Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

- US President Donald Trump announced fresh tariffs of the UK and Israel, sparking uncertainty across global markets.

- Bitcoin price tumbles towards $82,000 on Wednesday, down 3% from the daily timeframe peak of $87,400.

- Gold price climbed to a new all time high of $3,152, up 10% since Trump confirmed commencement of tariffs in early-March.

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Global markets tumble as Trump’s new tariffs prolong uncertainty

U.S. President Donald Trump has announced sweeping tariffs on imports from the United Kingdom, Israel, and several other nations, triggering volatility across global markets.

The move, framed as a "Declaration of Economic Independence," has led to divergent reactions in Bitcoin (BTC) and Gold prices.

While Bitcoin dropped to $82,143, marking a 3% decline from its daily peak of $87,400, gold (XAU) price soared to a new all-time high of $3,152 per ounce, up 10% since Trump confirmed initial tariffs in early-March.

On Wednesday, President Trump unveiled a comprehensive list of reciprocal tariffs on multiple nations. The tariffs include:

- China: 34%

- European Union: 20%

- United Kingdom: 10%

- Israel: 17%

- India: 26%

- Japan: 24%

- South Korea: 25%

- Vietnam: 46%

- Taiwan: 32%

- Thailand: 36%

During his White House address, Trump emphasized that the U.S. has been unfairly treated in global trade agreements for decades, according to BBC reports.

“April 2, 2025, will forever be remembered as the day American industry was reborn, the day America's destiny was reclaimed, and the day that we began to Make America Wealthy Again,”

- US President Donald Trump announces new tariffs, April 2, 2025

The tariffs, aimed at protecting domestic industries, have led to a mixed market response, with US stocks retreating, commodities like Gold rallying, and cryptocurrencies facing short-term selling pressure.

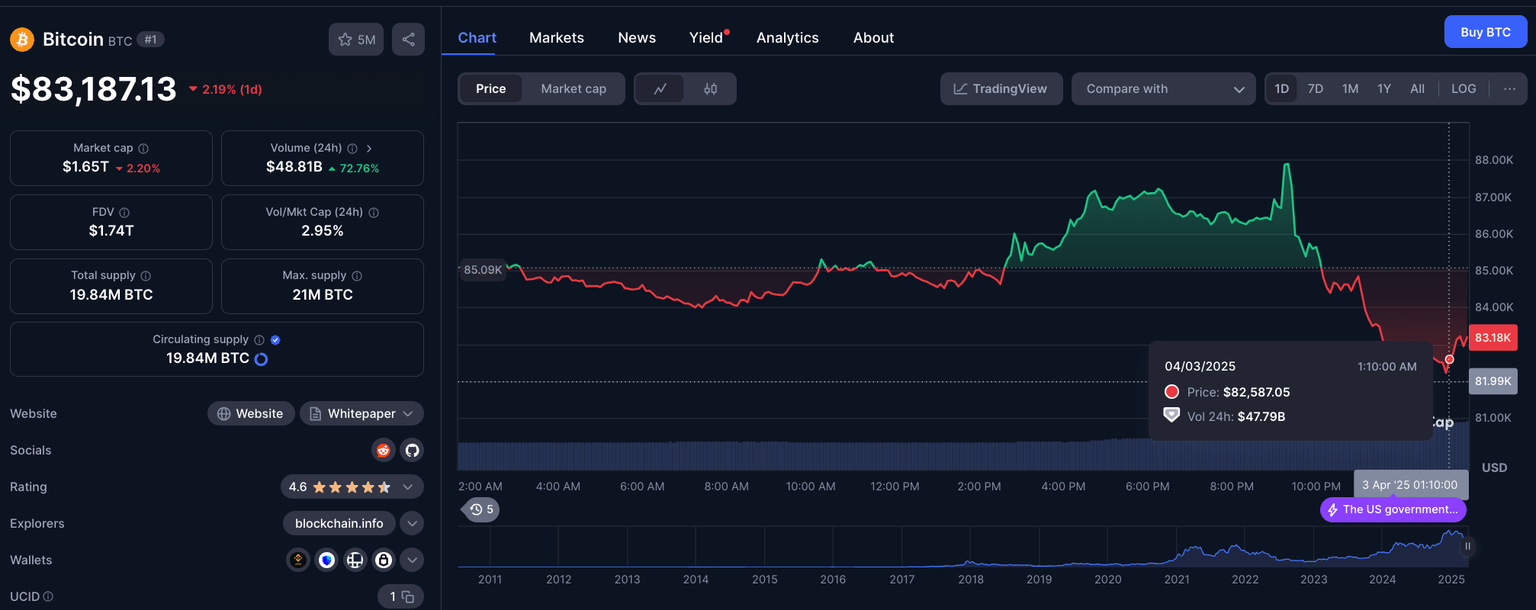

Bitcoin (BTC) price plunges 2% to find support at $82K

Bitcoin saw significant selling pressure following the announcement, plunging to a two-week low of $82,143 before stabilizing around $83,187.

This represents a 2% loss on the day, and a 7% drop from its recent high of $88,060 recorded on March 26.

The decline reflects investor concerns over escalating trade tensions and the broader implications of the tariffs on risk assets. With economic uncertainty rising, traders have moved away from speculative investments, favoring more traditional safe havens assets like Gold

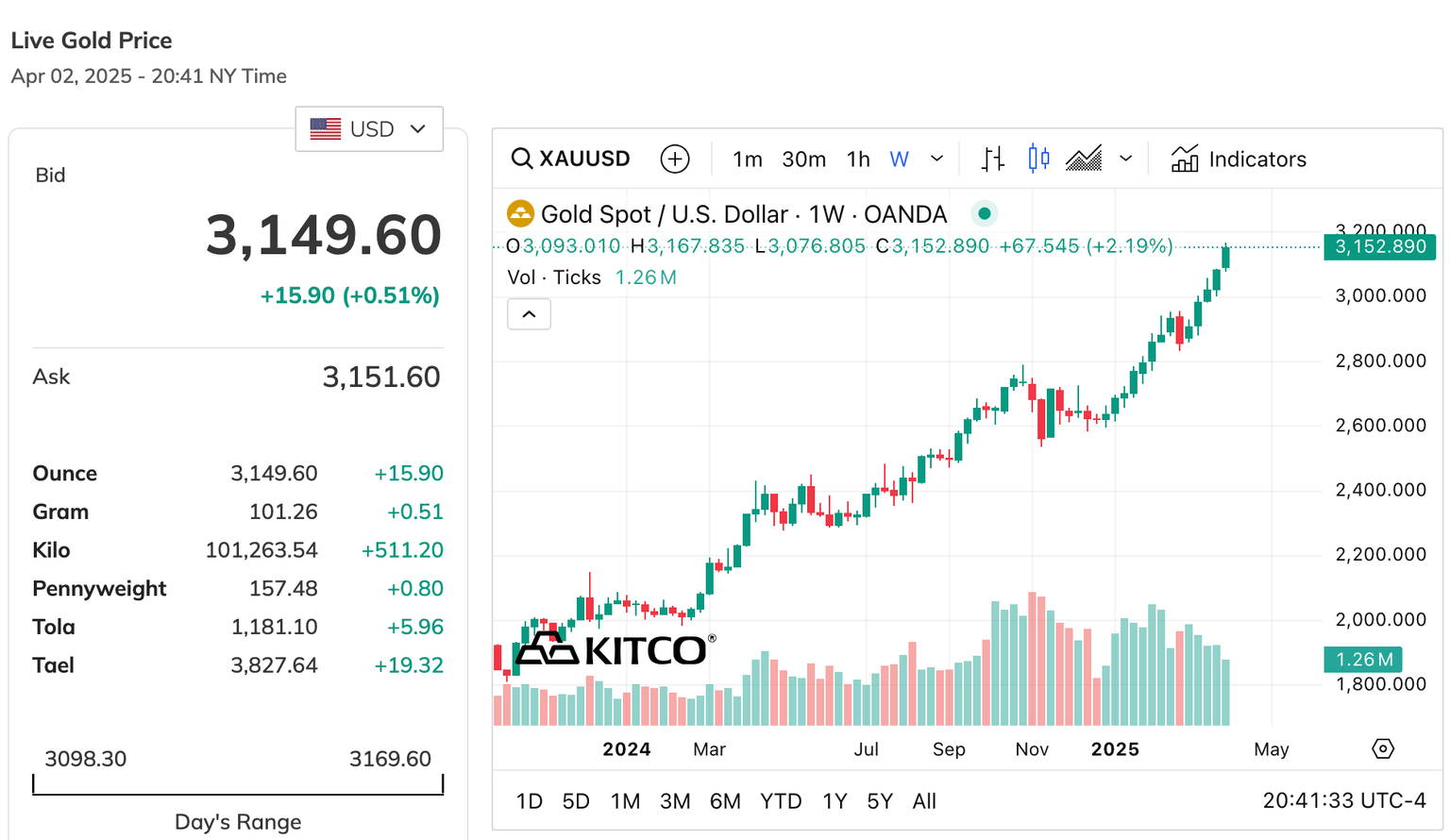

Gold (XAU/USD) surges past $3,150

In contrast to Bitcoin, gold prices surged, breaking through the $3,150 level for the first time in history. Spot gold traded at $3,128 per ounce, while U.S. gold futures settled at $3,152.

This marks a 10% increase since early March when Trump first hinted at the tariffs.

The surge in gold prices further emphasizes its status as a reliable hedge against economic instability and inflationary pressures in the modern financial system.

Long-term Outlook: Diverging paths ahead for Bitcoin and Gold due to US corporate exposure

The divergent reactions of Bitcoin and gold price on Wednesday highlight shifting investor sentiment in response to geopolitical and macroeconomic developments.

Gold’s rally reflects a flight to safety as investors seek stability in tangible assets amid rising economic uncertainty.

On the other hand, Bitcoin’s drop suggests that traders are adopting a risk-off approach, scaling back on digital assets in favor of more established stores of value.

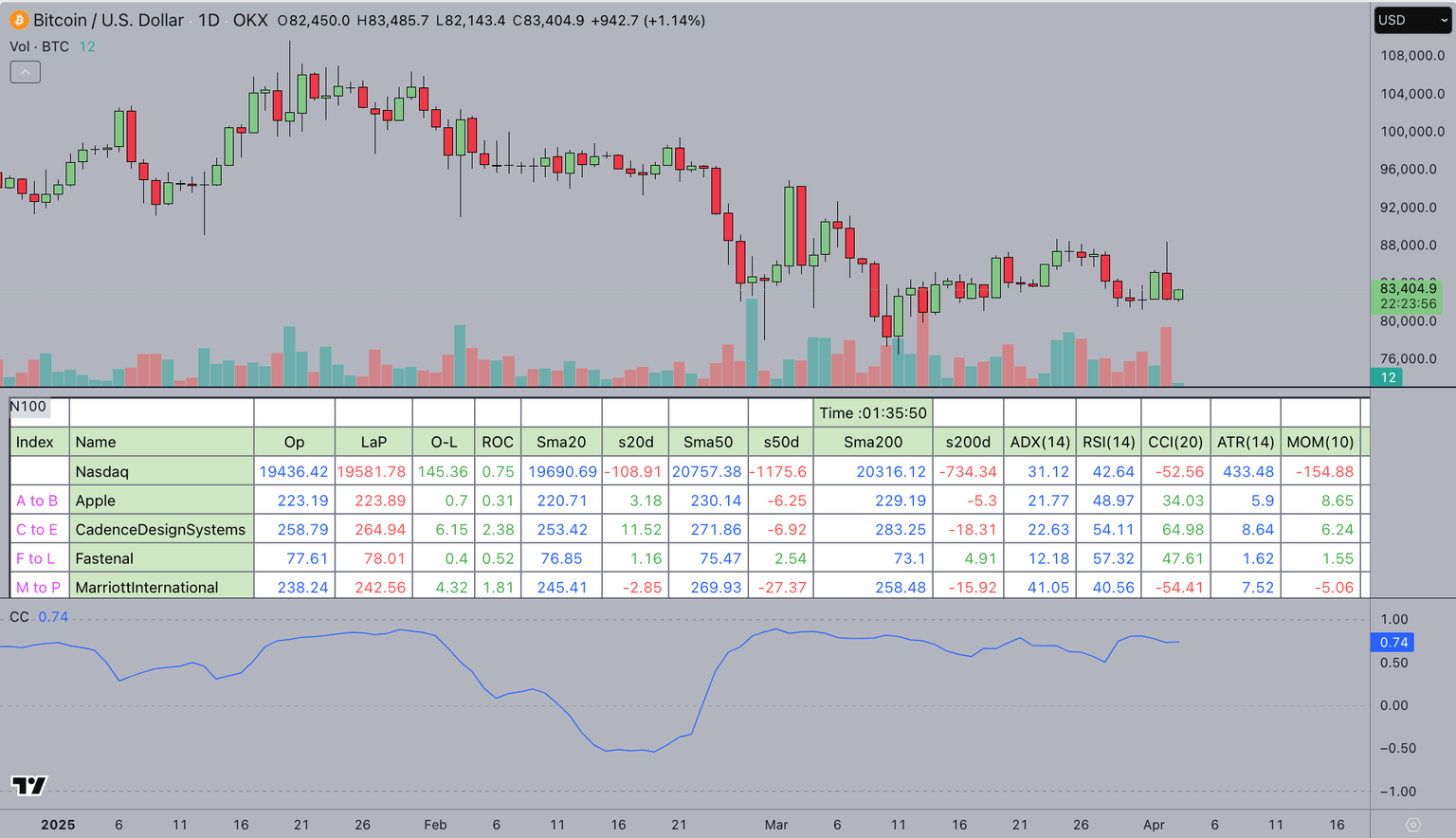

Historically, Bitcoin has been viewed as “digital gold,”. However, vital market indicators show that BTC price has exhibited growing correlation with US equities, in recent months.

At press time, Bitcoin price correlation to the Nasdaq 100 index stands at 0.74%. Based on this figure, every 10% decline in the top 100 US tech stocks. is due to result in a corresponding 7.4% dip in BTC prices, and viceversa. But with the active overhang from Trump's tarrif, the bearish scenario appears more likely.

Bitcoin (BTC) price correlation to Nasdaq 100 Index | April 2, 2025 | Source: TradingView

The development is linked to the growing involvement of the US Government under Trump with crypto and the direct exposure of publicly-traded firms like Blackrock, and Microstrategy.

This puts BTC’s short-term price momentum at risk, especially if US stocks continue to slide further as the impacted nations weigh retaliatory and diplomatic responses in the days ahead.

The coming weeks will be crucial in determining whether Bitcoin can establish itself as a true hedge against economic turmoil, or remain correlated to US tech stocks for the foreseeable future.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.