Bitcoin Price Fills $6.6K CME Gap as Technical Metrics Flip Bullish

Bitcoin (BTC) delivered few surprises on April 1 as steadier trading conditions prevailed for a third day and volume remained low.

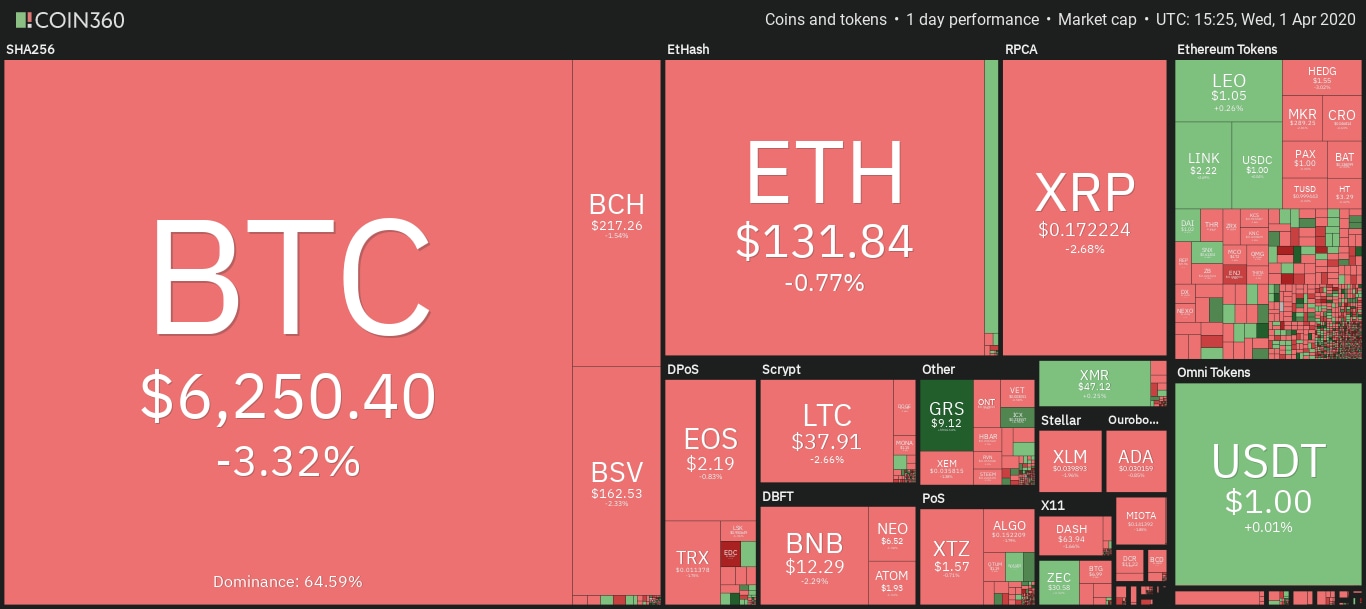

Cryptocurrency market daily overview. Source: Coin360

BTC price shoots to plug futures gap

Data from Coin360 and Cointelegraph Markets painted a decidedly lackluster April Fool’s Day 2020 for Bitcoin, which since March 30 had traded in a narrower corridor between $6,100 and $6,600.

Compared with volatility earlier March, conditions were a relief for traders, while compared with the same time last year, the overall picture remained less enthusiastic.

As Cointelegraph reported at the time, April 1, 2019, sparked a three-month bull run for BTC/USD, during which the pair topped out at $13,800.

After falling by 70% to hit lows of $3,700 on March 12 this year, markets then recovered to hit $7,000 before circling press-time levels of $6,250.

Bitcoin 1-day price chart. Source: Coin360

Now, analysts were still risk-averse, despite the encouraging signs which pointed to a long-term recovery continuing.

Cointelegraph Markets analyst Michaël van de Poppe noted that once again, Bitcoin had closed a “gap” in CME Group’s futures which had opened up over the weekend.

“...Rejection at the previous support at $6,600 and we're moving slightly down. Still mainly range-bound, hence the low volume levels on the markets. Still remaining bearish sub $6,900,” he told followers in a fresh Twitter update on Tuesday.

“Long term (next 4-6 years) extremely bullish on $BTC.”

Glassnode: crash produced “shift in sentiment”

Previously, a formerly bearish Tone Vays had changed his mind about the state of the market. Bitcoin returning below $3,700 was now unlikely, he said, considering that level as the new bottom.

According to monitoring resource Glassnode, meanwhile, “a range” of metrics flipped positive after the crash.

“On–chain metrics used to assess #Bitcoin market cycles are indicating a potential shift in sentiment,” the company summarized uploading charts on Monday.

In the weeks after $BTC's price drop, most have bounced out of or sit in zones that have historically signaled bottoms and good entry points.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.