Bitcoin Price Analysis: BTC/USD eyes $12K amid a potential symmetrical triangle breakout

- BTC /USD hits fresh five-week highs to test $11,500 levels.

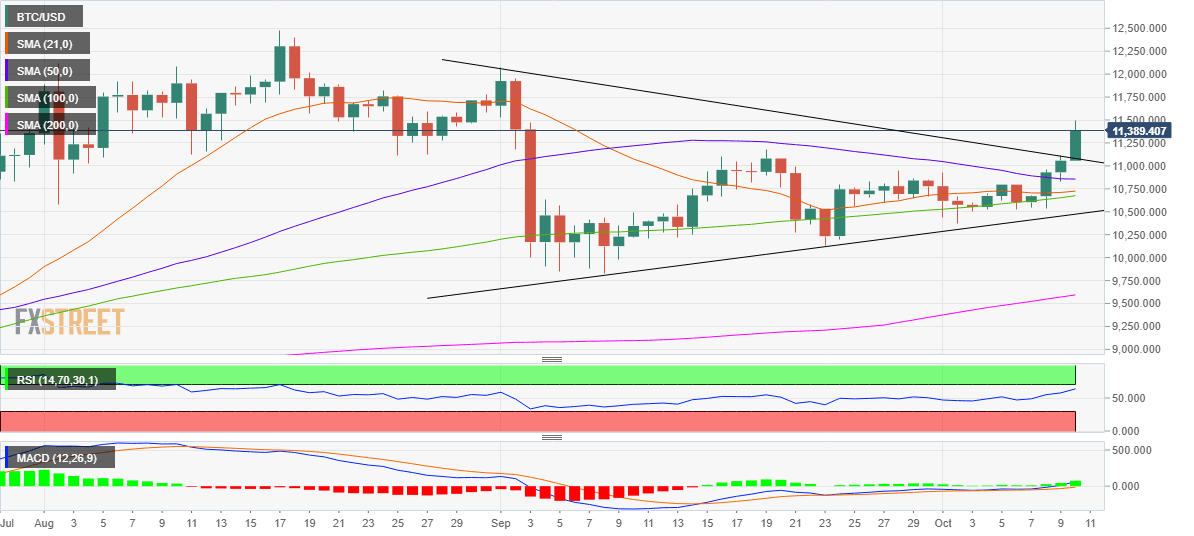

- A symmetrical triangle spotted on the daily chart.

- A daily closing above $11,080 key for additional upside.

Bitcoin (BTC/USD) is on a track to book four straight days of gains this Saturday, amid the upbeat mood seen across the crypto space. The most favorite crypto coin trades close to the highest levels in five weeks at $11,498, adding 3% so far. Despite the recent rally, some analysts view Bitcoin’s surge as a dead cat bounce or fake-out before substantial declines. At the press time, Bitcoin enjoys a market capitalization of $210.82 billion.

Technical Outlook

BTC/USD: Daily chart

As observed on the daily chart, BTC/USD has carved out a potential symmetrical triangle breakout, with the bullish formation likely to be confirmed only a daily closing above the falling trendline resistance at $11,080.

The 14-day Relative Strength Index (RSI) points north while trending below the overbought territory, suggesting that there is more room to the upside. Adding credence to the positive bias, the MACD has formed a strong bullish bar on Saturday.

The price has recaptured all the key Daily Moving Averages (DMA), backing the bullish case.

Therefore, the bulls could regain momentum and eye a test of the next critical barrier at the $12K mark before the spot embarks upon its journey to take on the pattern target near $13,300 levels.

Alternatively, any profit-taking declines could confront the former trendline resistance now turned support at 11,080, below which the 50-DMA support at $10,856 could come into play.

The next fierce support awaits around $10,700, which is the convergence of the horizontal 21 and 100-DMAs.

BTC/USD: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.