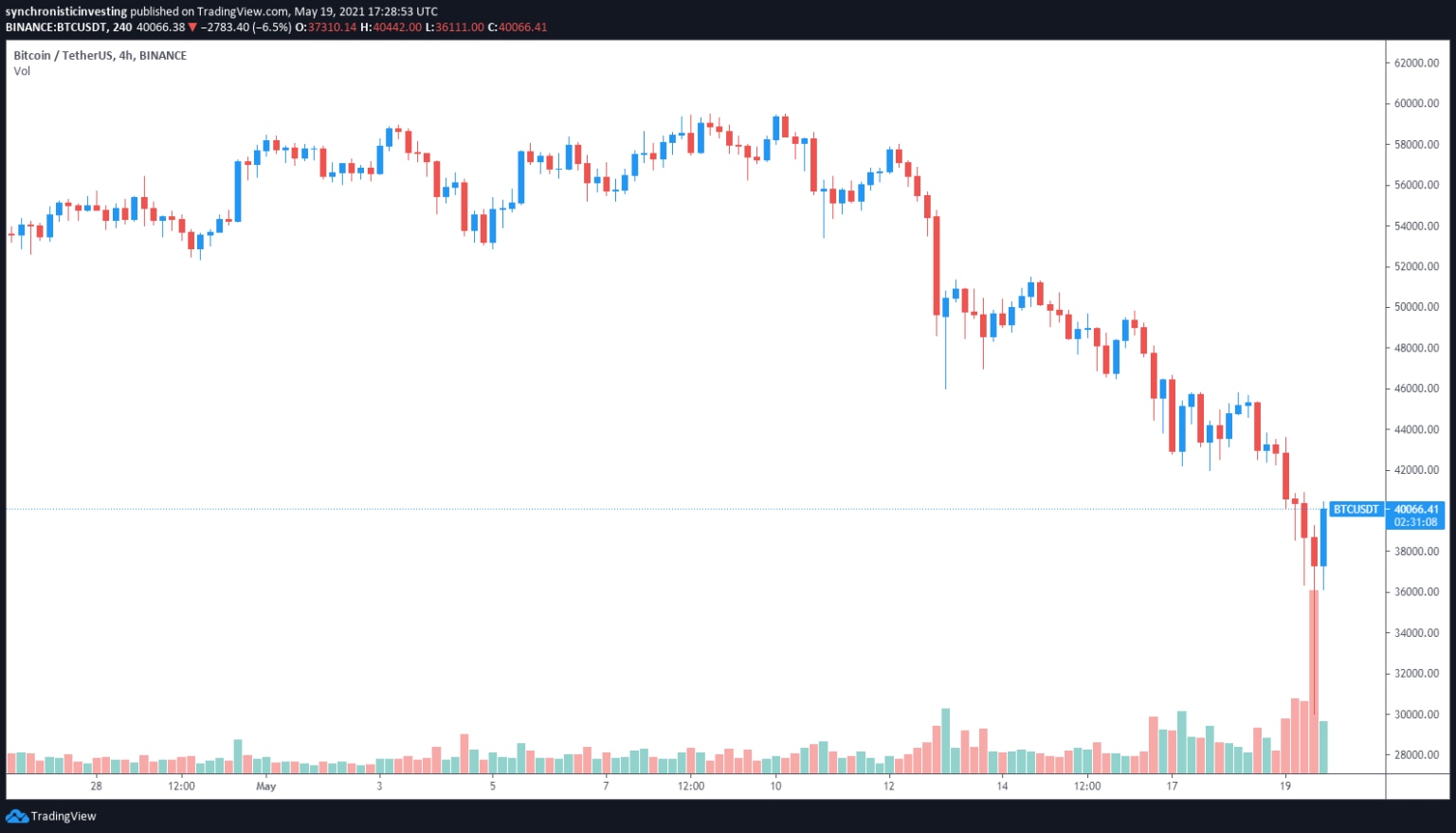

Data from Cointelegraph Markets and TradingView shows that the initial price dump that pushed BTC below the $43,000 support level on May 18 accelerated into the overnight trading session as $110 billion worth of trading volume fueled the wick down to $30,000.

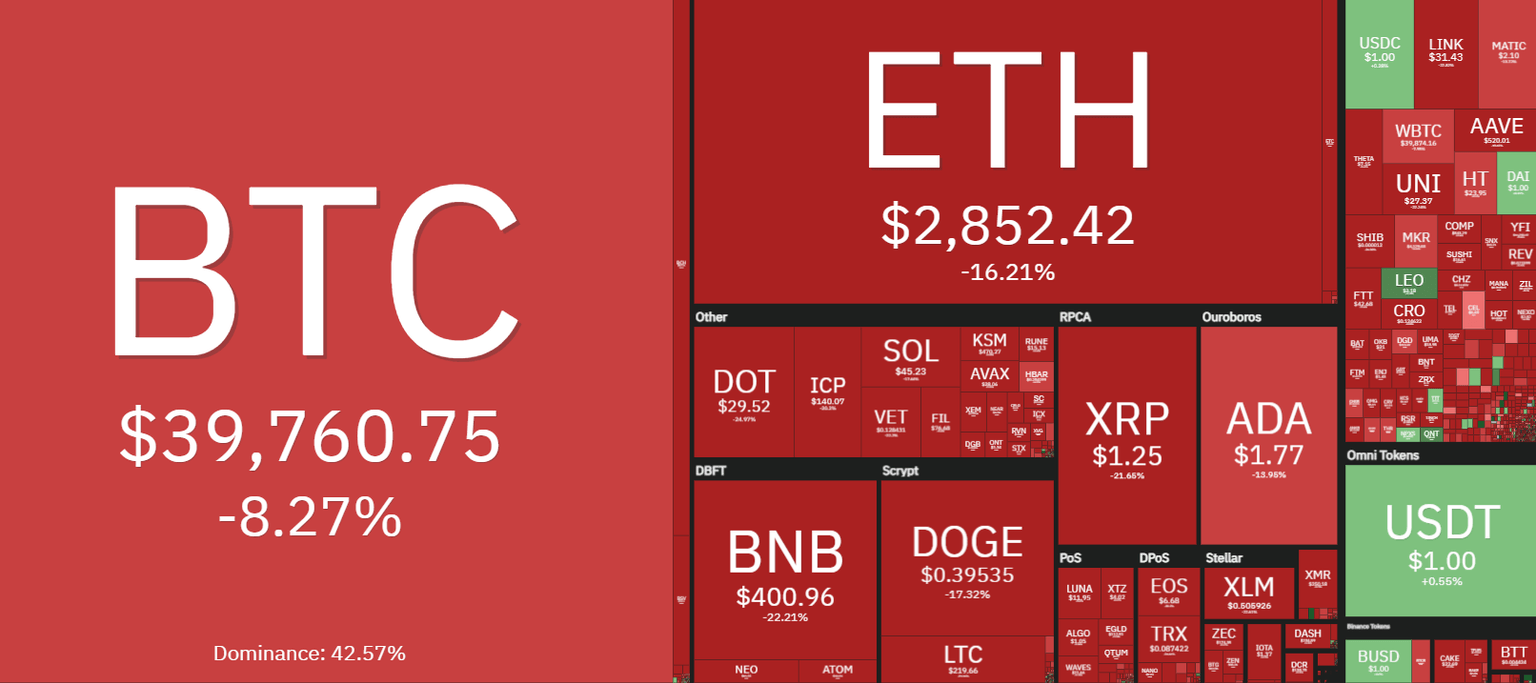

The market downturn sparked outages and other delays across a few of the top cryptocurrency exchanges, and the prices of the vast majority of altcoins cratered alongside the price of Bitcoin, with Ether (ETH) briefly plunging to $1,900 and Dogecoin (DOGE) bottoming out at $0.236.

The sell-off flushed out traders using excessive leverage

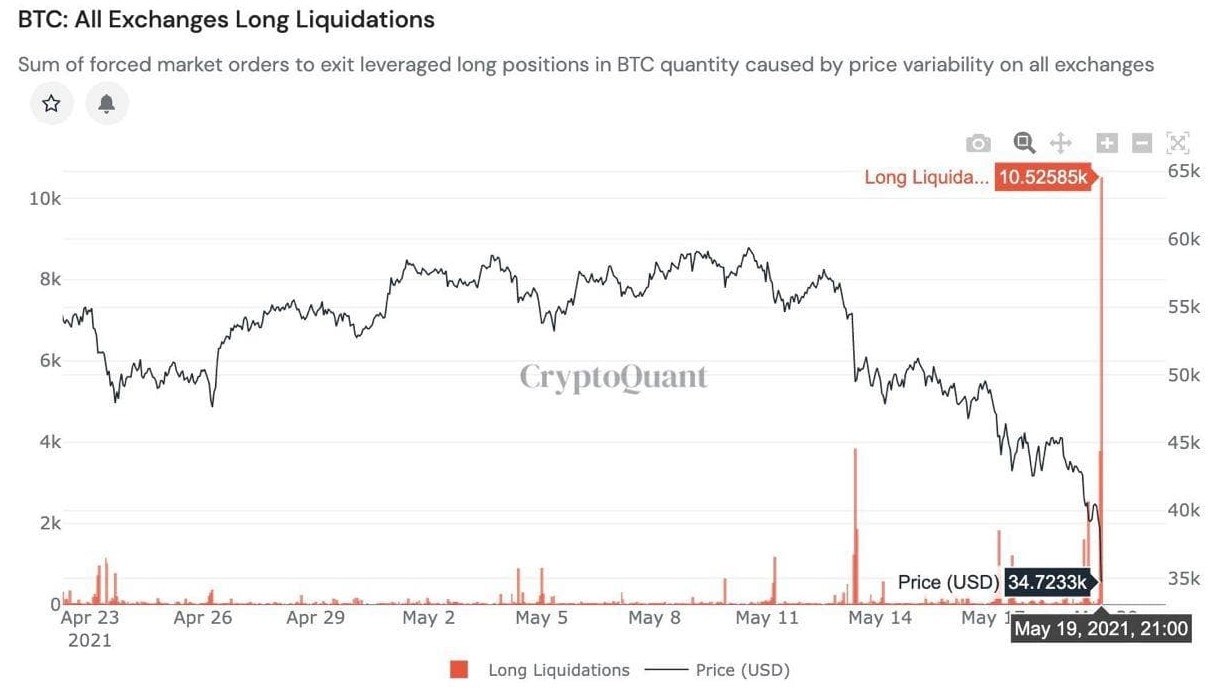

As with any significant downturn in the crypto market, derivatives and leveraged traders were hit especially hard by the rapid $8,000 price drop in BTC that resulted in a record 10,525 BTC being liquidated in one hour at the peak of the market squeeze.

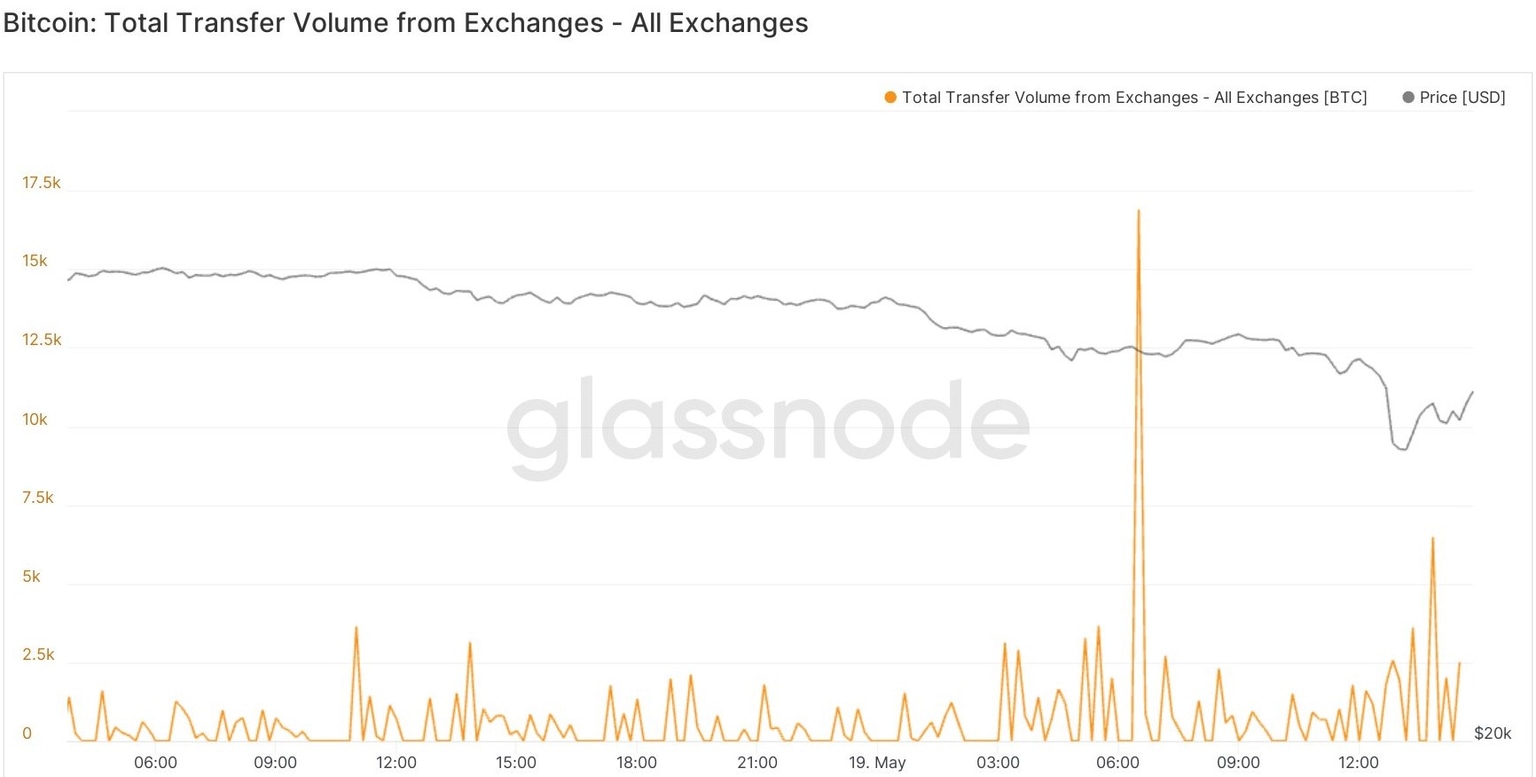

While leveraged traders were wiped out, some well-positioned traders and larger entities with dry powder used this opportunity to buy the dip and promptly put their newly acquired Bitcoin into personal wallets, as evidenced by the outflow of 16,895 BTC in a span of 10 minutes earlier on May 19.

As for what to expect next for Bitcoin, some clues have been offered by the team at Whalemap, which identified $33,000 as the new major support level for BTC, with the previous support at $46,000 now becoming a major resistance level should the price try to bounce higher.

Further analysis from the team also highlighted support levels at $37,400 and $34,200 and indicated that should the price continue to fall lower, it is crucial that the $29,000 support hold or the price could flush as low as $19,000.

While a price dip below $29,000 may seem dire to some, Whalemap instead closed its analysis by stating:

“Overall, this is a great dip buying opportunity with a clear invalidation which makes it a great risk/reward trade.”

Altcoins collapse under pressure

The saying that “As goes Bitcoin, so goes the rest of the market” held true in this most recent downturn, resulting in red across the board for altcoins.

Some of the hardest-hit coins in the top 30 include Litecoin (LTC), Polkadot's DOT and EOS, which have seen their prices fall by roughly 30% over the past 24 hours. As the market corrected, a series of price manipulations on the Binance Smart Chain-based Venus decentralized finance platform led to a 60% drop in the price of XVS.

Out of the top 200 cryptocurrency projects, the only two that managed to see positive gains amid the market turmoil were Celer Network's CELR, which gained 3.33% on the day, and Unus Sed Leo (LEO), which saw its price increase by 5.25%.

The overall cryptocurrency market capitalization now stands at $1.786 trillion, and Bitcoin’s dominance rate is 42.1%.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.