Bitcoin sees golden cross which last hit 2-months before all-time high

Bitcoin (BTC $23,016) lingered near $23,000 on Feb. 7 as a key chart phenomenon hit for the first time in 18 months.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Battle of the Bitcoin crosses begins

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD tracking sideways overnight, having shunned volatility at the week’s first Wall Street open.

While failing to flip $23,000 to support, the pair nonetheless saw a potentially significant event on Feb. 6 in the form of a “golden cross” on the daily chart.

This refers to the rising 50-period moving average crossing over the 200-period moving average. The last time that this occurred on daily timeframes was in September 2021 — two months before Bitcoin’s latest all-time high.

BTC/USD 1-day candle chart (Bitstamp) with 50, 200MA. Source: TradingView

Some crypto analysts have keenly watched the cross, with Venturefounder, a contributor to on-chain data platform CryptoQuant, arguing that $25,000 could reappear as a result.

“Bitcoin goldencross just happened!” he summarized in a Twitter reaction.

This potential correction could see BTC retest $20k (200DMA and key support), then in the bullish case, test $25k next. Make $25k support and it's nail in the coffin for the bears.

BTC/USD annotated chart. Source: Venturefounder/ Twitter

The picture remained complicated on the day thanks to an upcoming “countercross” on weekly timeframes, where the 50-period moving average remained on course to drop below the 200-period one — a phenomenon known as a “death cross” for its conversely detrimental impact on BTC price action.

BTC/USD 1-week candle chart (Bitstamp) with 50, 200MA. Source: TradingView

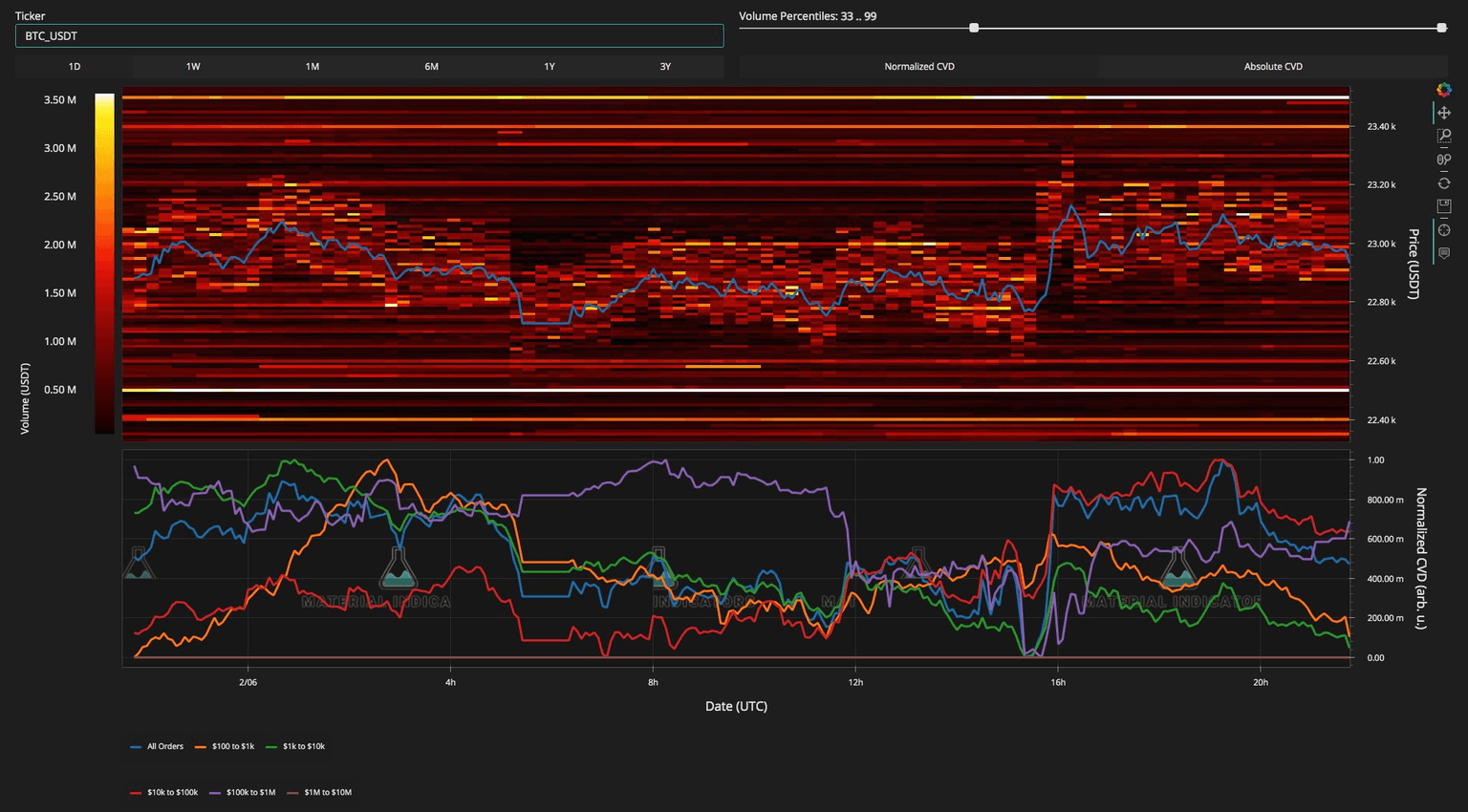

For on-chain monitoring resource Material Indicators, it remained uncertain whether the golden cross alone could propel BTC/USD higher.

“Whether it’s enough to get a legit test of the $25k range remains to be seen,” it wrote in part of a commentary on the Binance order book.

An accompanying chart showed major resistance in the form of ask liquidity stacked at $23,500 — the first major hurdle for bulls to overcome in the event of a move higher.

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

Powell speech “only key factor” of macro week

Another factor on the radar for Feb. 7 came from comments from the United States Federal Reserve.

Ahead of next week’s macroeconomic data prints, multiple Fed officials were set to speak, with Chair Jerome Powell’s words expected to be the most significant regarding market-moving potential.

“Nothing special this week, the only key factor to watch is Powell tomorrow afternoon. Perhaps one more sweep for correction and then the party should continue rallying upwards,“ part of a Twitter analysis by Cointelegraph contributor Michaël van de Poppe stated on Feb. 6.

Van de Poppe added that “buy the dip” might be an appropriate option on altcoins in the meantime, as Material Indicators noted was already the case with Bitcoin whales.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.