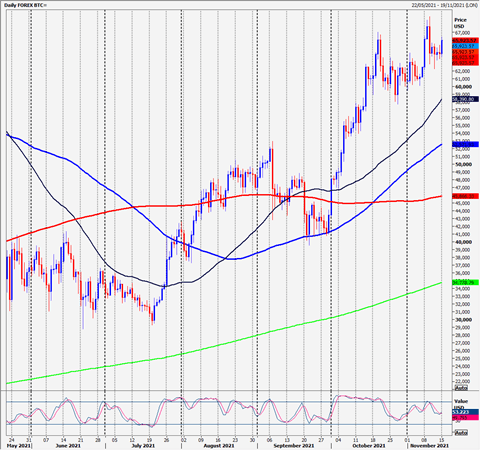

Bitcoin outlook is more positive: Strong support at 62000/61500

-

Bitcoin dipped to strong support at 62000/61500 with a bounce 250 ticks above.

-

Ripple has stabilised after the bearish engulfing candle on Wednesday. We held first support at 12100/12050 for a more positive outlook this week.

-

Ethereum consolidates after the bearish engulfing candle so we are trading sideways in what is probably a bull flag.

Daily analysis

Bitcoin outlook is more positive now we have held strong support at 62000/61500. If we can now hold above 64500 we can target 66000/66500 then retest 68000/68500. A break higher is a buy signal.

Best support at 62000/61500. I would try longs with stops below 60000. A break below 59000 is an important sell signal.

Ripple minor resistance at 12050/12100. A break higher targets 12600/12650. We should struggle here initially but a break higher eventually targets 12900/13000. Above here look for 13330/13380 before a retest of the recent high at 13450/13500.

Strong support at 11300/200. A break below 10150 however is a sell signal targeting 10750.

Ethereum minor resistance at 4700/50 this time. Further gains meet strong resistance at 4830/4860. Obviously a break above the all time high puts bulls back in the driving seat over this week initially targeting 4940/50 then 5165/85.

First support at 4550/4500. Longs need stops below 4450. A break lower is an important sell signal for today targeting 4350/30. A low for the day is likely. Longs need stops below 4300. A break below here is a more serious sell signal, initially targeting 4170/50 but 4050/4000 is certainly possible.

Author

Jason Sen

DayTradeIdeas.co.uk