Bitcoin traders are eyeing these price levels as BTC rebounds from weekend crash

Bitcoin is recovering, and traders are pinpointing $57,000 and $60,300 as the key short-term price levels to watch.

The price of Bitcoin (BTC) is recovering after a strong sell-off during the weekend caused by cascading liquidations in the futures market.

BTC/USDT 15-minute price chart (Binance). Source: TradingView.com

Traders are pinpointing three levels as the critical price areas to watch in the short term: $51,200 as the major support, $60,300 as the important resistance, and $57,000 as the near term area of interest for sellers.

It is critical for Bitcoin to reclaim $57,000

Although the price of Bitcoin dropped to as low as around $50,000, the market structure itself does not look largely concerning, according to a pseudonymous trader known as TraderKoz.

Bitcoin wicked to sub-$50,000, but it recovered quickly to around $53,000 and has sustained above $56,000 since.

Bitcoin price chart with key levels. Source: TraderKoz

Referring to the chart above, the trader said:

“You know, if this wick wasn’t quite as long because of all the cascading liquidations... it would actually be some really clean PA.”

In the near term, it is important for Bitcoin to rise and hold above $57,000. If BTC’s price stabilizes at these levels, it would confirm that the weekend crash was a purely technical and futures market-driven correction.

Popular pseudonymous trader Rekt Capital also emphasized that the macro support remains at $51,200. Bitcoin recovered quickly as soon as it dropped to the low $50,000 area.

Therefore, Bitcoin will confirm a higher low structure if it continues to recover in the short term and does not drop below $51,200.

A higher low structure forms when the most recent Bitcoin low is higher than the previous low point.

The trader explained:

“Last time #BTC dipped into the low-$50000s was four weeks ago Then, $BTC dipped to ~$50200 before reversing Recently, BTC dipped to the low-$50000s again This time, BTC dipped to ~$51200 before reversing BTC bottomed $1000 higher on this dip. That is a Higher Low.”

Additionally, analysts at Santiment noted that BTC recovered rapidly immediately after the funding rate of Bitcoin on BitMEX went negative.

This indicates that significant organic buyer demand emerged when selling pressure started to amp up in the derivatives market, which would support the argument for a short-term trend reversal as long as Bitcoin remains above $57,000.

The analysts wrote:

“The #BitMEX funding rate for #Bitcoin went negative (more contracts betting against $BTC’s price rising than contracts betting in favor) this weekend for the first time in 3 months. As is often the case, the price bounced right as the #FUD settled in.”

Will the relief rally continue?

There were large deposits made to exchanges when the price of Bitcoin dropped, adding to the selling pressure.

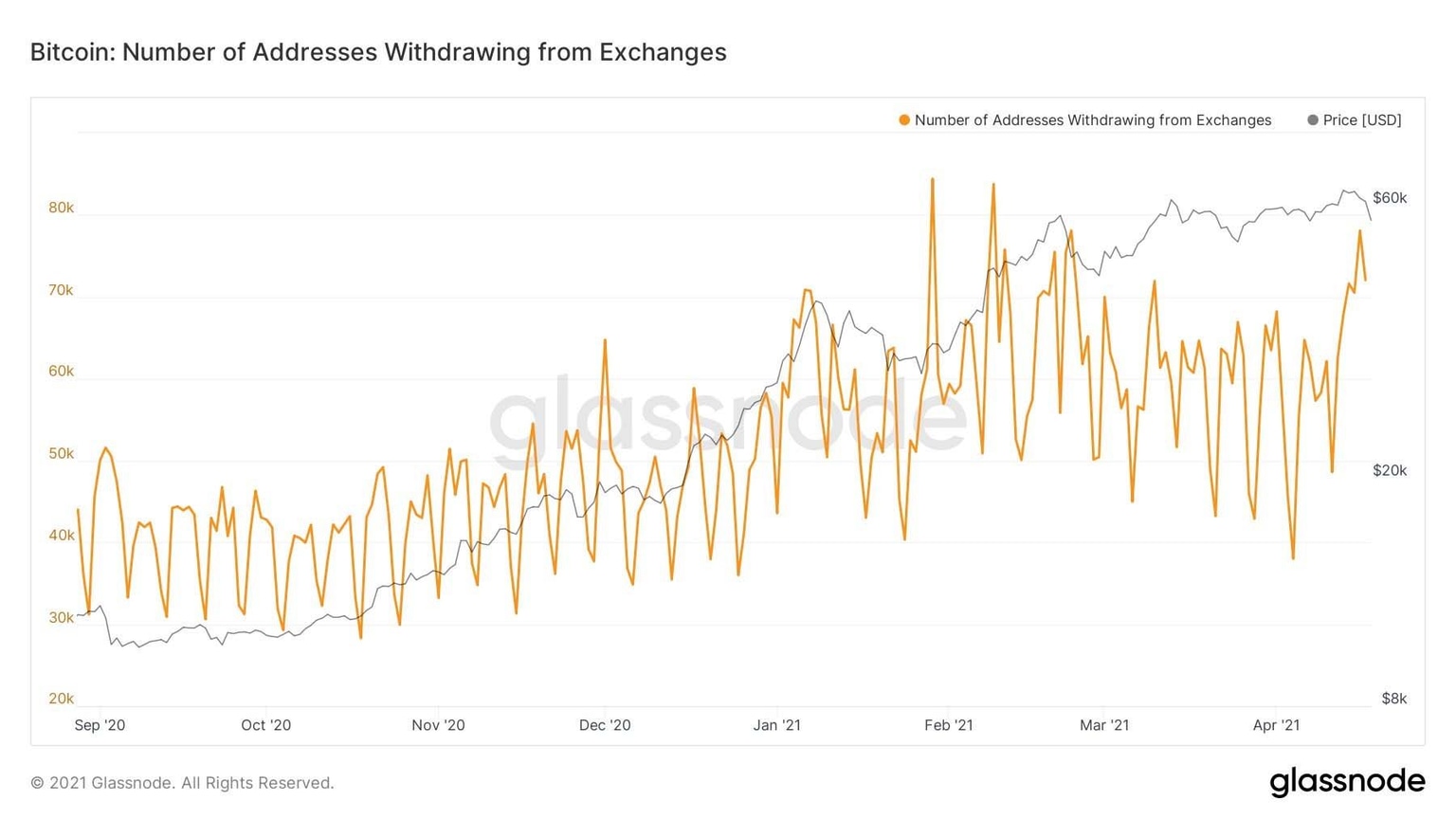

But, as pointed out by Bitcoin Jack, a cryptocurrency derivatives trader, exchange withdrawals or outflows exceeded the deposits nevertheless.

He said:

“April 15, 16 and 17th $BTC saw ~482K addresses deposit to exchanges Same period ~220K addresses were withdrawn to from exchanges & net positive outflow recorded Many tiny hands in -> fewer bigger hands out Confirmed by short term holder SOPR capitulation.”

Number of Bitcoin addresses withdrawing from exchanges. Source: Glassnode

As long as exchange withdrawals are on par or higher than exchange deposits, the technical momentum of Bitcoin is not at risk of losing steam in the near term.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.