Bitcoin ETF approval may not come this week, likely to be postponed till January

- Bitcoin price corrected lower over the weekend to trade around the $36,800 mark.

- The spot ETF window until November 17 will be an important catalyst for BTC; however, per analysts, the approval may not come this time but in January.

- MicroStrategy founder Michael Saylor has been indirectly shilling BTC, stating it could 10X in the next 12 months.

Bitcoin price is testing an important support level following the price decline over the weekend. This week is expected to be highly volatile as the window for the Securities and Exchange Commission (SEC) to approve the 12 spot BTC ETF is coming to an end. However, there is a fair chance that things may not turn out to be as fruitful as the market's expectations. And that is what MicroStrategy founder Michael Saylor is attempting to fix.

Spot Bitcoin ETF may not be approved this week

- Bitcoin price has been hinging on the probability of the spot BTC ETF applications receiving approval from the SEC. The initial window of approval began on November 8 and is set to end by November 17, which is the scheduled deadline to rule on all applications. However, the hard deadline is still far away, set for January 10, 2024, when the SEC will have to announce the verdict on the 12 applications at any cost.

- With only four days left before the deadline, the SEC still has not provided any clarity or hint at whether they will be approving or rejecting the ETF applications, and the market is reacting negatively. Over the weekend, Bitcoin price declined and is likely to fall further based on Bloomberg ETF analyst James Seyffart's comments.

- Seyffart stated,

"If we are indeed going to see Bitcoin ETF approvals for this wave, I think it's more likely to happen closer to January than this current window."

- This delay would naturally trigger a rather pessimistic reaction among the investors, which could result in a price fall.

- However, Bitcoin evangelist and MicroStrategy founder Michael Saylor is doing his best to keep the bullishness up to counter the effects of the waning bullishness. Statements and tweets hyping up Bitcoin have been suddenly making an appearance, with Saylor even claiming demand for BTC could increase 10X in the next 12 months and the supply could halve.

- Furthermore, Saylor took a dig at Gold, calling it dead money as it declined by 3% since MicroStrategy adopted the Bitcoin strategy in August 2010. Since that day, BTC has grown by 214%, which has resulted in the company noting over $1 billion worth of unrealized profits on its holdings. He tweeted a similar observation regarding the S&P 500 Index.

The cost of conventional thinking. #Bitcoin pic.twitter.com/QarzhvU5lj

— Michael Saylor⚡️ (@saylor) November 12, 2023

- The chances of these tweets making an impact on the price action are, however, very low.

Bitcoin price to see red

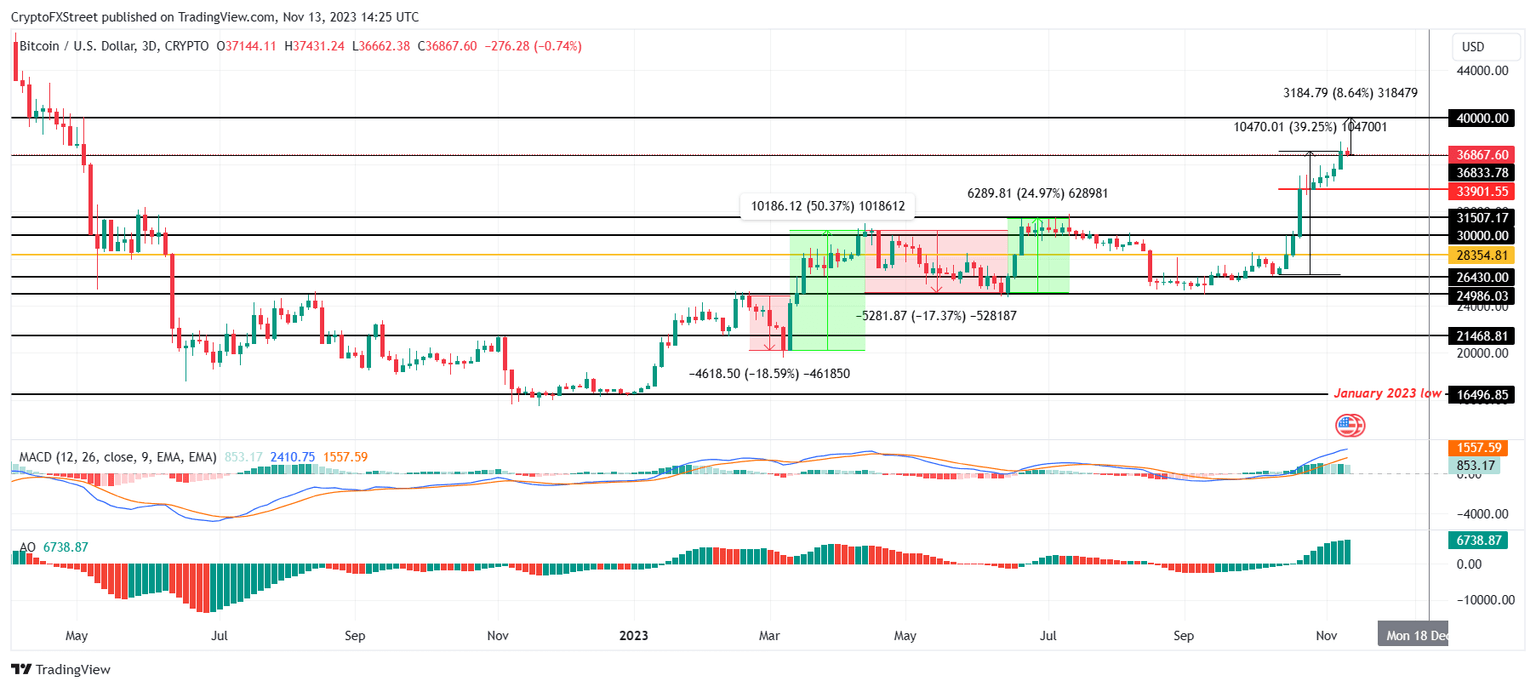

Bitcoin price, trading at $36,867 at the time of writing, is hovering right above the support line at $36,833. The fall over the last three days has suggested potential correction impending, which could bring BTC down to test the support line at $33,901.

FXStreet analyst, Akash Girimath, noted regarding the possibility of a decline,

"The ETF approval news has negated the weekly breaker's selling pressure, which has pushed Bitcoin price up to $38,000. Although unlikely, if there is a lack of response from the SEC or delays in ETF approval, it could send BTC lower."

The potential lack of approval could thus further this decline and send Bitcoin price towards $31,507.

BTC/USD 3-day chart

However, if the SEC approves the 12 spot Bitcoin ETF applications before November 17, BTC could observe a revival of the rally, pushing the cryptocurrency up by 8% to breach $40,000. This would invalidate the bearish thesis and send BTC further higher.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.