Bitcoin price prepares for a spike in retail interest as institutional investors fill their BTC bags

- Bitcoin price hit a new all-time high at $48,142 after Tesla announced the purchase of $1.5 billion worth of BTC.

- Many on-chain metrics show that retail investors are looking to buy Bitcoin.

- Nonetheless, investors need a plan to exit in case of a crash.

After Tesla’s big announcement of a $1.5 billion purchase worth of Bitcoin and the possibility of accepting the digital asset as a payment option, the flagship cryptocurrency had a massive move to a new all-time high at $48,142 and aims for more.

Bitcoin price can hit $50,000 as interest grows significantly

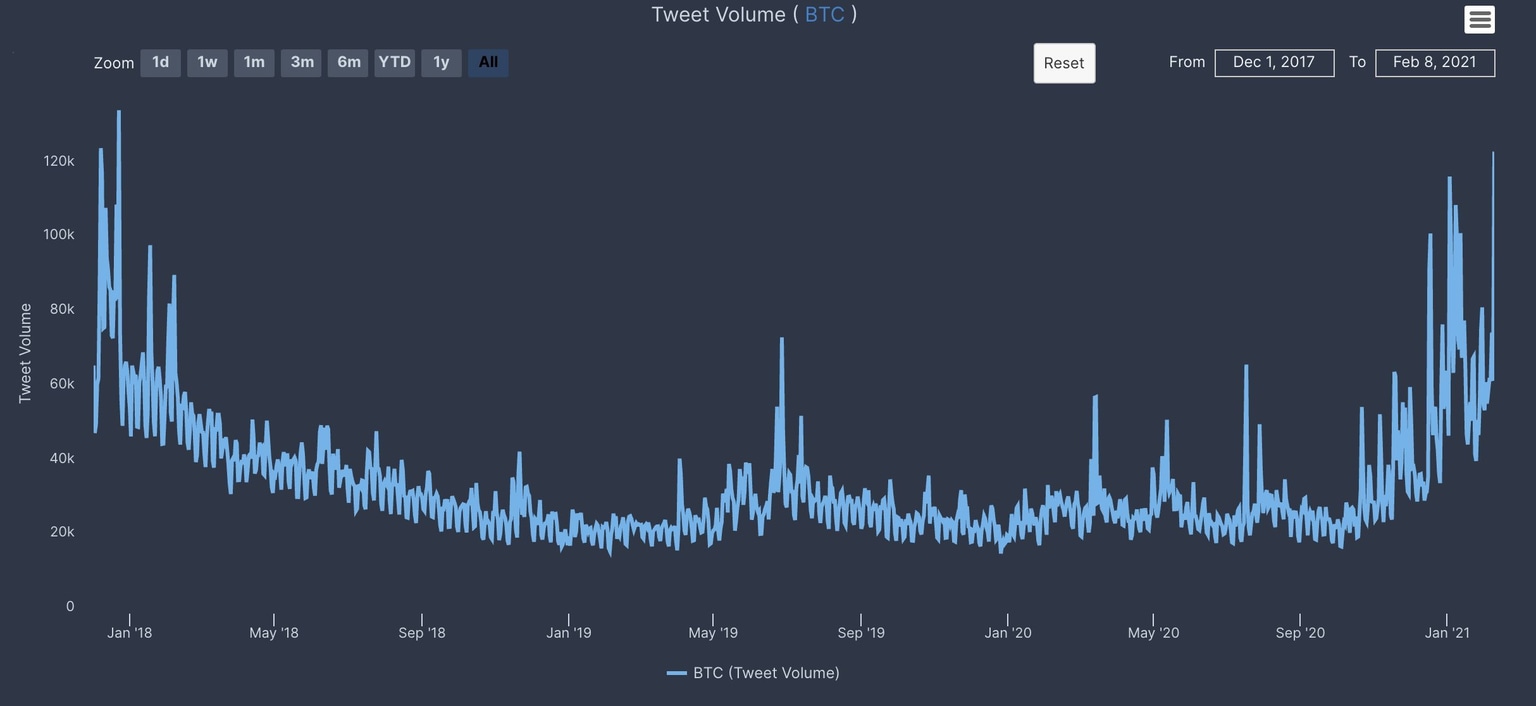

After the most recent rally towards $48,142, Bitcoin’s Twitter volume has just hit a new all-time high with around 143,000 tweets sent in just 24 hours, beating the previous high of December 22, 2017.

Bitcoin Twitter Volume

This number indicates that retail interest in Bitcoin and cryptocurrencies has grown significantly but could increase even more. On top of that, the number of active addresses has also seen a massive increase over the past several months.

Bitcoin active addresses

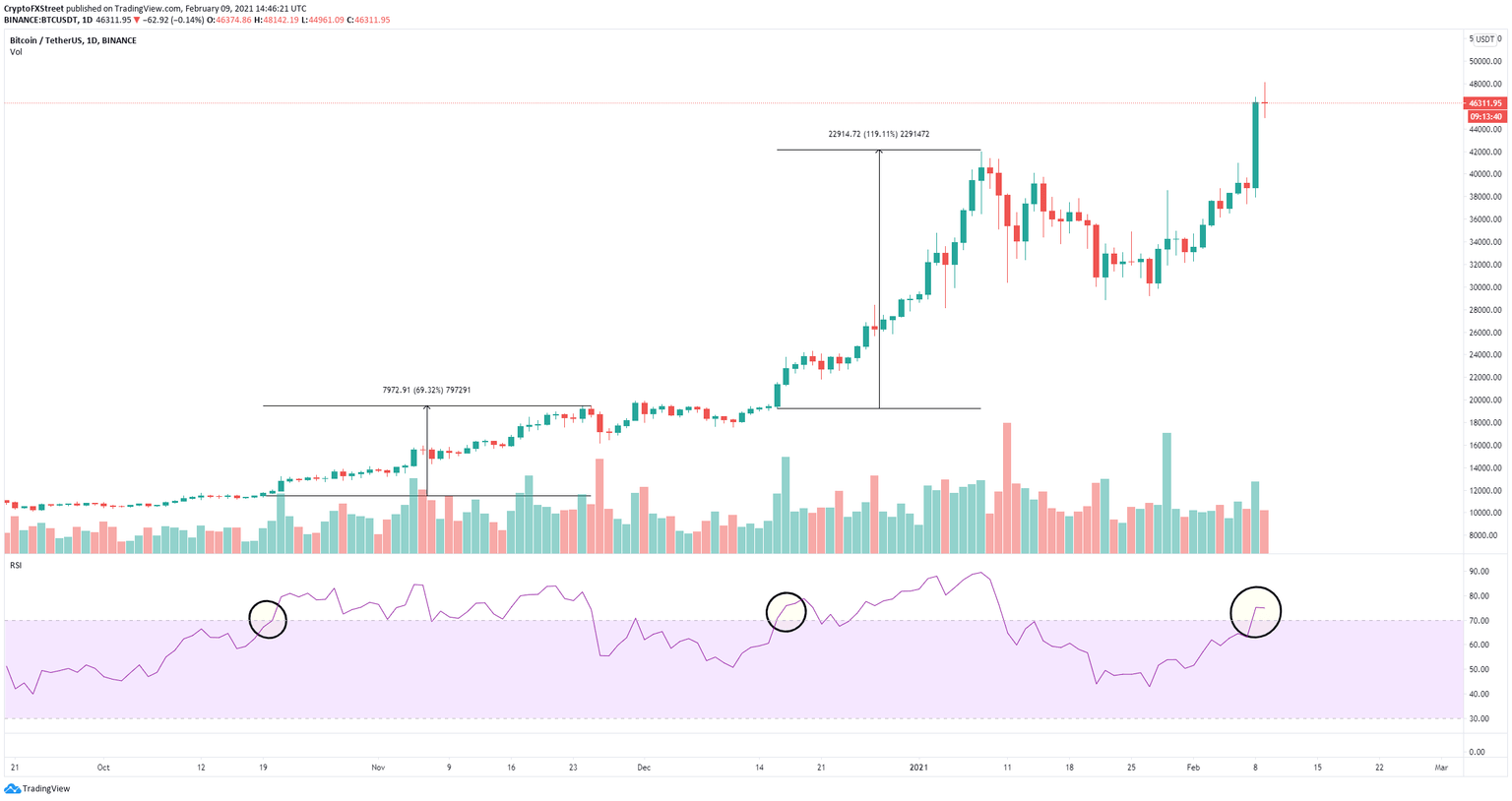

The rise in active addresses indicates that the climb to $48,142 is justified as it matches the activity of the network. After the recent 25% price spike, the RSI is overextended on the daily chart again.

BTC/USD daily chart

However, the past two times this happened, Bitcoin prices continued to surge even higher. In October 2020 the RSI was overextended but Bitcoin climbed 70% until it cooled off. Similarly, back on December 16, 2020, BTC had a 120% rally despite the RSI being overextended. This theory seems to suggest that Bitcoin price is poised for a significant move within the next few weeks.

Stages of a Bubble as seen by a 45 year trading veteran

— Peter Brandt (@PeterLBrandt) February 9, 2021

Stage 1. A neighbor asks me what I know about $BTC

Stage 2. A friend ask if $BTC is a good buy

Stage 3. A relative asks if he/she should buy $BTC

Stage 4. A person I've not seen in 30 yrs, calls, bragging he/she bought $BTC

Despite Bitcoin’s momentum, trading veteran Peter Brandt has warned investors that Bitcoin’s bubble could pop soon. According to Brandt, when average people ask about Bitcoin, if it’s a good buy or a good investment, the asset could be on the verge of a correction. This theory makes sense as Bitcoin and other assets can normally experience pullbacks when their social volume spikes.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.47.08%2C%252009%2520Feb%2C%25202021%5D-637484794874808679.png&w=1536&q=95)