Bitcoin price decouples from gold strengthening its store of value properties

- Bitcoin price seems to have finally decoupled from gold after a massive rally that started in October.

- The flagship cryptocurrency is on the verge of hitting a new all-time high above $20,000.

It seems that Bitcoin has decisively decoupled from gold for the first time in years as the correlation coefficient is dropping fast. In November 2018, Bitcoin price and gold price were inversely correlated, with gold seeing a 12% rally in the following four months while Bitcoin dropped from a high of $6,500 to a low of $3,228 in just one month.

Bitcoin price close to all-time highs as whales continue accumulating

Bitcoin has decoupled from the stock market and, more importantly, from gold, outperforming the precious metal. The narrative about Bitcoin becoming digital gold is gaining traction again, and it seems that whales agree.

Bitcoin whales chart

The number of whales holding between 10,000 and 100,000 BTC has increased significantly since May, growing by 2% in the last six months. This is a notable indicator that investors are still accumulating despite the price of Bitcoin rallying from a low of $3,782 towards a high of $19,400.

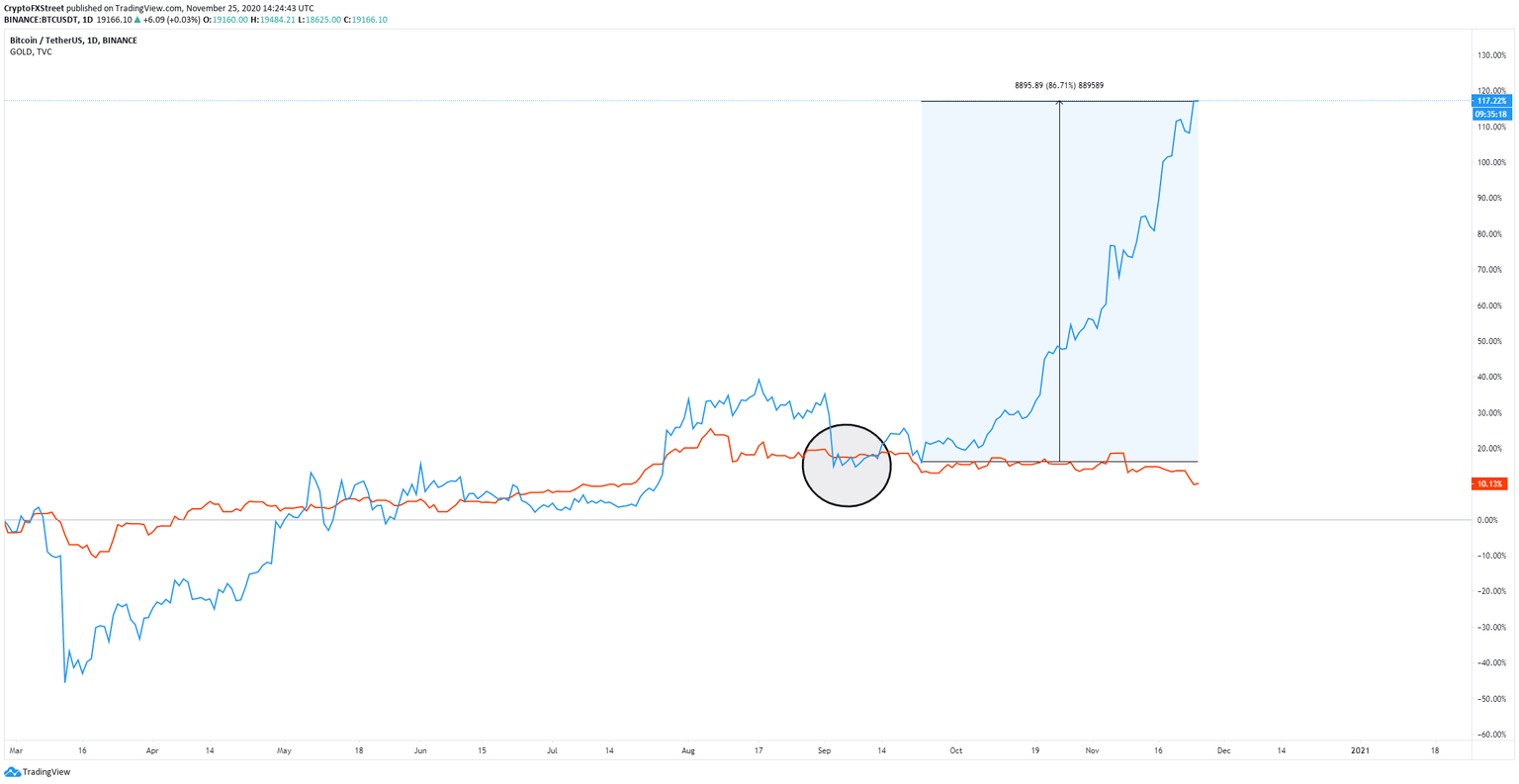

Gold vs Bitcoin chart

This factor, in conjunction with the break of the correlation with gold, is an extremely bullish indicator. On September 4, the price of Bitcoin was hovering at $10,000 and has increased by around 87% since then. On the other hand, gold has dropped by 8% in the same period of time.

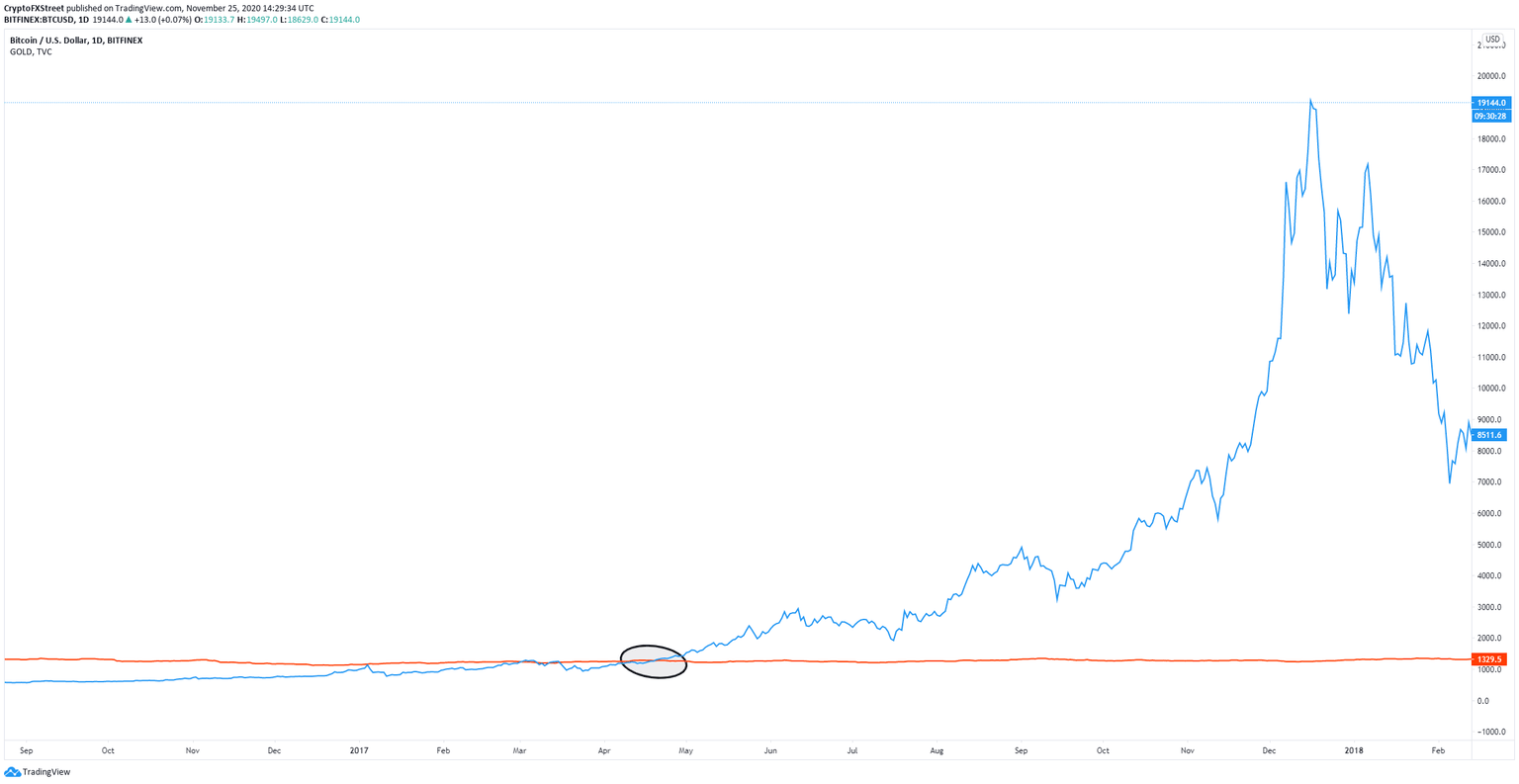

Gold vs Bitcoin chart

The last time this happened was around April 2017 when Bitcoin was trading at $1,308 right before its biggest bull rally to date. The digital asset managed to reach almost $20,000 while gold was in a downtrend. This would suggest that BTC is ready for another colossal rally as it is on the verge of establishing a new all-time high.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.