Bitcoin price recovers as on-chain metrics point at potential BTC rally

- Bitcoin price tests resistance at $43,000, recovering from a week-long slump.

- Bitcoin on-chain metrics signal a likelihood of a BTC price rally.

- BTC profit-taking by whales has declined, paving the way for extended price gains.

Bitcoin (BTC) price tested resistance at $43,000 on Friday, recovering from declines earlier this week, in a sign of increasing buying pressure after a choppy week. Some of the asset’s on-chain metrics support the thesis of further price gains ahead, although Bitcoin price has been moving broadly sideways for the last two months.

Also read: Bitcoin price scenarios to consider with approaching BTC halving event

Daily digest market movers: Bitcoin could ride the wave of bullish on-chain metrics

- Bitcoin price sustained above the $43,000 level on Friday, on the way to closing its second consecutive week in the green after a price slump at the beginning of 2024.

- The asset could kick-start a potential rally as on-chain metrics are bullish and renewed BTC ETFs inflows after weeks of massive GBTC outflows.

- These two catalysts – on-chain metrics and net positive flows to ETFs – are likely to emerge as drivers of the Bitcoin price rally.

- An analysis of Bitcoin’s on-chain metrics (whale transactions valued at $100,000 and higher and Network Realized Profit/Loss) suggests that:

- Whale transactions valued at $100,000 and higher have declined between January 17 and February 1.

- As these spikes in whale transactions coincided with Network Realized Profits in the past several weeks, the recent decline in transaction volumes indicates large-wallet investors are reducing their profit taking.

Whale transaction count and Network Realized Profit/Loss. Source: Santiment

- The Social dominance metric, which measures the volume of Bitcoin’s mentions in conversations on platforms like X, shows that there is a decline in BTC’s dominance. Altcoin chatter is likely taking over, and this decline has foreshadowed BTC price increases several times in the past six months..

BTC Social dominance and price. Source: Santiment

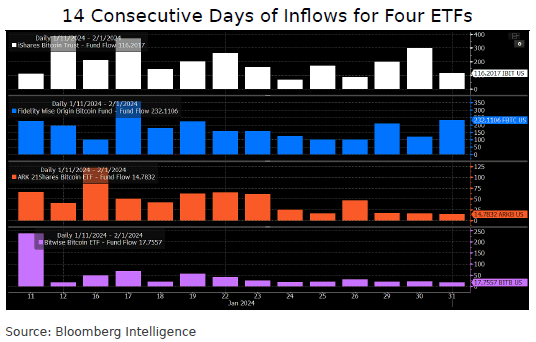

- BIT, FBTC, ARKB and BITB ETFs registered capital inflows on each of the first 14 trading days, while Grayscale’s GBTC posted outflows every single day since its conversion, according to data from Bloomberg Intelligence.

Inflows to BTC ETFs for 14 consecutive days. Source: Bloomberg Intelligence

- Consistent inflows to Bitcoin ETFs signal an increase in BTC demand among market participants as ETF issuers like BlackRock continue to scoop up BTC on OTC markets. This is bullish for Bitcoin in the long-term.

Technical Analysis: Bitcoin price could kick-start bull run

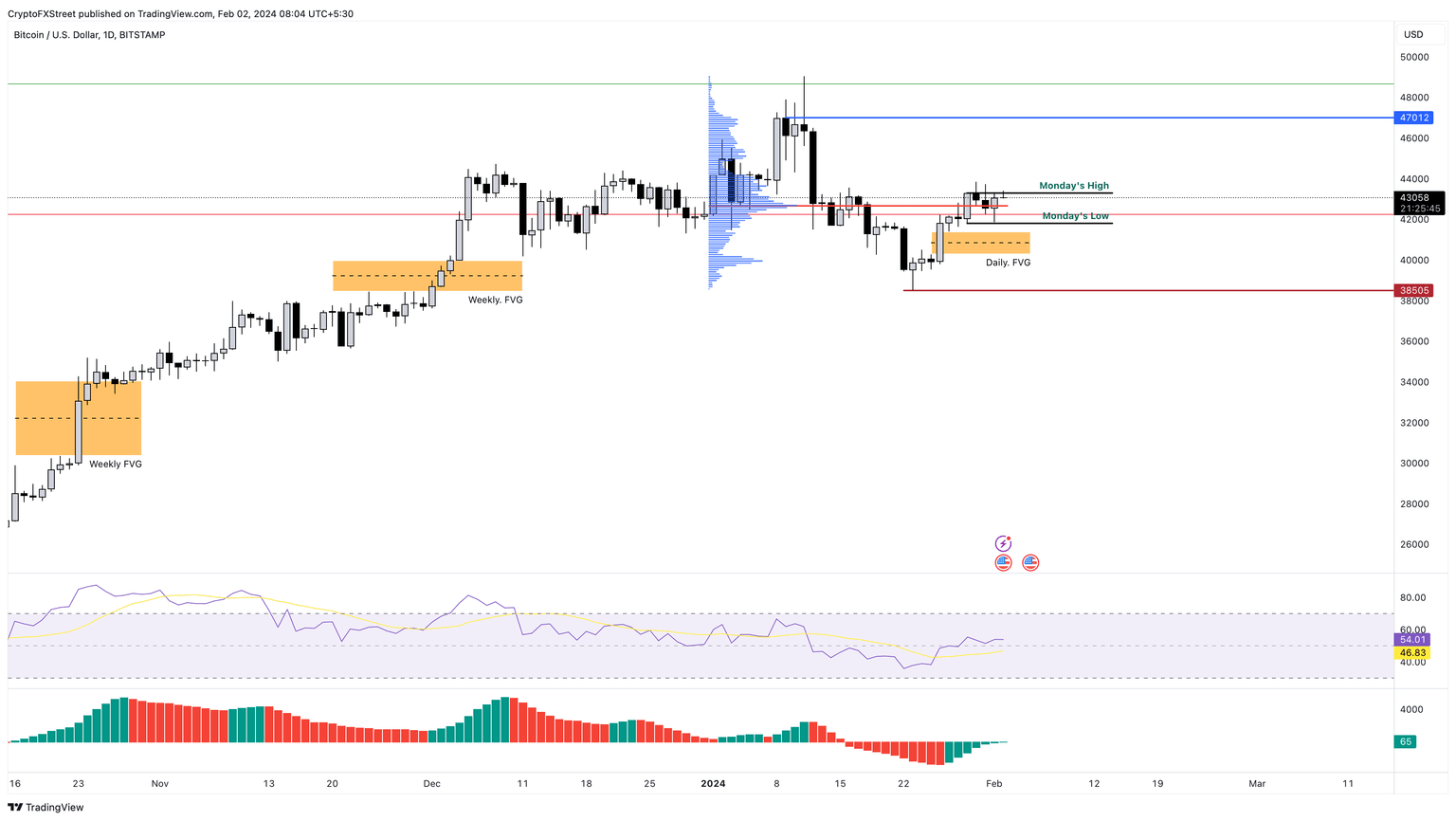

Akash Girimath, technical analyst at FXStreet, notes that Bitcoin price shows no signs of a directional bias in the short-term, the asset is trading around the $43,000 level. Girimath argues that on-chain metrics show clear bullish signs, and that BTC could potentially kick-start a bull run.

Girimath says two scenarios could play out. In the first case, Bitcoin price uptrend could continue after January’s swing low at $38,505. Alternatively, Bitcoin price could correct to the $34,000 level. The analyst notes that traders are expecting a correction that flushes out late long positions and pushes BTC to the $34,000 to $35,000 region. But this correction is highly unlikely, he said.

On the daily timeframe, if Bitcoin price dips into the daily imbalance zone between $41,396 to $40,278, its reaction to the $40,000 region could determine where BTC is headed next. Strong buying pressure has the potential to push Bitcoin to a higher high above $44,000, a moderate buy signal for traders.

BTC/USD 1-day chart

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B10.54.12%2C%252002%2520Feb%2C%25202024%5D-638424539550370748.png&w=1536&q=95)

%2520%5B11.15.20%2C%252002%2520Feb%2C%25202024%5D-638424539830392348.png&w=1536&q=95)