Bitcoin Price Prediction: BTC bulls claw back ground, $12,000 within a striking distance – Confluence Detector

- BTC/USD bulls struggle to push the price towards the critical $12,000.

- The local support is created by $11,500, which is the lowest level of the previous week.

Bitcoin (BTC) bottomed at $11,370 on August 22 and resumed the recovery towards $12,000. At the time of writing, the first digital asset is changing hands at $11,800, having gained nearly 2% on a day-to-day basis. While the critical resistance remains unbroken, the upside momentum may gain traction later during the day as the coin is moving within the strong bullish trend amid low volatility.

BTC/USD daily chart

On the intraday charts, the local resistance is created by 1-hour SMA200 marginally above the current price. Once it is out of the way, the upside is likely to gain traction with the next focus on $11,900. This area stopped the recovery on Friday, August 21; a sustainable move above this level will open up the way to the psychological $12,000. On the downside, the first support comes at $11,700-$11,680. This zone served as a local resistance during the weekend; also, it includes 1-hour SMA100.

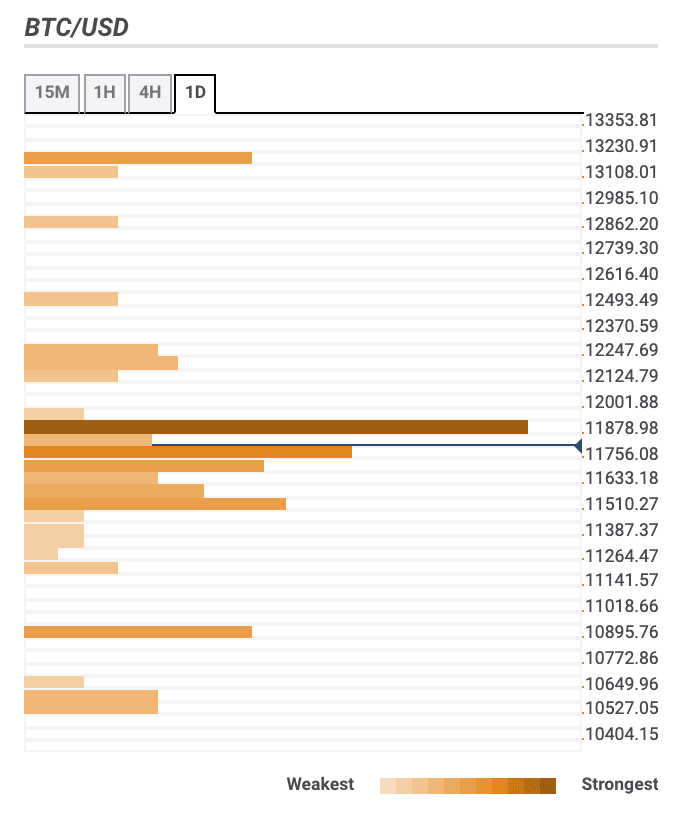

Bitcoin confluence levels

There are a lot of strong technical barriers clustered above the current price, on approach to $12,000 which means, Bitcoin bulls might have a hard time building a recovery momentum. Meanwhile, several important support levels are likely to limit the downside at this stage. Let’s have a closer look at support and resistance levels for BTC/USD.

Resistance levels

$11,850 — 1-hour SMA200, 4-hour SMA50, daily SMA10, the upper line of the 4-hour Bollinger Band, 38.2% Fibo retracement weekly

$12,200 — the upper line of the daily Bollinger Band, Pivot Point 1-week Resistance 1

$12,500 — the highest level of the previous week

Support levels

$11,700 — the middle line of 1-day Bollinger Band, 23.6% Fibo retracement weekly, 1-hour SMA10

$11,500 — the lower line of the 4-hour Bollinger Band, the lowest level of the previous week, the highest level of the previous month

$11,200 — Pivot Point 1-week Support 1

BTC/USD, 1-day

Author

Tanya Abrosimova

Independent Analyst

-637338697710828236.png&w=1536&q=95)