Bitcoin price touches $16,000 but gets rejected and falls 2% within hours

- Bitcoin price finally reached $16,000 on Coinbase for the first time since January 2018.

- The flagship cryptocurrency only managed to touch $16,000 before quickly falling.

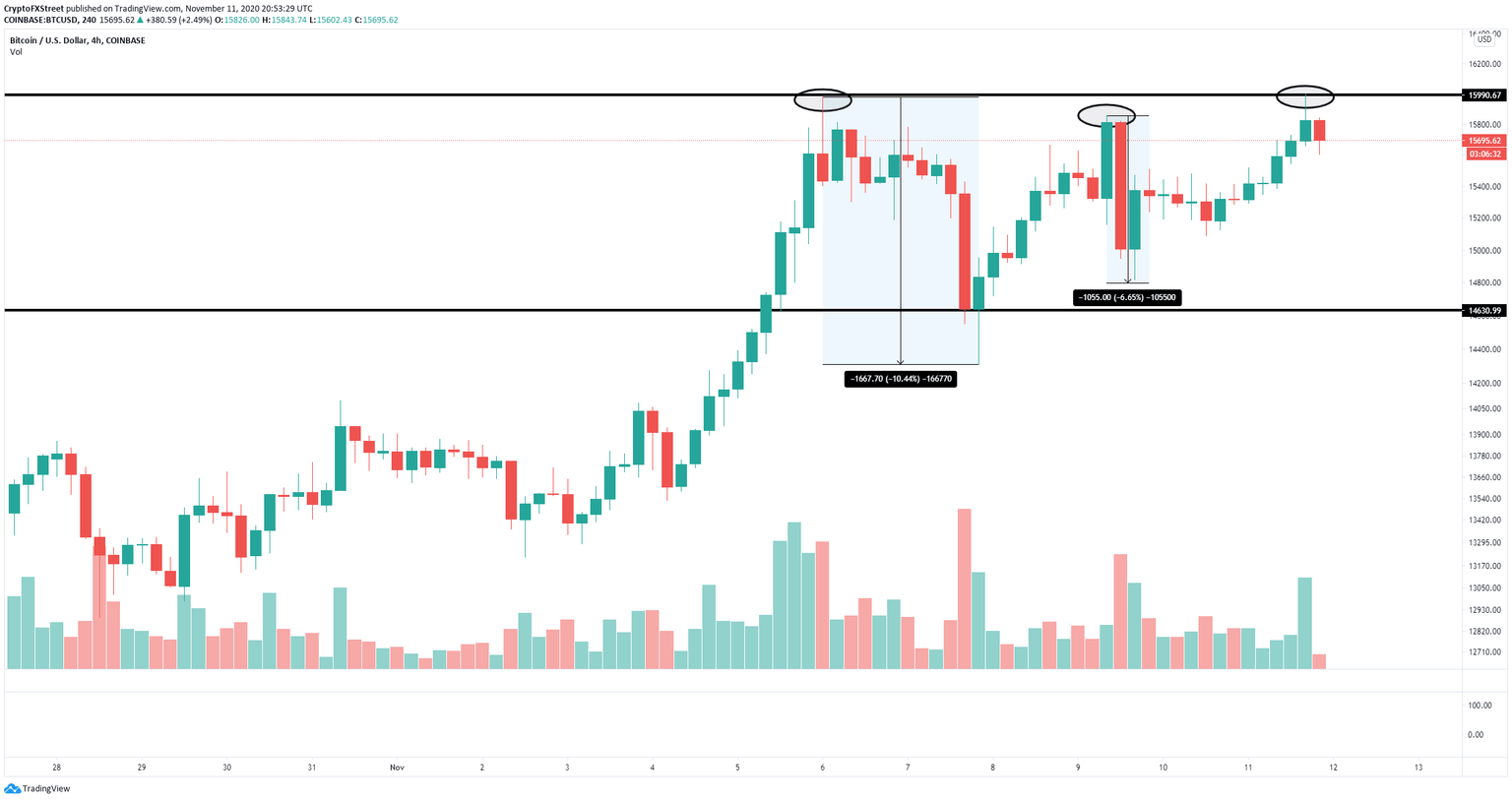

After another run towards $16,000, Bitcoin price got rejected again forming what seems to be a potential double top on the 4-hour chart. Nonetheless, there is still a lot of buying pressure behind BTC as the number of whales continues increasing.

Bitcoin faces a significant bearish pattern

Although Bitcoin price managed to reach $16,000 on Coinbase, breaking the last high of $15,977 on November 6, this would still be considered a double top on the 4-hour chart if BTC breaks the support line at $14,630.

BTC/USD 4-hour chart

Because of the support trendline being so low at $14,630, it’s hard to predict whether this will be a double top or not. Nonetheless, it does show that the $16,000 is a critical resistance level and this rejection will likely lead to a bearish continuation in the short-term like the one on November 6 or November 9. The price target would be $14,630, although a breakdown from this point is an extremely bearish indicator with the potential to drive Bitcoin price towards $12,000.

BTC Holders distribution chart

On the other hand, investors do not seem worried despite Bitcoin price slowing down. The number of whales holding between 10,000 and 100,000 BTC has jumped from a low of 104 on October 17 to 111 currently.

Additionally, the number of smaller holders with 10 - 100 coins has been in an uptrend since September 21 from 138,020 to a high of 139,530. It’s clear that investors continue accumulating Bitcoin even though the price could be considered to be overextended.

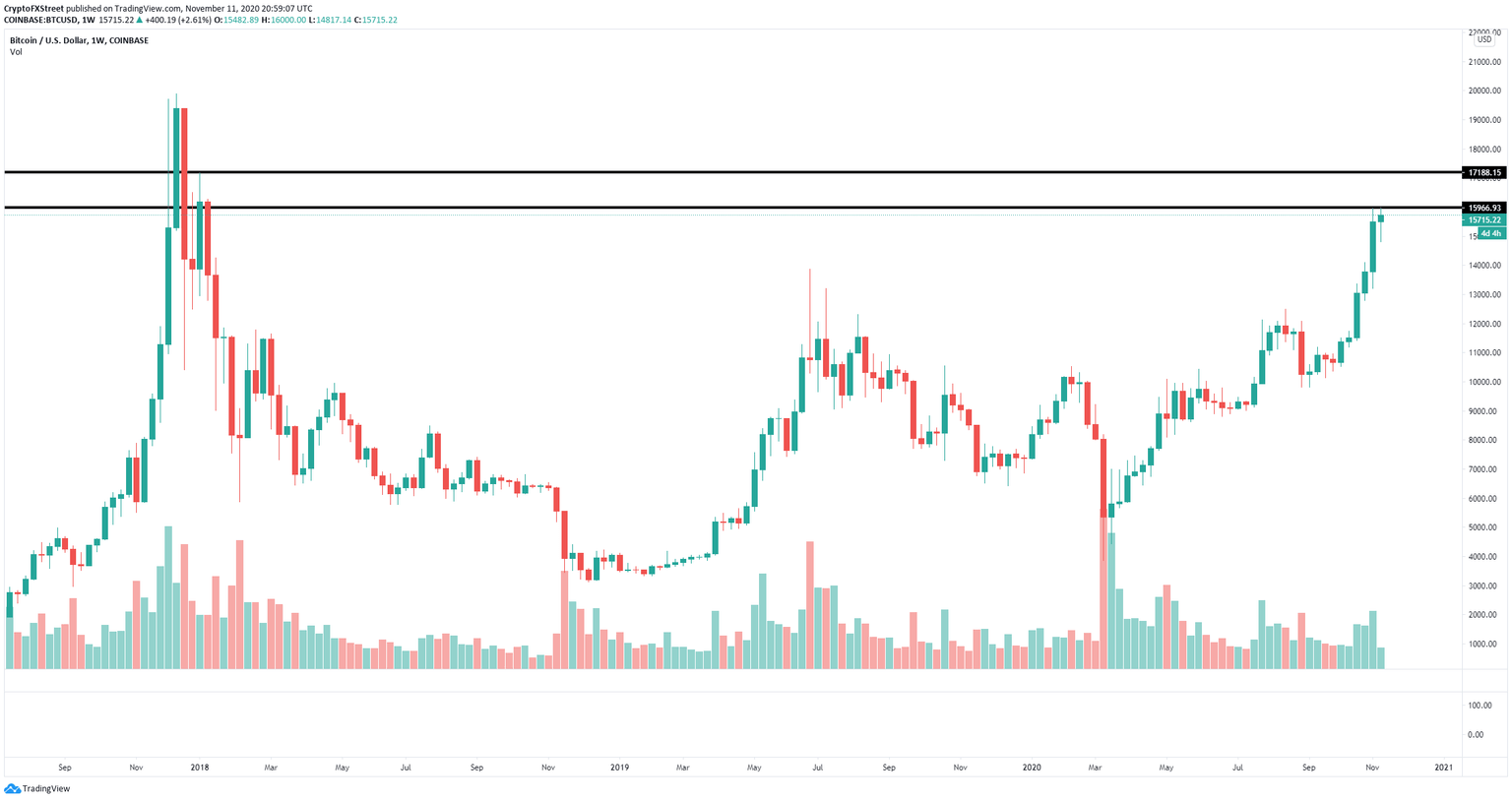

BTC/USD weekly chart

The weekly chart shows very little resistance to the upside if $16,000 is broken. The next potential price target would be $17,188 followed by the all-time high at $19,891.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%20%5B21.56.17%2C%2011%20Nov%2C%202020%5D-637407252328157080.png&w=1536&q=95)